Report

Social media trends: The highlight reel

Here’s what nearly 1 million consumers told us about their social media habits.

Foreword

The world of social media moves faster than the algorithms behind it. Brands have the lofty challenge of keeping on top of the latest platforms and striking a chord with audiences on them. It’s tough out there, we get it. But we’re here to shed light on the most important trends in this space - with a little extra support from our friends at Reddit, Snapchat, and Once upon a time.

Our job is to help humans everywhere understand each other and the habits of social media users on a deeper level. This report doesn’t just document platform usage figures. It maps out changes in why people use social networks, explores their cultural influence, and looks at how content expectations vary from one platform to the next.

Ready to supercharge your socials? Let’s scroll.

Key insights

Social is transforming how people consume news

More people say they follow news influencers than fashion ones, and there’s been an uptick in people using certain social platforms to keep up with current events. With the media’s trust dwindling, people are on the hunt to find information elsewhere.

Some platforms have better reach, but others are more culturally relevant

In terms of reach, Facebook comes out on top, while TikTok comes in at eighth place. But when we look at cultural power, TikTok shoots to third place. For many brands, staying on top of what’s happening on the app, and contributing or reacting to relevant content, will get their word out.

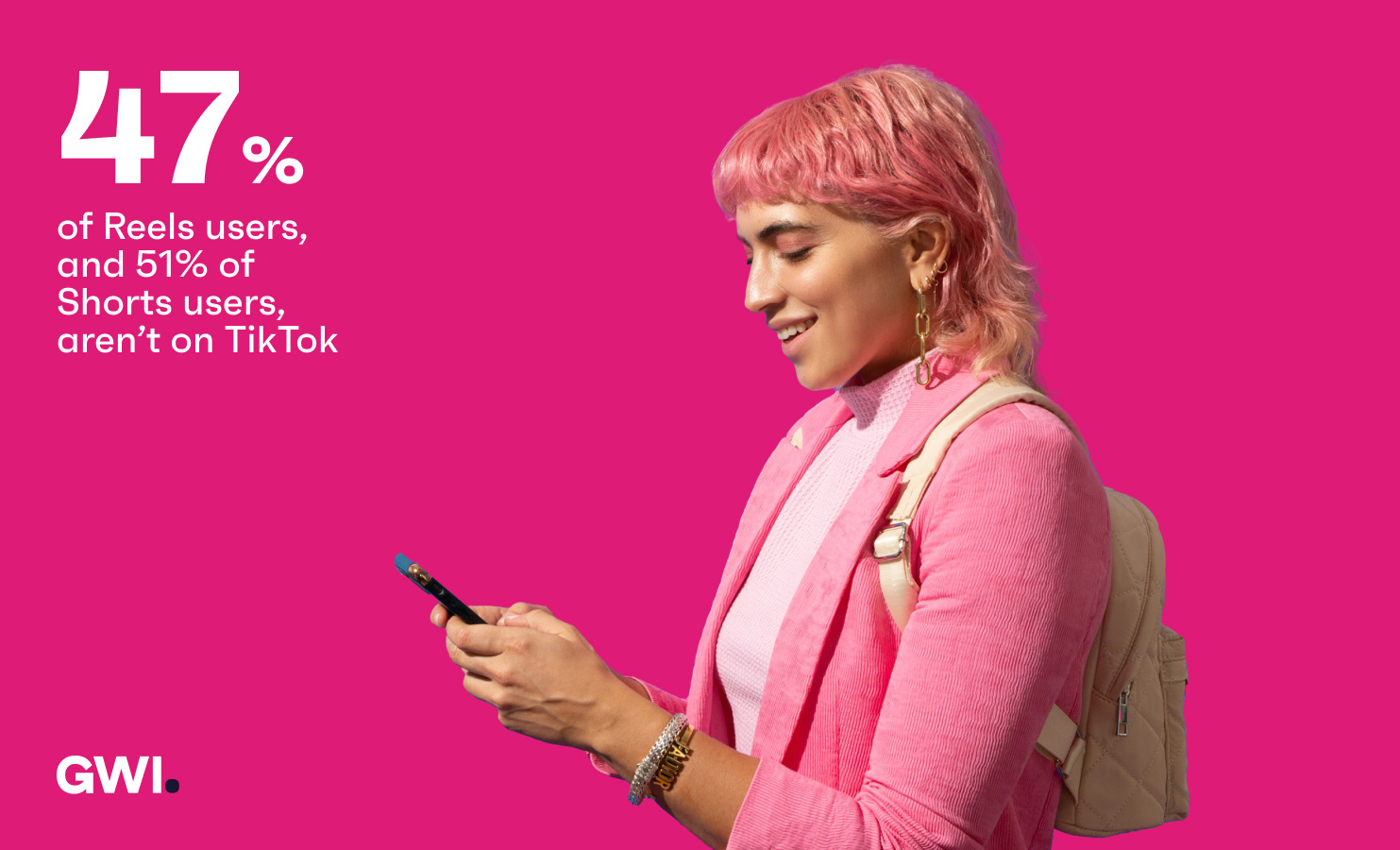

Short-form content is bigger than just TikTok

Brands that want to invest in short-form content shouldn't just think about TikTok. Instagram Reels and YouTube Shorts are very popular, and have unique audiences. They should also consider whether short-form is right for their content type, as sometimes long-form video is a better fit.

More people find products through social media than search engines

Social media plays a bigger role in the purchase journey than you might think. Companies that want to get in the spotlight need to create content that sparks curiosity and inspires their target audience to explore their brand even further.

Authentic, knowledgeable, and trustworthy influencers can boost ROI

Influencer marketing can have a huge impact, but it needs to be approached strategically. An influencer’s follower count is just part of the picture - they need to resonate with their audience, seem authentic, and come across as a subject matter expert - especially in the beauty industry.

01

The social scene

has changed

Social media’s matured and is going steady. Unless there’s another life-altering event like a global pandemic, or unusually tough regulation is introduced in key markets, consumers’ overall time spent on social platforms probably won’t fluctuate much going forward.

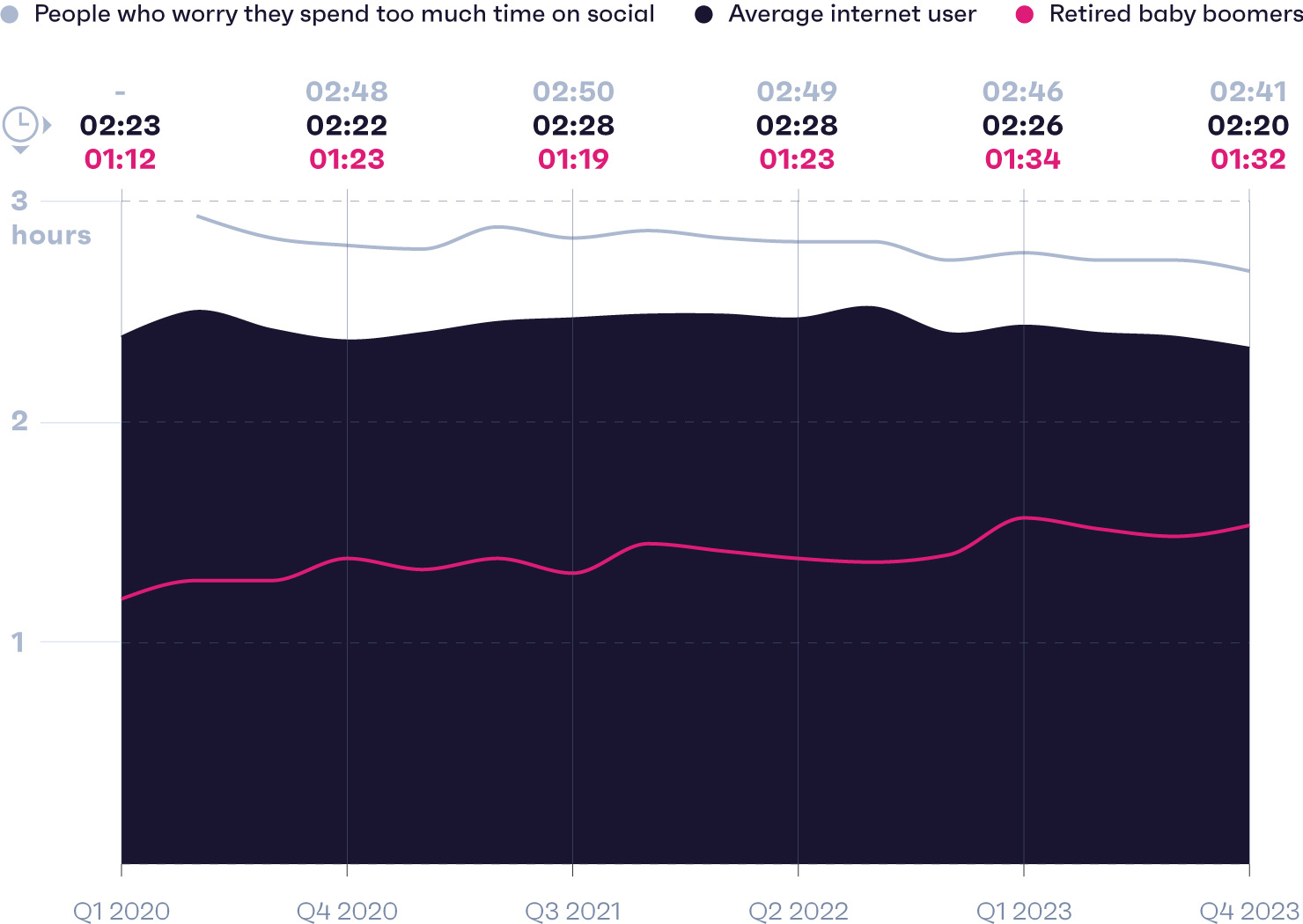

Consumers' daily time on social stays steady

The average daily time consumers in each group say they spend on social media in hh:mm

- Source: GWI Core Q1 2020-Q4 2023

- Base: 3,449,153 internet users, 89,910 retired baby boomers, and 882,347 consumers who worry they spend too much time on social media, aged 16-64

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core Q1 2020-Q4 2023

- Base: 3,449,153 internet users, 89,910 retired baby boomers, and 882,347 consumers who worry they spend too much time on social media, aged 16-64

Already a GWI user? Explore the data on the GWI platform

Sure, we might see new records among different groups: retired baby boomers’ social media usage has continued to climb since the pandemic, a trend we’ve written about in detail before. And people concerned about the effects of excessive scrolling may see slight drops from time to time. But these audience-level shifts probably won’t impact the global trend, which is pretty stable. That’s why we’ve got our eye on who’s using each platform and how they’re using it, which is moving much quicker.

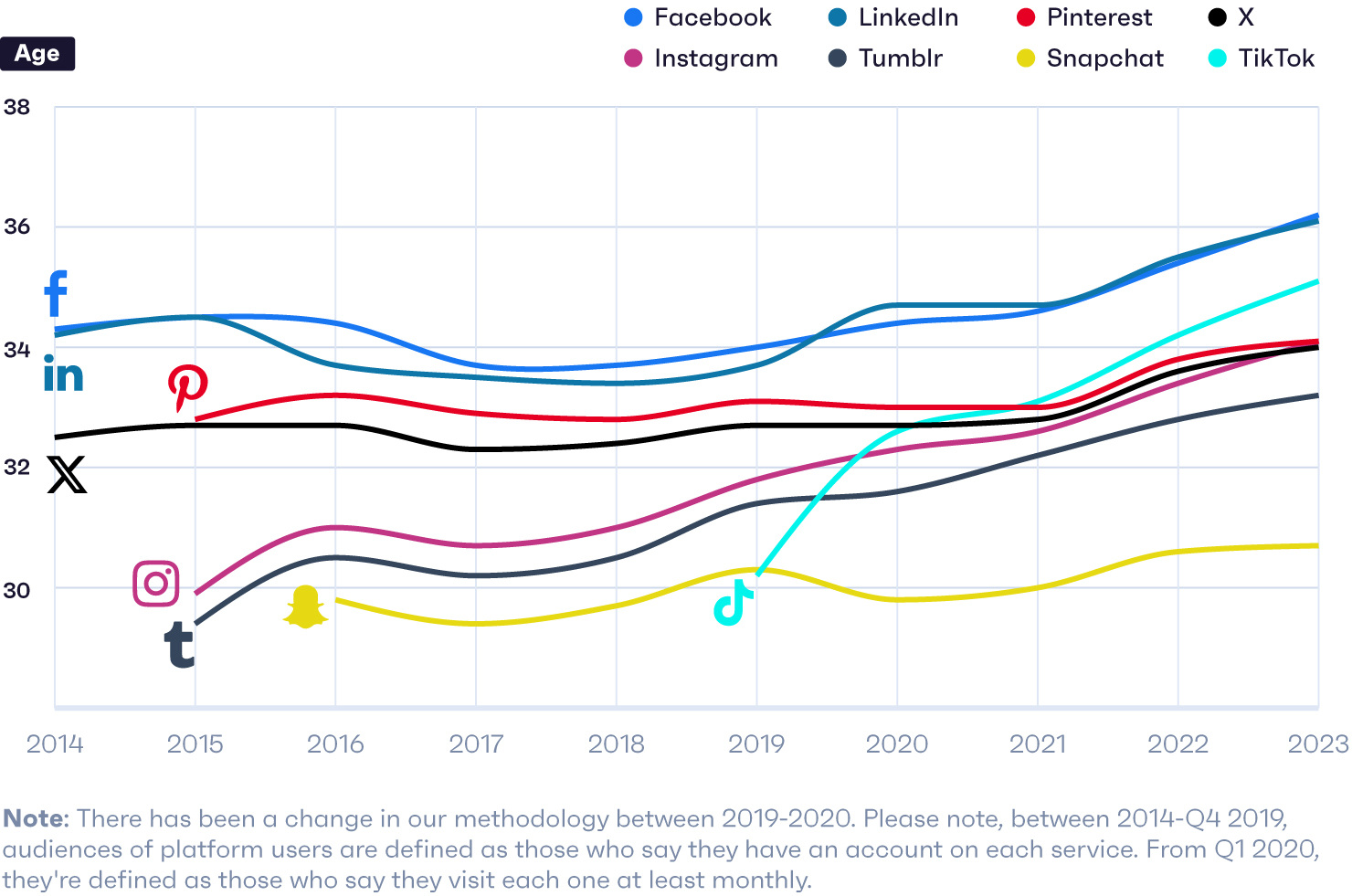

Aging in sync: Most (but not all) users are maturing with social

The average age of each platform's users by year

- Source: GWI Core 2014-2023 (averages of waves conducted between Q1 2014-Q4 2023)

- Base: 2,019,611 social media users (2014-2019) and 3,449,153 social media users (2020-2023) aged 16-64

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core 2014-2023 (averages of waves conducted between Q1 2014-Q4 2023)

- Base: 2,019,611 social media users (2014-2019) and 3,449,153 social media users (2020-2023) aged 16-64

Already a GWI user? Explore the data on the GWI platform

As social media’s matured, so has its user base. Brands need to regularly re-evaluate each of the social networks they advertise on and consider whether it’s still the best way to reach their target audience. Unlike other major platforms, the average age of Snapchat’s users has stayed consistent over time, which reminds us that each app moves in a different direction, and at its own speed. Marketers should always avoid making assumptions where they can and instead aim to zoom in on specific trends.

Ask our customers

I think the answer to the shift we are seeing in social media platform use lies in Prof Vignoles' work. He posits that we have two ongoing identity-based processes; one where we are constructing our identity and the other how we live that out. GWI data seems to point towards consumers increasingly using a portfolio approach to social platforms that support these identity processes - like using Snapchat for personal identity, TikTok for social identity and Twitch as a digital café.

Social is transforming how people consume news

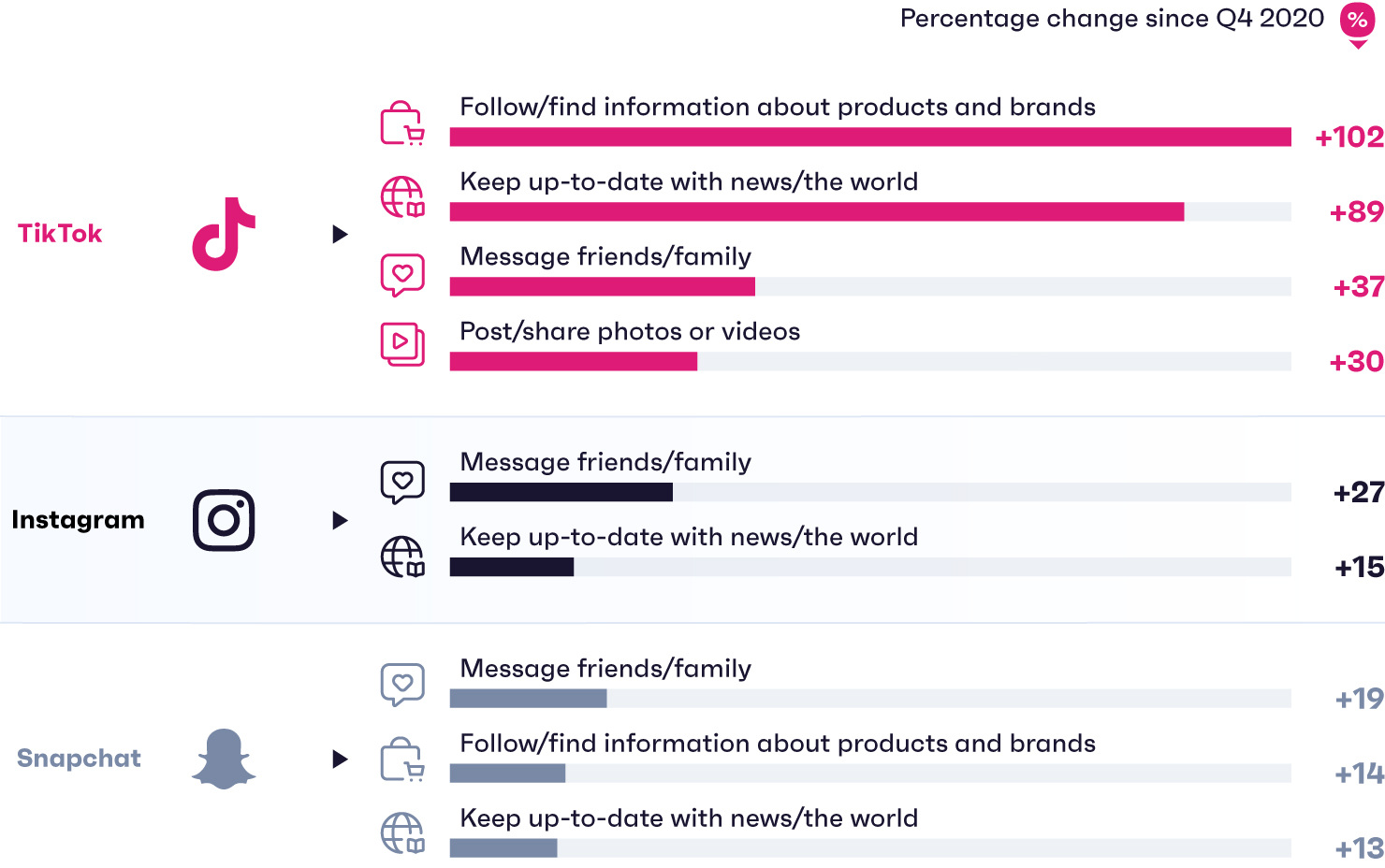

Social platforms are evolving - not just their user bases, but also how people see and use them. For starters, less traditional apps like Instagram, Snapchat, and TikTok are increasingly being used for social media’s original purpose: messaging friends and family. But the act of messaging has become more varied and complex - users might emoji-react to a friend’s story in their direct messages or speak to a creator through features like Instagram broadcast channels. Brands may want to focus on creating content suited to intimate sharing among smaller groups.

News consumption is moving from print to pixel

% increase since Q4 2020 in the number of each platform's users, outside China, who say they log onto it for the following reasons

- Source: GWI Core Q4 2020 & Q4 2023

- Base: 48,475 (Q4 2020) and 103,820 (Q4 2023) TikTok users, 103,877 (Q4 2020) and 148,839 (Q4 2023) Instagram users, 41,486 (Q4 2020) and 55,175 (Q4 2023) Snapchat users, outside China, aged 16-64

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core Q4 2020 & Q4 2023

- Base: 48,475 (Q4 2020) and 103,820 (Q4 2023) TikTok users, 103,877 (Q4 2020) and 148,839 (Q4 2023) Instagram users, 41,486 (Q4 2020) and 55,175 (Q4 2023) Snapchat users, outside China, aged 16-64

Already a GWI user? Explore the data on the GWI platform

Even more significant than the changing nature of sharing is the rise of news consumption on video-based apps and tools. As many people say they’ve watched or listened to political content on social media in the last month as read it (40%). There’s even been an 11% increase in Gen Alpha using social media to keep up with the news in just the last year.

Infographic

Understanding political attitudes

by generation

Get an inside look at how US consumers feel ahead of the upcoming election and uncover how they see, hear, and read information.

Check it outAs the media struggles to maintain consumer trust, people are looking elsewhere for diverse voices. More social media users now say they follow news influencers than fashion ones, proving that influencer marketing isn’t just about selling products anymore. Publishers could work alongside these individuals to produce snackable content in their efforts to drive engagement and improve people’s relationships with the media.

US spotlight: Social media and AI at the ballot box

The 2024 US presidential election is fast approaching, and with Americans turning to social media - especially the short-form format - to keep up with news, this election cycle will be unprecedented.

There’s a high degree of skepticism toward politics in general and the emergence of generative AI isn’t helping. Deepfake images and calls have already played a part in this election cycle, so it’s no wonder that over half of Americans show some concern over AI’s role in both election campaigns and news stories. So, what can publishers do?

Ballot box buzz: Clear and concise content can supercharge engagement

% of Americans who've consumed political content on social media and say the following would get them to engage more

.jpg?width=1480&height=2146&name=Chapter-1---Graph-4(spotlight).jpg)

Source: GWI Zeitgeist February 2024 • Base: 748 Americans aged 16-64 who say they've consumed political content on social media in the last month • Question: Which of the following would make you engage more with digital political content on social media?

A third of Americans who consume political content on social media would engage more if there was third-party verification for any claims, giving them some peace of mind in knowing that what they’re seeing is trustworthy. They don’t mind ideas that challenge their beliefs - some actively seek it - they just want clear, accurate, and verifiable content as they scroll their way through this election cycle.

All about audio

Another emerging trend that’s on our radar is audio - that’s everything from audio messaging to social media podcasts.

It’s early days but brands are starting to explore this space, and our data shows why. Various industries could leverage audio messaging to improve their customer service and stand out from the crowd via personalized messages - whether that’s food delivery updates, order confirmations, or insights into spending habits. One brand that’s made moves in this space is Domino’s Pizza, which uses an AI-powered voice assistant to process orders and give customers status updates.

Audio messages speak louder across certain groups

% of Facebook/Instagram users in each category who say they've sent an audio message on either app in the last month

- Source: GWI Core Q4 2023

- Base: 186,373 Facebook/Instagram users, outside China aged 16-64

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core Q4 2023

- Base: 186,373 Facebook/Instagram users, outside China aged 16-64

Already a GWI user? Explore the data on the GWI platform

Video podcasting is taking off in certain spaces too. With around 3 in 10 YouTubers saying they listen to a podcast online weekly, this is yet another audio-based option for creators, publishers, and marketers to consider. Audio is definitely ripe for experimentation and innovative brands will lead the way by demonstrating how it can be used to drive engagement. At the very least, others should listen out for their results.

02

Platforms under

the microscope

We mentioned that each platform’s user base has changed over time, now let’s look at things from a generational standpoint.

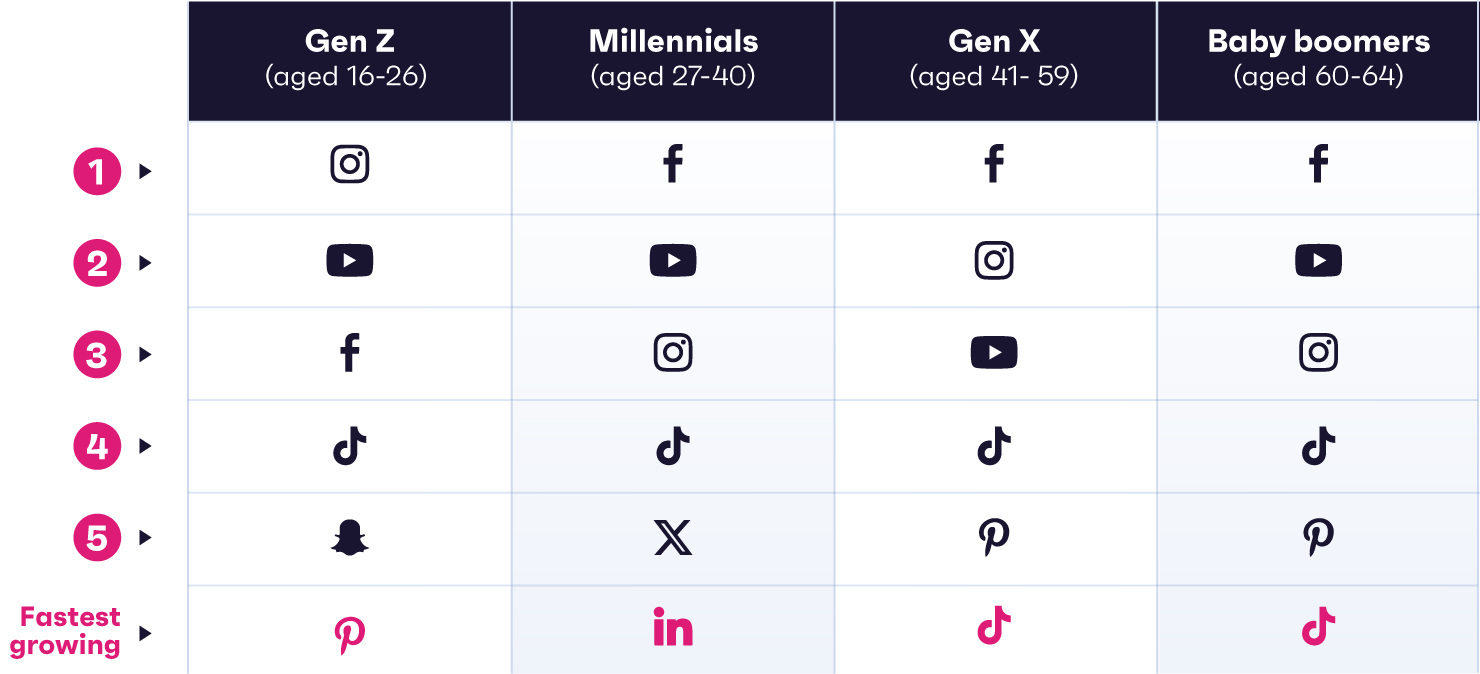

Top 5 generational faves and fastest growing socials

Based on the % of each generation who say they use the following each month

- Source: GWI Core Q4 2022 & Q4 2023

- Base: 218,996 internet users (Q4 2022) and 215,092 internet users (Q4 2023), outside China, aged 16-64

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core Q4 2022 & Q4 2023

- Base: 218,996 internet users (Q4 2022) and 215,092 internet users (Q4 2023), outside China, aged 16-64

Already a GWI user? Explore the data on the GWI platform

Our data shows that Facebook is still the global leader for monthly engagement among millennials, Gen X, and baby boomers. It even ranks in Gen Z’s top three, dispelling the myth that younger groups are ditching their accounts.

Report

The new age of Gen Z

Think you know everything about today’s “it” consumer? Get the scoop on the real lives of these young adults to discover how diverse Gen Z really is.

Explore the trendsGen Z do have a unique social media footprint, though. Instagram is both their most-used app and the one they’re most likely to say they’ve mentioned during recent in-person conversations, which leads us nicely to our next point.

Apps that get people talking IRL

Reach and cultural power are different, and companies should consider which one they’re prioritizing when choosing their mix of socials. One increases the chances of a brand's products and messages being seen, while the other improves the chances of them being talked about by consumers.

Word-of-mouth recommendations are still one of the top drivers of brand and product discovery, on par with ads seen on social media. If brands share compelling stories on social platforms that spark conversation, they could gain more (and free) exposure.

All of our top platforms have both reach and cultural power to varying degrees, though some score relatively better for the latter. Take TikTok for example; while it’s eighth on the list of most-used platforms, it comes third for perceived cultural power.

This is where trends are being created. For many brands, staying on top of what’s happening on YouTube, Instagram, and TikTok, and contributing or reacting to relevant content, will help get the word out.

TikTok has less reach, but more cultural power

Ranked order of social media apps, based on the % who say they use them monthly; and the most culturally impactful, based on the % who think the following have the most impact on cultural trends

- Source: GWI Core Q3 2023 & GWI Zeitgeist December 2023

- Base: 13,465 internet users aged 16-64 in 11 markets

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core Q3 2023 & GWI Zeitgeist December 2023

- Base: 13,465 internet users aged 16-64 in 11 markets

Already a GWI user? Explore the data on the GWI platform

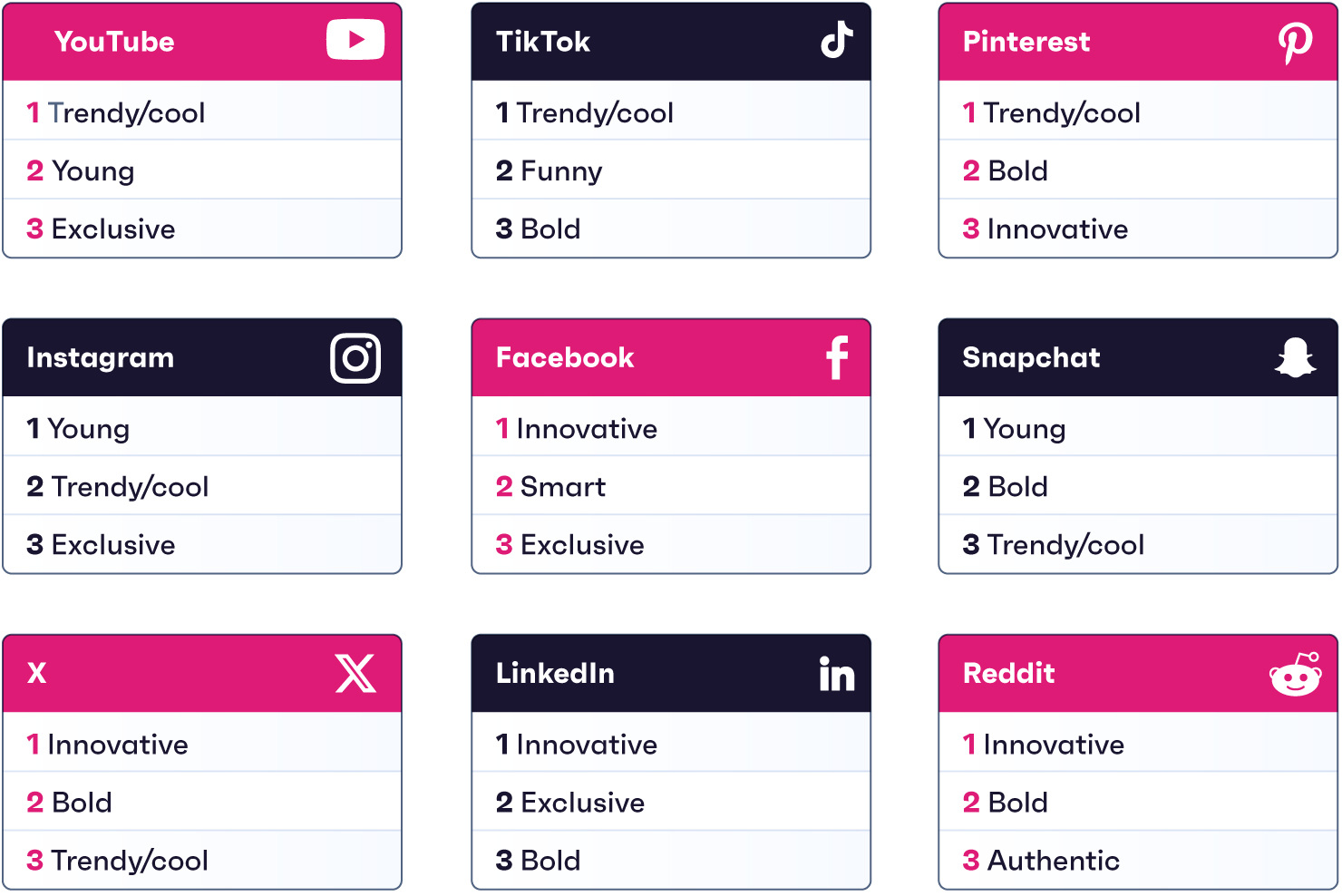

Getting the vibe right on each platform

People might use several apps every day, even simultaneously, and consume similar video and text content on each of them. But we can’t forget - each platform has its own unique culture, vibe, and audience expectations. As a brand, understanding these nuances and tailoring your content to suit each space is key to knocking your social media strategy out of the park.

Why brands should repurpose, not duplicate

The most distinctive qualities that users of each platform want brands to be, compared to the average social media user, outside China

- Source: GWI Core Q4 2023

- Base: 67,377 X users, 103,820 TikTok users, 68,668 Pinterest users, 59,046 LinkedIn users, 55,175 Snapchat users, 29,733 Reddit users, 148,839 Instagram users, 54,763 YouTube viewers, and 158,099 Facebook users, outside of China, aged 16-64

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core Q4 2023

- Base: 67,377 X users, 103,820 TikTok users, 68,668 Pinterest users, 59,046 LinkedIn users, 55,175 Snapchat users, 29,733 Reddit users, 148,839 Instagram users, 54,763 YouTube viewers, and 158,099 Facebook users, outside of China, aged 16-64

Already a GWI user? Explore the data on the GWI platform

We’re not saying that content shouldn't be repurposed, we’re saying it shouldn’t be duplicated. The same video or copy can be cut up or tweaked to be funny, trendy, or bold - and clever marketers will squeeze all the value they can out of (and add shelf life to) good content.

03

Video content -

short, long, and everything in

between

There’s nothing small about the influence short-form video has had on the global media landscape. While TikTok’s only eight years old, it competes in the same league as Netflix and YouTube when it comes to monthly engagement, and has truly changed the nature of social media.

Report

The global media landscape

The secret to finding your audience online is here. Explore 2024’s hottest media trends from shoppers to streamers.

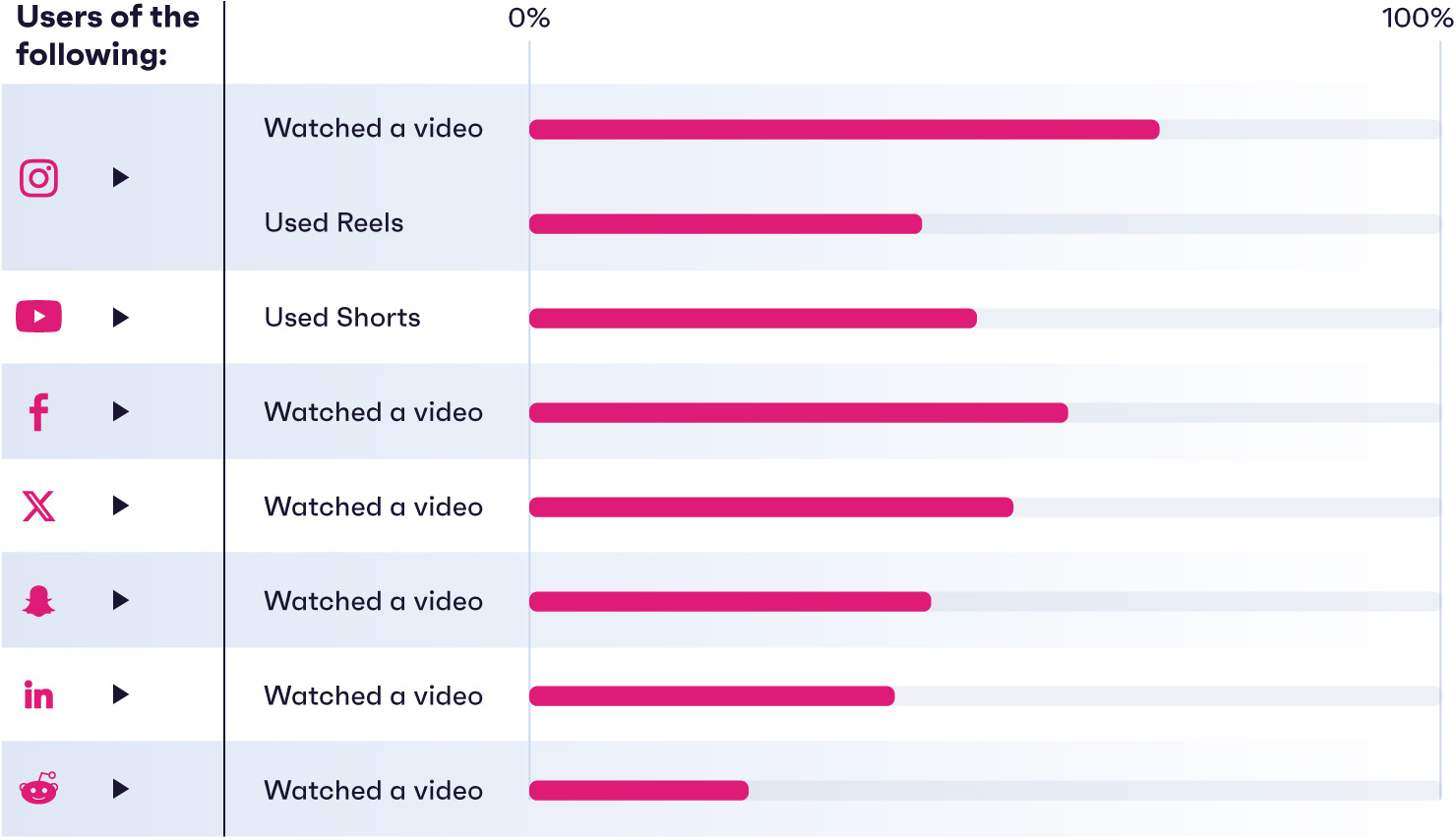

Unlock the reportHere, there, everywhere: Video's trending big time

Based on the % of each platform's users, outside China, who say they've done the following on it in the last month

- Source: GWI Core Q4 2023

- Base: 148,839 Instagram users, 54,763 YouTube viewers, 158,099 Facebook users, 67,377 X users, 55,175 Snapchat users, 29,733 Reddit users, and 59,046 LinkedIn users, outside China, aged 16-64

Already a GWI user? Explore the data on the GWI platform

- What have you done on Instagram in the last month?

- What have you done on Facebook/Messenger in the last month?

- What have you done on X in the last month?

- What have you done on LinkedIn in the past month?

- What have you done on Snapchat in the last month?

- What have you done on Reddit in the last month?

- Short video consumption in last month

- Source: GWI Core Q4 2023

- Base: 148,839 Instagram users, 54,763 YouTube viewers, 158,099 Facebook users, 67,377 X users, 55,175 Snapchat users, 29,733 Reddit users, and 59,046 LinkedIn users, outside China, aged 16-64

Already a GWI user? Explore the data on the GWI platform

- What have you done on Instagram in the last month?

- What have you done on Facebook/Messenger in the last month?

- What have you done on X in the last month?

- What have you done on LinkedIn in the past month?

- What have you done on Snapchat in the last month?

- What have you done on Reddit in the last month?

- Short video consumption in last month

Our message isn’t just to start using short-form video (if you don’t already), it’s to think carefully about which specific tools you’d benefit most from investing in.

US spotlight: Sports highlights score on short-form

Short-form video’s done a lot for the music industry, with these features bringing singers like Lil Nas X and genres like sea shanties to light. In 2021, Gen Alpha were more likely to say they discovered new audio content by searching for it online than hearing about it on social media. Now the opposite is true, and discovery happens more due to social than recommendations from friends and family. This shift in music discovery has ultimately coincided with the rise of short-form platforms and features.

Game changer: Social videos have given sports content a leg-up

% increase in the number of US social media users who say they've viewed the following on platforms monthly between Q1 2022-Q1 2024

-1.jpg?width=1780&height=647&name=Chapter-3---Graph-2(spotlight)-1.jpg)

Source: GWI USA Q1 2022 & Q1 2024 • Base: 18,812 (Q1 2022) and 18,720 (Q1 2024) social media users aged 16+ • Question: Which of these have you viewed on social media in the last month?

Short-form video’s currently doing the same for other sectors too, namely sports, with highlights being the fastest-growing content type in the US.

While 2024’s Super Bowl broke all kinds of live TV viewing records, 25% of Gen Z and millennial viewers also kept up via updates on social media. Just as short clips made some less-known music artists popular, it’s carving out a bigger space for emerging sports, as we show in our latest Connecting the dots report.

Short videos should also be on the film industry’s radar, with movie trailers being consumed in higher doses. Industry leaders like The Boxoffice Network hope that giving scrollers snippets will get them going to cinemas or streaming from home more, and it seems to be working. Compared to other US Instagram users, those who watch Reels and film trailers on social media are 23% more likely to say they go to movie theaters at least monthly.

Report

Connecting the dots 2024

Feel like you’re out of the loop? Check out these unexpected insights to make sure you're up to speed with the biggest consumer trends of the year.

See what’s nextDon't count out long-form

For sports companies in particular, short-form video is a great way to draw in new and unexpected fans, but they should still service existing ones. NBC Sports offers both condensed and extended highlights of its Premier League coverage on its YouTube channel, making its different categories of followers happy in the process.

Consumers mainly watch short-form video to fill up spare time and keep up-to-date with trends, but many will turn to longer clips when they’re looking for more insight and nuance. Even short clip watchers are fairly likely to agree that the quality of short-form content is generally lower than that of long-form content (38% do, which is greater than the number who disagree with this statement).

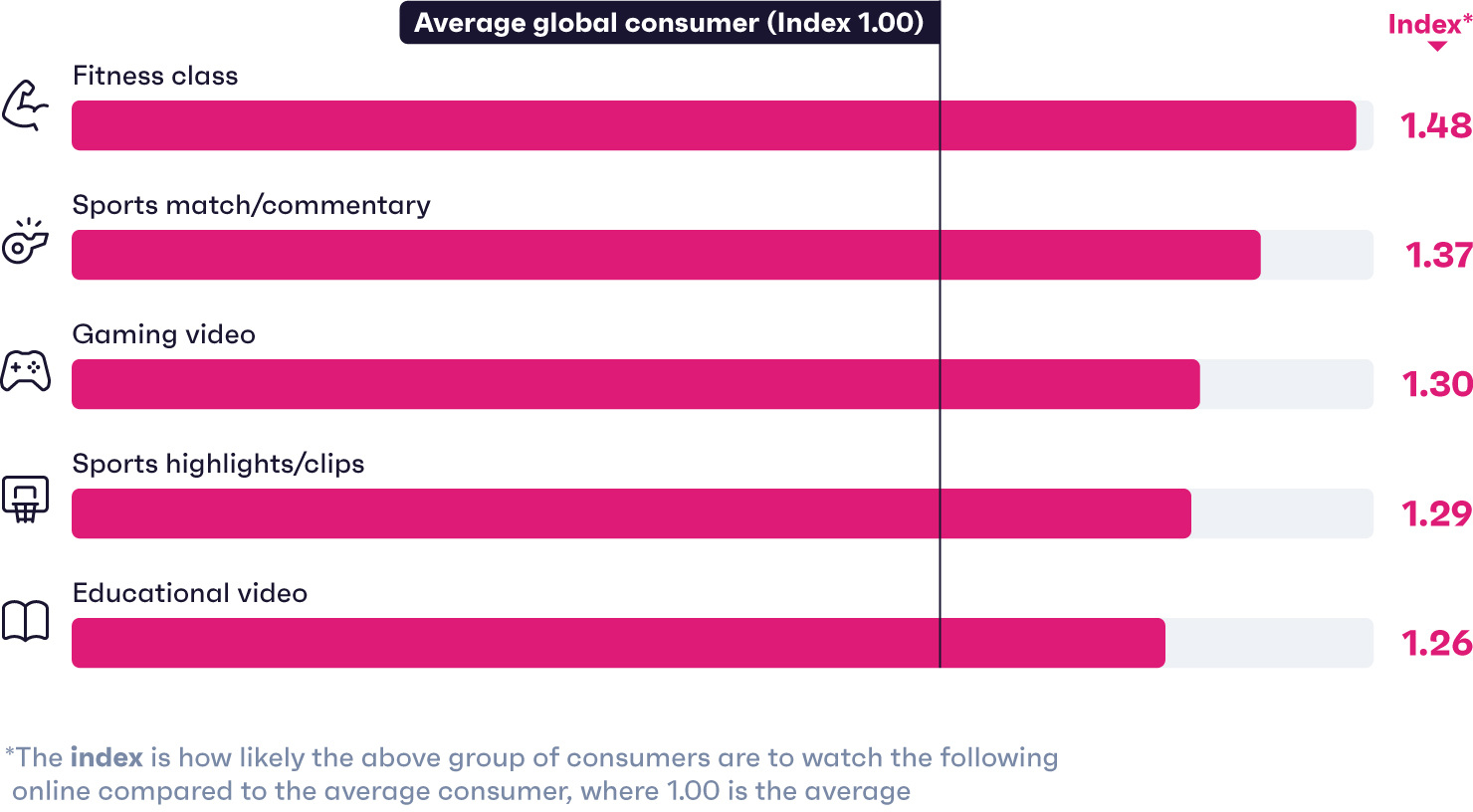

Long-form content works for some content types

High-indexing* content types among consumers who think long-form's quality is superior, based on the % who say they've watched each one in the last week

- Source: GWI Core Q1 2023 & GWI Zeitgeist July 2023

- Base: 3,402 internet users who think short-form's quality isn't as good as long-form's aged 16-64 in 11 markets

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core Q1 2023 & GWI Zeitgeist July 2023

- Base: 3,402 internet users who think short-form's quality isn't as good as long-form's aged 16-64 in 11 markets

Already a GWI user? Explore the data on the GWI platform

Consumers who believe this stand out for having watched fitness classes, sports matches, and commentary in the last week. Fitness classes are often streamed via a smart TV or casted onto a larger screen, allowing for better workouts. And dedicated fans generally don’t just want the best bits of a match, but a deeper breakdown and analysis.

On the whole, the explosion of short-form video isn’t happening at the expense of long-form video; it’s happening alongside it. TikTok’s testing 30-minute uploads, which is entering TV episode territory, and Reels now accommodates videos up to 15 minutes. So, if you’re a brand that prides itself on quality TV-like content, you’re hardly out of luck.

APAC spotlight: Live, laugh, livestream

Livestreaming is a feature offered on most social media platforms today, and over 20% of social media users worldwide cite it as a main reason for logging on. But in APAC markets, livestreaming gets a lot of love.

One possible explanation for this is that APAC consumers are used to doing day-to-day tasks on their mobiles. They’re more likely than the average global consumer to use their mobile device to order groceries, send money, and even take fitness classes, so it’s no surprise that they also interact with influencers and brands via livestreams, and are huge fans of live shopping.

Over 40% of APAC consumers know what a live shopping experience is, and are 51% more likely than the average global consumer to have bought something during a live shopping event.

Live shopping can foster community

APAC social streamers' highest-indexing* motivations for brand promotion, based on the % who say the following would drive them to endorse their favorite brand online

-2.jpg?width=1480&height=986&name=Chapter-3---Graph-4-(spotlight)-2.jpg)

Source: GWI Core Q4 2023 • Base: 56,493 APAC social streamers, outside China, aged 16-64 • Question: What would most motivate you to promote your favorite brand online?

For many companies, live shopping yields especially high ROI because it’s a sociable experience, and it fosters feelings of exclusivity and involvement, and APAC social media shoppers are more likely to advocate online for brands that do exactly this. APAC-based or international brands with customers in this region should keep their livestreaming appetite in mind, while Western brands considering or using this technology can look to the area's success stories for best practice tips.

04

From scrolling

to shopping:

A love story

Search engines may be the first term that comes to mind when thinking about product discovery, but depending on your audience, maybe it shouldn’t be. Finding new ideas or inspiration has become a more important reason for using the internet, a trend that’s largely linked to social media. And Gen Z especially like the customized results they get on social platforms too.

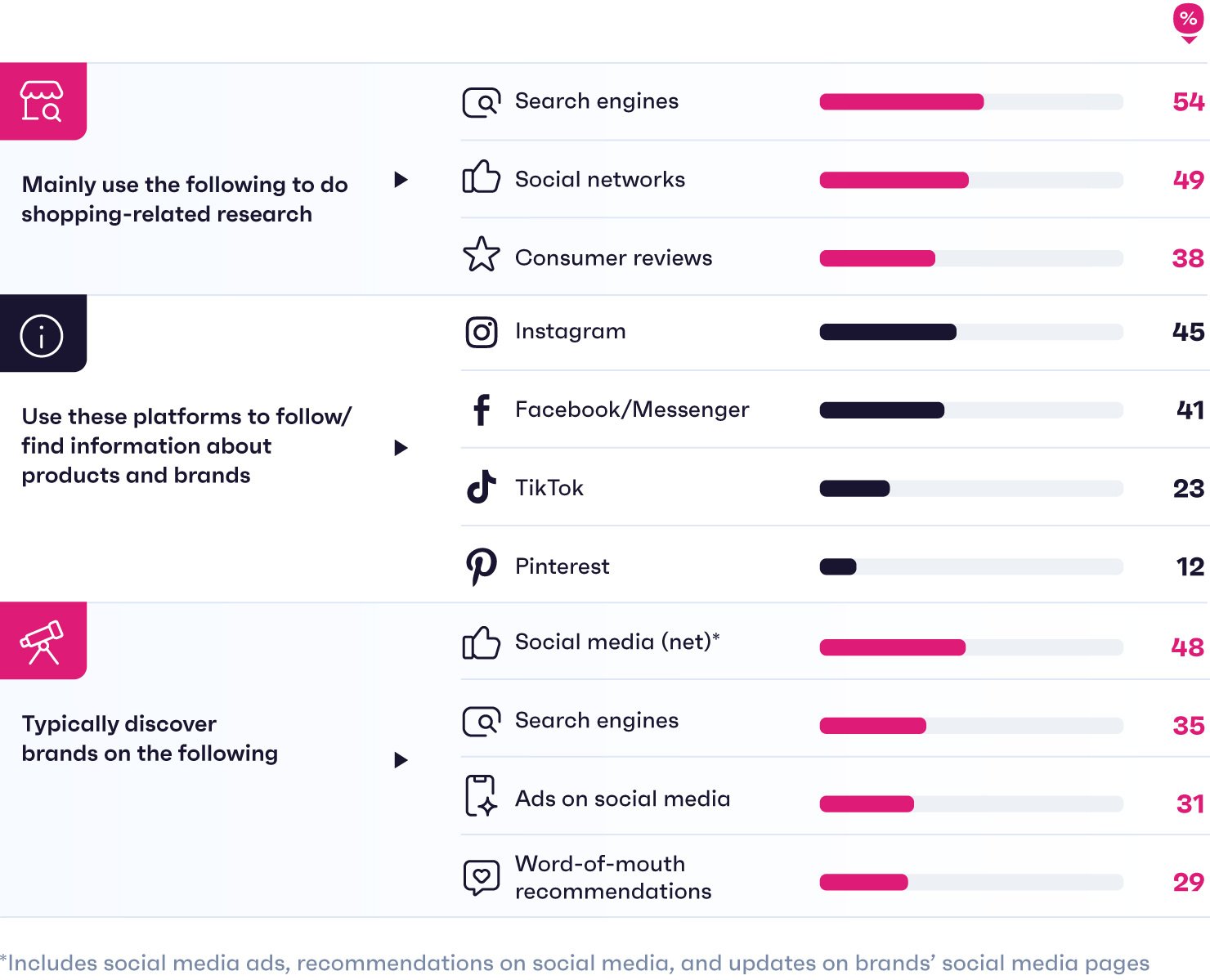

Scrolls to sales: Social media fuels the purchase journey

% of consumers, outside China, who...

- Source: GWI Core Q4 2023

- Base: 239,091 internet users, outside China, aged 16-64

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core Q4 2023

- Base: 239,091 internet users, outside China, aged 16-64

Already a GWI user? Explore the data on the GWI platform

Today, more consumers discover products via social media ads, updates on a brand’s social pages, or recommendations in this space than on search engines. When combined, these methods have a lot of influence.

Not only that, but many scrollers actively turn to apps like Instagram to research products, and we’ve seen jumps in the number of TikTok and Snapchat users saying they use each app to do this, as well as a rise in people messaging friends on them. This means people can discover, research, forward on, and purchase all in one place. In fact, over 50% of consumers who’ve bought an item on TikTok Shop say they purchased from a brand or seller they discovered using the feature.

Companies should aim to create visually engaging content that inspires their target audience to explore, and those in certain sectors stand to benefit from social media’s increasingly sophisticated ecommerce tools.

Ask our customers

As per industry sources, the projected sales from social commerce is $87 billion for 2024 and platforms like Snapchat have been the top source of discovery for consumers when it comes to brands and products. According to our research, 64% of Gen Z and millennials have made a purchase on, or through, social platforms in the past year. This shift is driven by several reasons including more interactive shopping experiences, like augmented reality try-on lenses on Snapchat, and tailored recommendations, which are seen as more quick and convenient tools. More importantly, the ability to include friends and family in the shopping experience has also led to the growth of shopping via online platforms. We know that Gen Z turns to Snapchat more than any other app to get feedback from close friends on purchase decisions.

In the mood(board) for inspo

%20for%20inspo-1.png?width=2106&height=1458&name=Chapter%204%20image%20-%20In%20the%20mood(board)%20for%20inspo-1.png)

We mentioned that Gen Z are driving the shift toward inspo-driven searching on social media, and mood boards are a means of collecting all that inspiration in one place. 47% of Pinners say they use the app for style inspiration, almost as many for home décor/design ideas, and 18% for wedding/event inspo.

Gen Z make up larger portions of Pinterest and Tumblr users than Instagram or TikTok, and Pinterest is their fastest-growing app in terms of usage.

Gen Z stands out for wanting brands to be trendy/cool, and mood boards are an ideal place to monitor what they’re interested in. That’s because they allow for natural and spontaneous creative ideas, something which is often missed in the current influencer marketing landscape.

Brands have a variety of opportunities with mood boards and can create products to match trending “vibes.” After noticing that Pinterest users were pinning pictures of David and Victoria Beckham from the 1990s in parachute pants, Jaded London released some of their own, and have since sold over 200,000 pairs.

Brands can also collaborate with mood boards on exclusive drops, exactly what hidden.ny and JJJJound have done successfully in the past. These boards ultimately give Gen Z consumers what they want - exclusivity, personalization, and a community to belong to.

Newsletter

On the dot

Get fresh insights, surprising stats, and fun pop culture moments in our newsletter delivered straight to your inbox every week.

Sign up nowGen Alpha: The next screen teens

Not everything’s about Gen Z, though. Gen Alpha are growing up, and with this, comes more agency. In the last year, we’ve spotted increases in the number of teens who choose their own clothes, video games, and food.

More importantly, they’re getting a sense of which brands and products they like on social media; there’s been an 11% year-on-year rise in the number of teens who say finding things to buy is one of their main reasons for using it.

Gen Alpha are increasingly using social media for shopping ideas

% increase in the number of social media users aged 12-15 who say the following are their main reasons for using social media since Q1 2023

- Source: GWI Kids Q1 2023 & Q1 2024

- Base: 10,577 (Q1 2023) and 10,650 (Q1 2024) kids who use social media aged 12-15 in 18 markets

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Kids Q1 2023 & Q1 2024

- Base: 10,577 (Q1 2023) and 10,650 (Q1 2024) kids who use social media aged 12-15 in 18 markets

Already a GWI user? Explore the data on the GWI platform

Brands would be wise to start speaking to and building early bonds with Gen Alpha, but do so in a mindful way. Thanks to social media, “Sephora kids” have been inspired to get into skincare earlier, and we’ve seen a rise in younger groups buying anti-ageing serums or creams designed for older consumers. This trend has even pushed a Swedish pharmacy chain to start ID'ing its skincare buyers.

In this case, companies can work with relatable public voices to educate their Gen Alpha audience or create product options that are suitable for them.

The influencer effect

A recent HubSpot survey revealed that 50% of marketers who collaborate with influencers plan to boost their investments in 2024. But others may be wondering if the juice is worth the squeeze. While there was a small climb in the number of social media users saying they follow influencers between 2020-21 (+6%), it’s stayed pretty consistent since then, a sign that growth isn’t increasing at the rate of marketer investments.

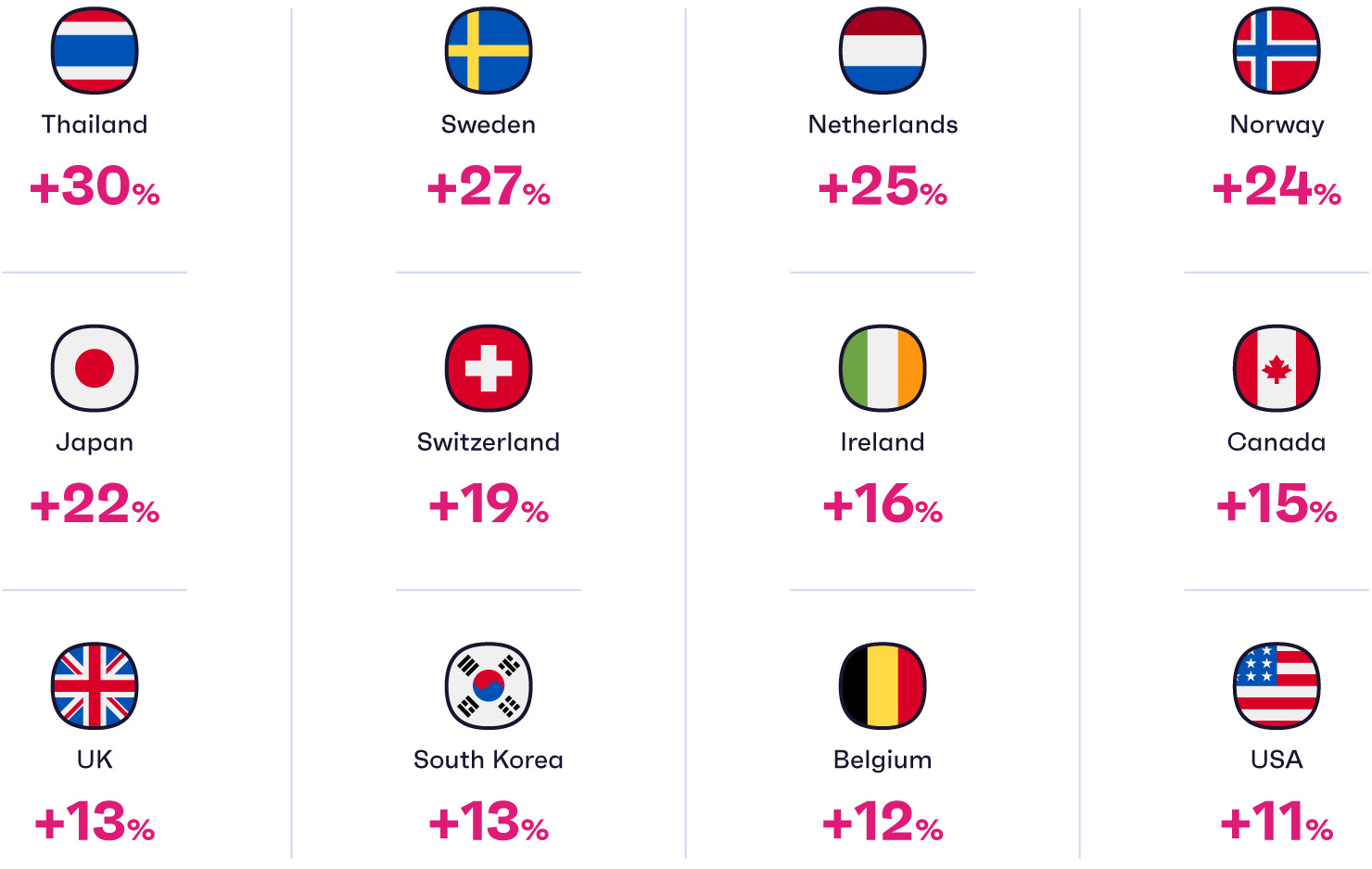

That said, some markets are still seeing bigger and more recent jumps in influencer engagement. In the past year, the proportion of social media users following influencers in countries like the US, Ireland, and South Korea has hit or passed the 25% mark, which is an impressive milestone. Also, while younger generations are the most likely to follow influencers, the number of baby boomers who do is growing faster - climbing by an impressive 17% since Q4 2022.

Influencer engagement is still climbing in some markets

% increase in the number of consumers who say they follow influencers in each market since Q4 2022

- Source: GWI Core Q4 2022 & Q4 2023

- Base: 228,113 (Q4 2022) and 225,108 (Q4 2023) social media users aged 16-64

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core Q4 2022 & Q4 2023

- Base: 228,113 (Q4 2022) and 225,108 (Q4 2023) social media users aged 16-64

Already a GWI user? Explore the data on the GWI platform

The important thing is that influencer followers are an audience with a lot of purchase intent. They’re 45% more likely to say they use social networks to find products to buy than the average social media user, and 24% more likely to have bought a product or service online in the last week.

With more social media touchpoints and platforms to choose from than in the past, and an enormous creator economy, brands can be very tactical in their decision-making. Using data, they can identify high potential markets with engaged influencer followers, keep an eye on ROI, and zero in on their audience’s influencer preferences.

Ask our customers

Marketers desperately need to rethink the idea of “influence.” We’re no longer in a top-down media environment where single, centralized sources are wholly trusted. The search bar provides answers from advertisers who spent the most, while influencers are incentivized by endorsements. Today, trust is decentralized and bi-directional. On Reddit, the hive-mind consistently and democratically sources answers from people they trust. 93% of those who came across a Reddit recommendation were “more than satisfied,” and therefore trust Reddit more than influencers, TV ads, and salespeople. From which skincare products are most underrated, to how to navigate each of life’s stages, in a world of distributed trust, the influencer isn’t a person, but the crowd.

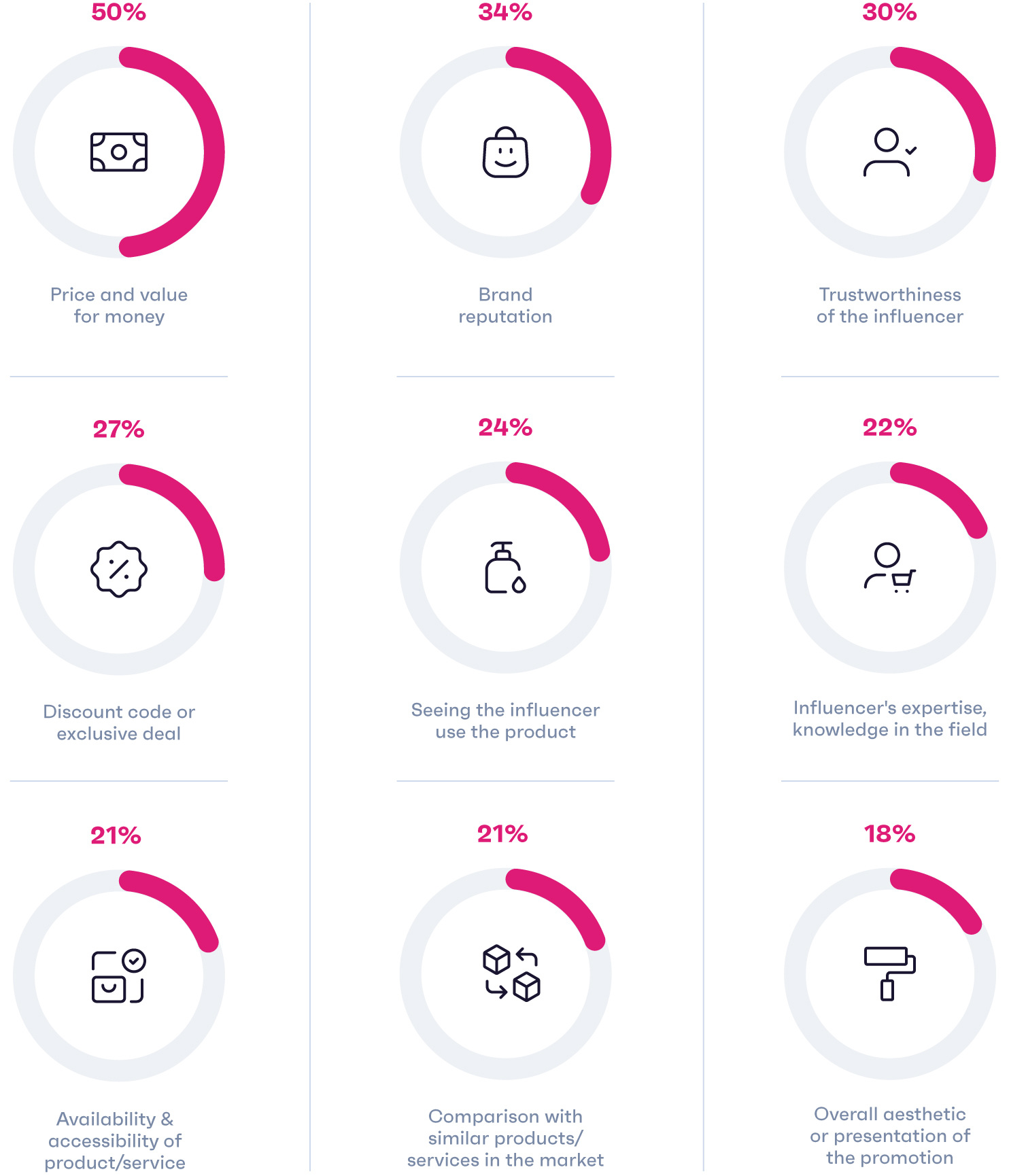

Clout alone doesn't convince consumers to buy

So how powerful is influencer marketing, really? Globally, 13% of consumers say that influencer recommendations would most increase their likelihood of buying a product online, compared to 40% for discounts. This reminds us that influencer marketing should generally be a supplement to, rather than the bulk of a brand’s advertising strategy, and that it should be approached strategically.

Price/value is the top motivation for influencer-driven purchases, which is no surprise given the current economy. Yet, 84% of those who buy from influencers say they avoid using their links at least sometimes and prefer visiting official websites. Offering a discount code personalized to the influencer can help incentivize direct purchases, and also help brands track ROI on their investments.

Walk the walk: Expertise and product demos boost trustworthiness

% of influencer buyers who say the following factor into these shopping decisions

- Source: GWI Zeitgeist March 2024

- Base: 6,136 internet users who've purchased a product/service off the back of an influencer's endorsement aged 16-64 in 12 markets

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Zeitgeist March 2024

- Base: 6,136 internet users who've purchased a product/service off the back of an influencer's endorsement aged 16-64 in 12 markets

Already a GWI user? Explore the data on the GWI platform

Next, an influencer’s credibility matters a lot. People care about whether an influencer specializes in their field, which is one of the reasons why the micro influencer vs celebrity debate gets so much attention.

With more Gen Z identifying as influencers/creators than healthcare workers, the talent pool is huge and who you go with will depend on your budget, what you sell, and whether you have short or long-term goals. Still, brands should create an overall “scorecard” for each influencer they’re considering, which accounts for things like engagement metrics and the consistency of their messaging, not just their follower count.

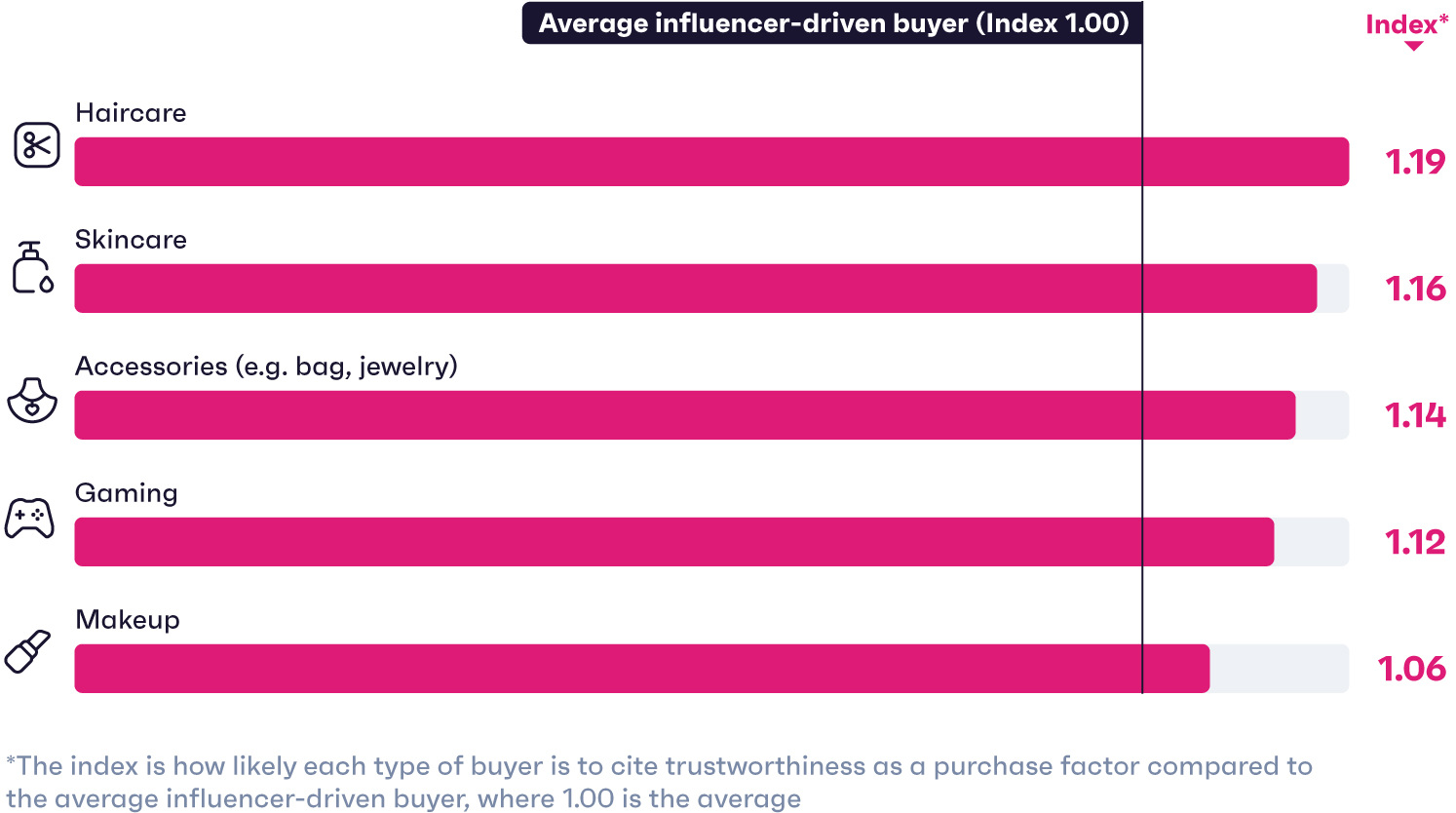

Credibility sells, especially in the beauty sector

Highest-indexing* types of buyers who value trustworthiness, based on the % of influencer-driven shoppers who say trustworthiness factors into their purchase decisions

- Source: GWI Zeitgeist March 2024

- Base: 6,136 internet users who've purchased a product/service off the back of an influencer's endorsement aged 16-64 in 12 markets

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Zeitgeist March 2024

- Base: 6,136 internet users who've purchased a product/service off the back of an influencer's endorsement aged 16-64 in 12 markets

Already a GWI user? Explore the data on the GWI platform

This is especially important in certain industries. Despite being low investment purchases, an influencer’s trustworthiness matters more to those who buy haircare, skincare, and makeup. Among all influencer-driven buyers, trustworthiness is the third most-considered factor, behind value for money and brand reputation. Among beauty buyers, it ranks ahead of brand reputation.

In the beauty industry, accessibility, personalization, and inclusivity are in the limelight. Products are increasingly being made with specific skin tones, conditions, and hair types in mind. And with many marginalized groups already engaging relatively more with influencers, and responding less to traditional ads than average, this is a promising channel for companies focused on brand-building.

Finally, product demos are also a big part of why consumers trust recommendations: as many people are motivated to buy from influencers because they’ve seen them use a product because of their expertise. This shows that how influencers market items matters as much as their online clout. Brands should generally aim to give influencers creative freedom, as they know their audience best, but a few data-driven guidelines never hurt anyone.

Ready to become an expert on your audience? Take a tour of our consumer research platform that represents the views of nearly 3 billion people.

Let's get startedNotes on methodology

Each year, GWI interviews over 960,000 internet users aged 16-64 in 53 markets via an online questionnaire for our Core data set. A proportion of respondents complete a shorter version of this survey via mobile, hence the sample sizes presented in the charts throughout this report may differ as some will include all respondents and others will include only respondents who completed GWI’s Core survey via PC/laptop/tablet.

When reading this report, please note that we focus on data from our ongoing global quarterly research, but also refer to our monthly Zeitgeist studies across 12 markets, our GWI USA data set, which surveys over 80,000 internet users in the US aged 16+ each quarter, and GWI Kids, which surveys 20,000 internet users aged 8-15 across 18 markets.

Throughout this report, we refer to indexes. Indexes are used to compare any given group against the average (1.00), which unless otherwise stated refers to the global average. For example, an index of “1.20” means that a given group is 20% above the global average, and an index of “0.80” means that an audience is 20% below the global average.