Report

The global media landscape

Your game plan for shoppers, streamers, and scrollers

Many brands share the same challenges: they're trying to reach as many people as possible, select channels with the best ROI, engage niche fanbases on a more personal level, adapt their creative for different platforms, and leave room to experiment on up-and-coming spaces. They’ll find tips on all this, and more, in our report.

Key insights

Broadcast TV still commands the greatest share of total TV time

AI platforms are one of the top three ways Gen Z search online

POC are more receptive to influencers, and less to ads, than average

There’s been a rise in people wanting ads to include discounts

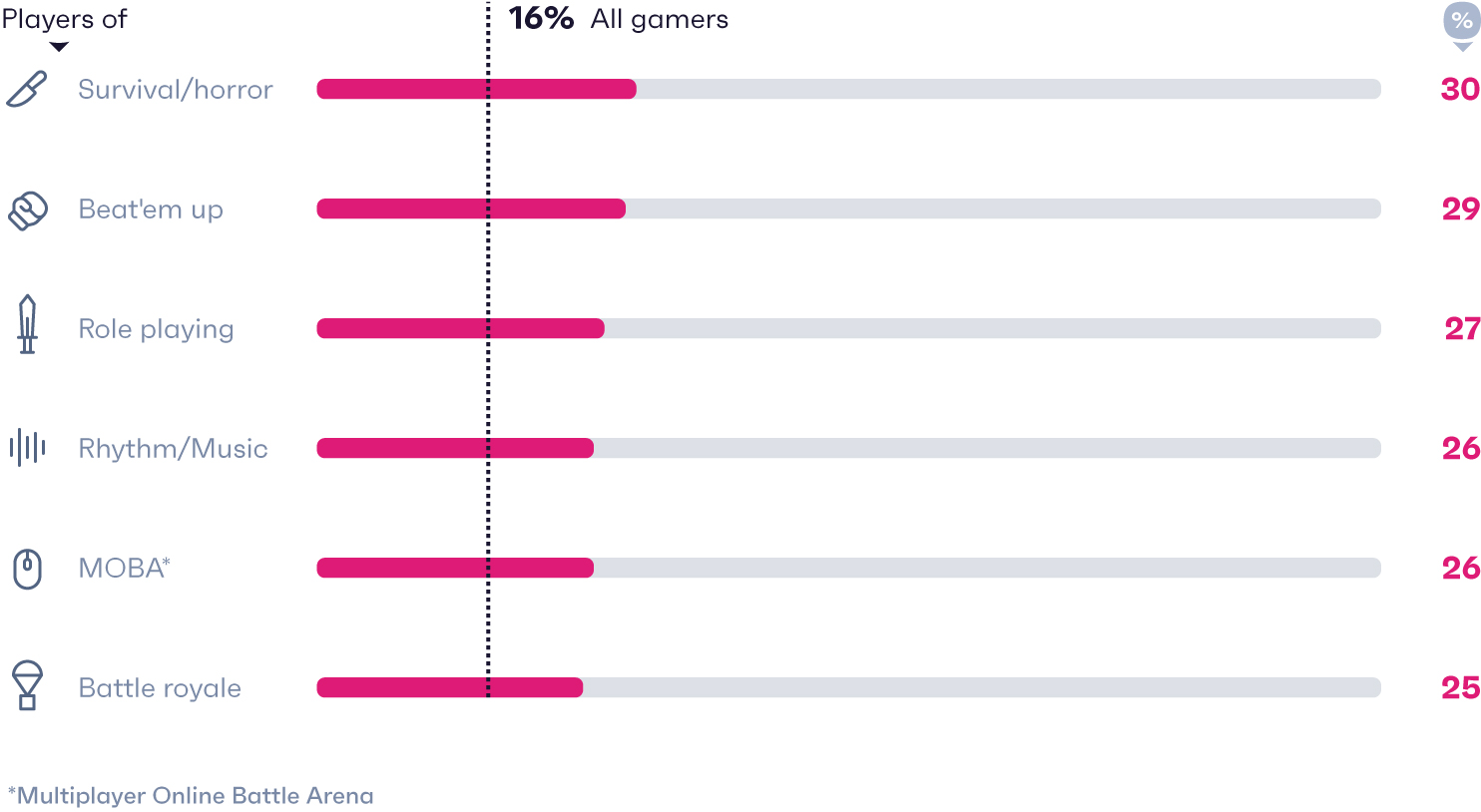

Survival/horror players are most excited about gaming luxury collabs

01

Today’s top media trends

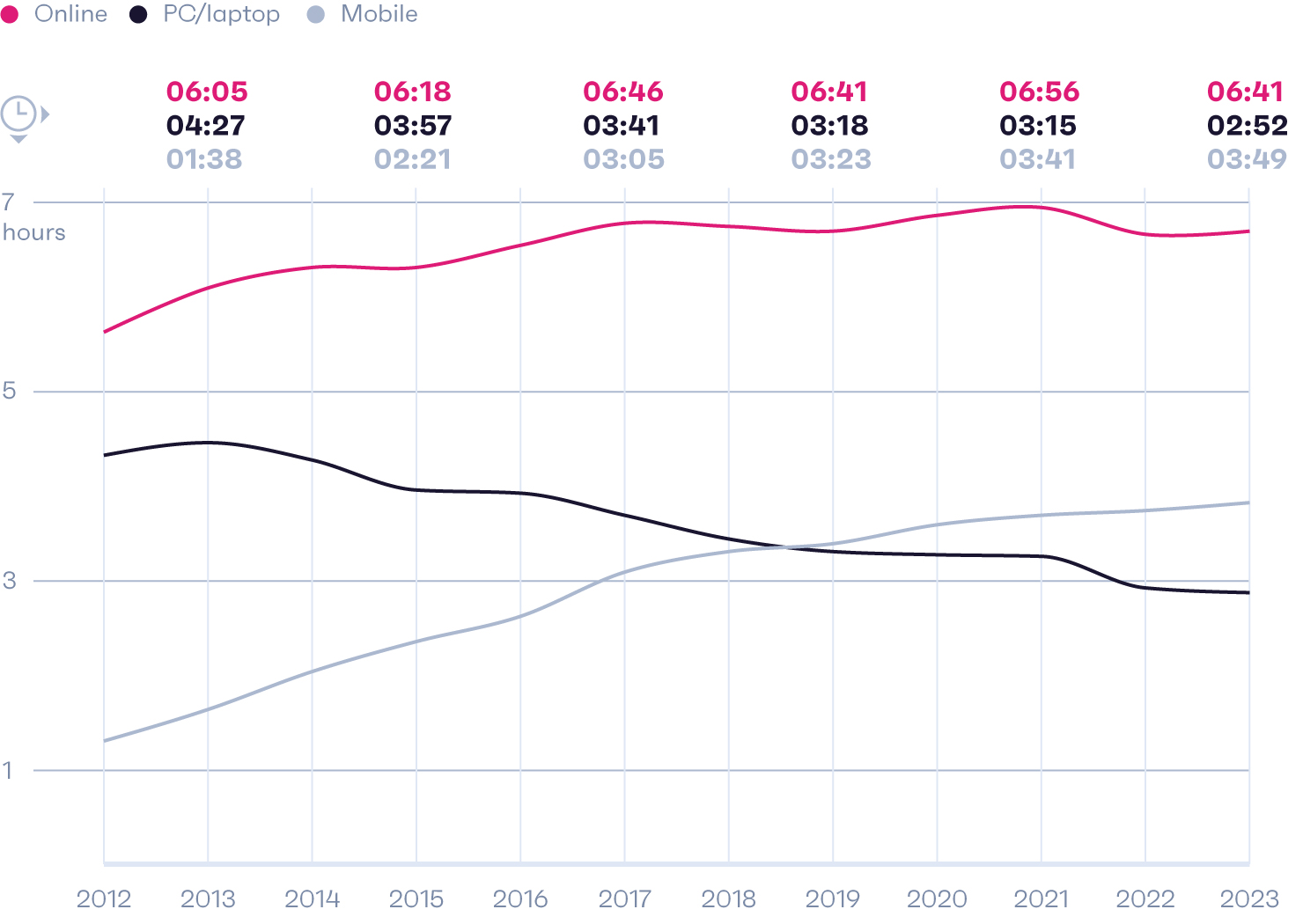

Up until 2016, the headline was: consumers are spending more and more time online. We didn’t know where the ceiling was.

We soon found it. Lockdowns and their aftermath were responsible for new peaks, but they were a one-off. Now, business professionals are returning to the office, new technology like AI has joined the long list of platforms we use regularly, and tighter budgets have pushed people to rethink subscriptions.

There’s been slight drops in internet usage, but generally it’s pretty stable and likely to stay that way. So, it’s better to move away from the amount of time we spend online and start focusing on the what, how, and why.

Average time online isn't changing much, but device usage and behaviors are

Average daily time that global consumers say they spend online/on mobile/on PC or laptop in hh:mm

- Source: GWI Core Q4 2012-Q3 2023

- Base: 3,438,923 internet users aged 16-64

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core Q4 2012-Q3 2023

- Base: 3,438,923 internet users aged 16-64

Already a GWI user? Explore the data on the GWI platform

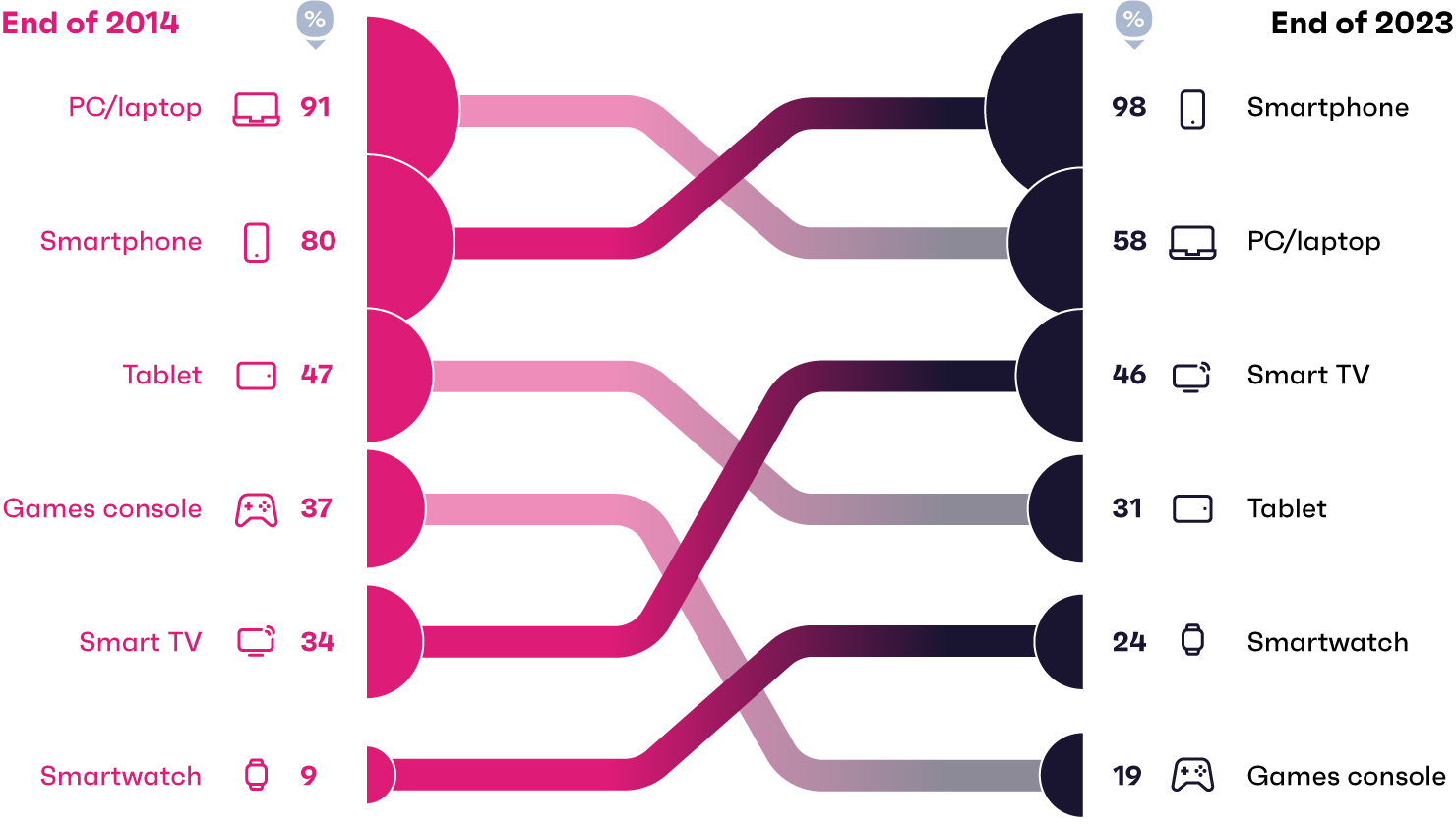

Smart products are branching out

Smartphones dominate today’s media landscape, which has had a domino effect. Their intelligent features made smart tech more mainstream, and devices like watches and thermostats continue to rely on their apps.

Device ownership has changed a lot over the last decade

Ranked order of devices owned, based on the % of global consumers who said they owned them in Q3 2014 and Q3 2023

- Source: GWI Core Q3 2014 & Q3 2023

- Base: 281,218 internet users aged 16-64

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core Q3 2014 & Q3 2023

- Base: 281,218 internet users aged 16-64

Already a GWI user? Explore the data on the GWI platform

As a result, we’ve seen some big shifts in product ownership. Smart TVs overtook tablets in 2018, with smartwatches speeding past game consoles in 2022.

Plus, we’re keeping a watchful eye on these markets as they evolve. Back in 2015, 36% of US/UK Apple Watch owners were female; today, it’s 57%, and their use cases are expanding. Health/fitness tracking is still the number one reason for having them but among owners of brands like Sony and G-Shock, entertainment, browsing, or communication rank top. In the future, consumers might start leaning more heavily on an even smaller screen for everyday scrolling, which could mean extra focus on strong visuals in ads, and less on text and click metrics.

Smart home products are also branching out. The number of people saying they own one has risen by 15% in the last two years, with growth being boosted by groups like parents with young children (+22%) or divorced/widowed consumers (+27%), which means the list of potential marketing possibilities is ballooning.

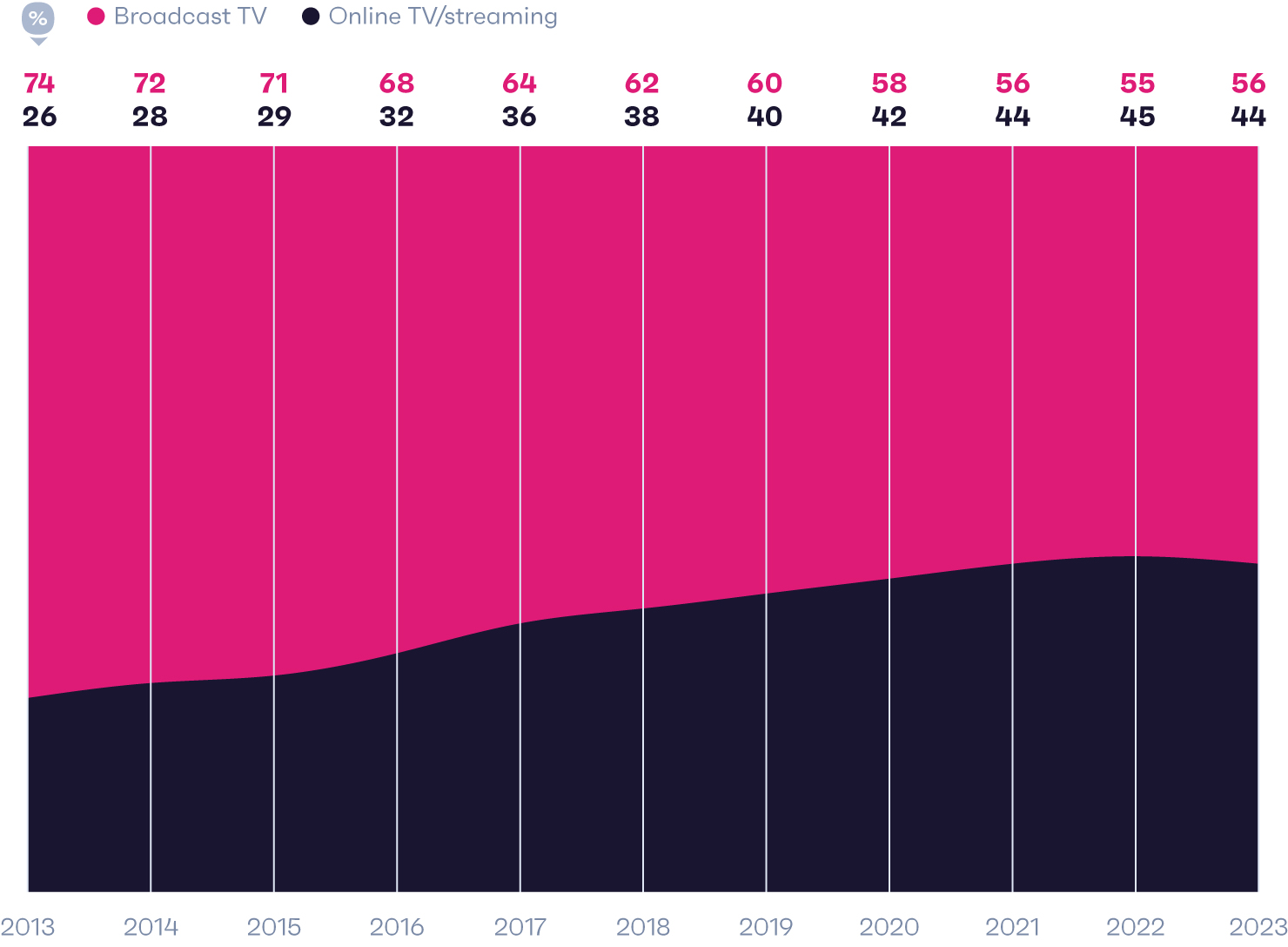

Broadcast TV is still the main character

You might have read headlines that broadcast TV has less reach than it used to, and we can confirm they’re true. Late 2023 was the very first time that 1 in 10 internet users said they don’t watch any broadcast TV on a usual day.

Though, headlines tend to focus on what’s changing, rather than on what’s staying the same – which is also important. Broadcast TV still commands a greater share of total TV time than streaming, with broadcast shows like "The Traitors" and the 2024 Super Bowl smashing all kinds of live viewership records. Groups like baby product/pet food buyers, cruise fans, and spirit drinkers are heavy TV watchers, so it’s also a great channel to explore if you have a specific audience in mind.

Online TV commands a greater share of total TV time than it used to

% share of total TV time that's devoted to the following, based on the amount of time global consumers say they spend using each on a typical day

- Source: GWI Core Q1 2013-Q3 2023

- Base: 3,438,923 internet users aged 16-64

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core Q1 2013-Q3 2023

- Base: 3,438,923 internet users aged 16-64

Already a GWI user? Explore the data on the GWI platform

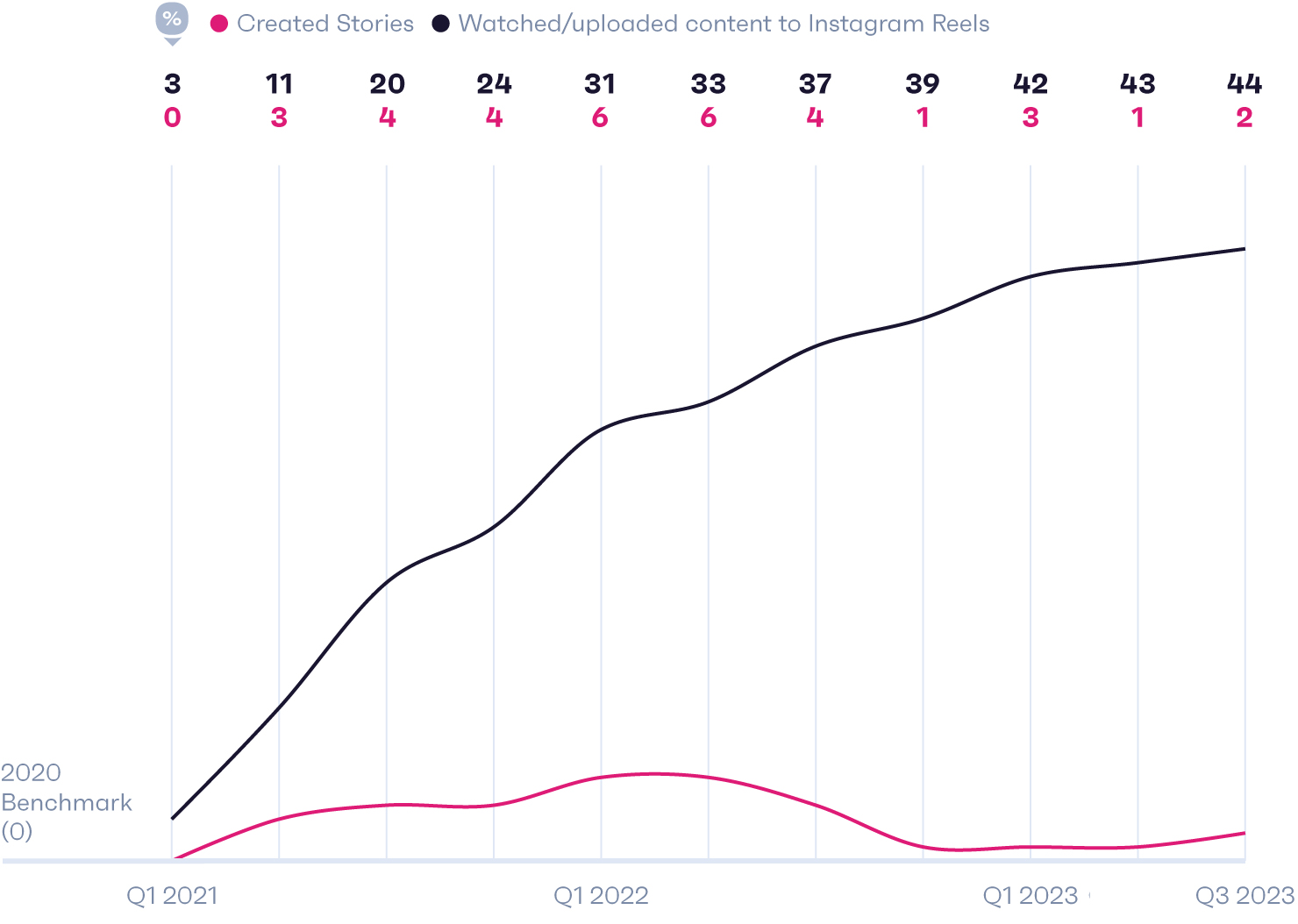

Came to scroll, stayed for the entertainment

At the top of the leaderboard, social platforms beat all other media types for the daily time people spend using them – for the average consumer, this is 2 hours and 23 minutes. And the fabric of this space is changing.

Short videos are having a big impact

% change in the number of Instagram users who say they've done the following on the platform in the last month, relative to 2020

- Source: GWI Core Q4 2020-Q3 2023

- Base: 1,627,803 Instagram users aged 16-64

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core Q4 2020-Q3 2023

- Base: 1,627,803 Instagram users aged 16-64

Already a GWI user? Explore the data on the GWI platform

What’s happening on Instagram is emblematic of a wider shift: people are using social media more for entertainment, and relatively less for personal sharing. While creating stories has stayed fairly stable on Instagram, Reels is where the momentum is.

Short-form video is ultimately a great playground for creativity, and an opportunity to drive powerful brand engagement. Half of those who view short clips on social media say they "like" or "comment" on them more than long-form content, and 62% say they share them with family/friends more.

Guide

The ultimate guide to social for agencies

Keep up with the changing social media scene with all the insights you need to reach your audience in 2024.

Get the guideUSA spotlight

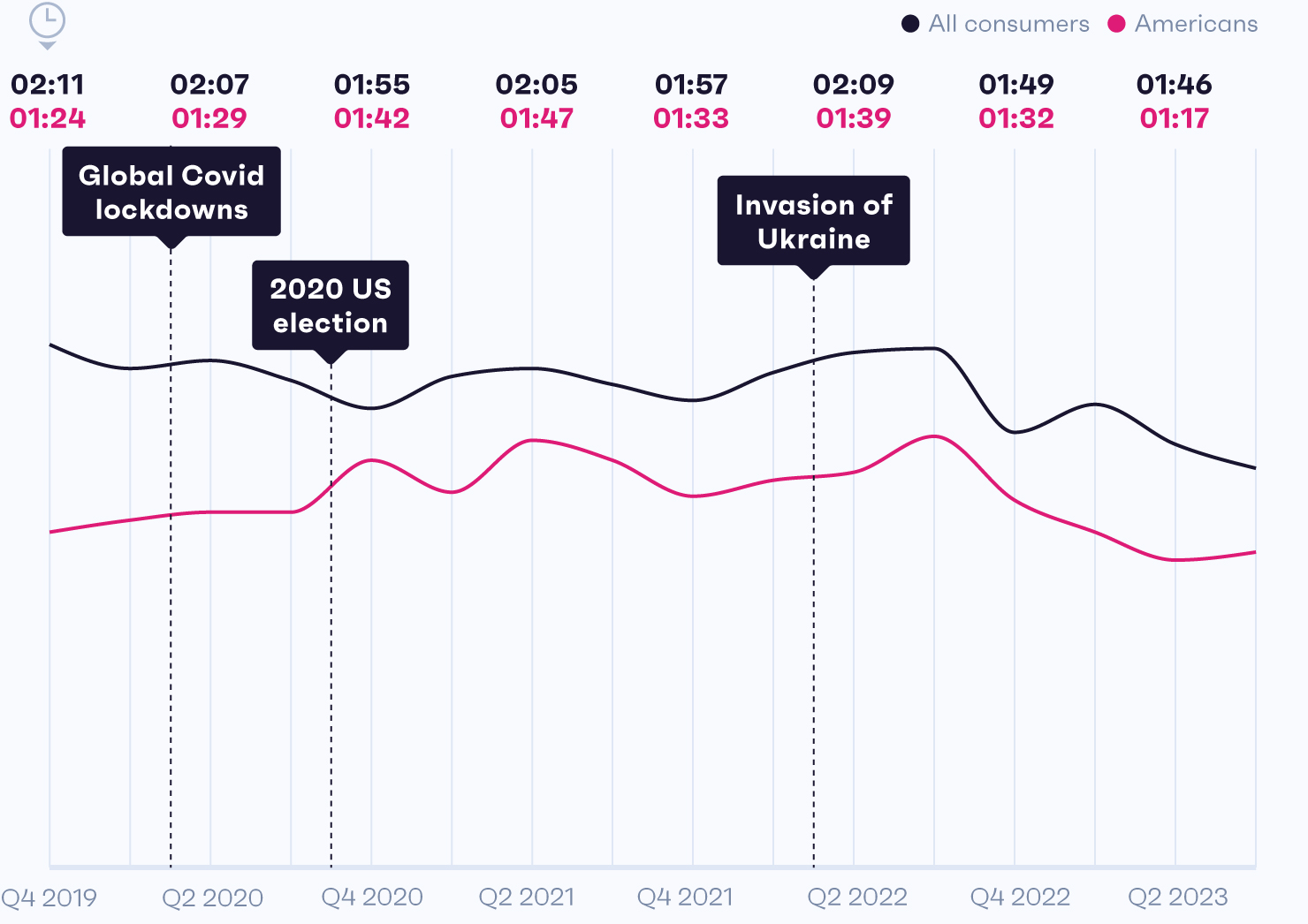

During the initial, highly uncertain phase of the pandemic, news was in great demand, so much so that briefings from heads of state became some of the most-watched programs in history. But as we’ve entered an age of “permacrisis”, people have switched off. They’re spending less time reading both physical print and online press, with half of consumers saying they found themselves actively trying to avoid news on a weekly basis in December 2023.

Engagement with the news is slipping

Average daily time that global/American consumers say they spend reading online press and physical press in hh:mm

Source: GWI Core Q4 2019-Q3 2023 • Base: 2,393,052 internet users aged 16-64; and 405,857 Americans • Question: On an average day, how long do you spend on print press | On an average day, how long do you spend on online press?

But it’s not just negative content that’s driving disengagement; distrust is rising. Trust is especially relevant to US brands right now, as concerns around misinformation tend to rise before an election. America saw an uptick in time spent reading news during the 2020 presidential race, which shows there’s a window of time at the beginning of an event where more people are highly engaged. This means US publishers have an opportunity to gain new and loyal fans in the months ahead using some of the methods we’ve outlined in our 2024 consumer trends report, Connecting the dots.

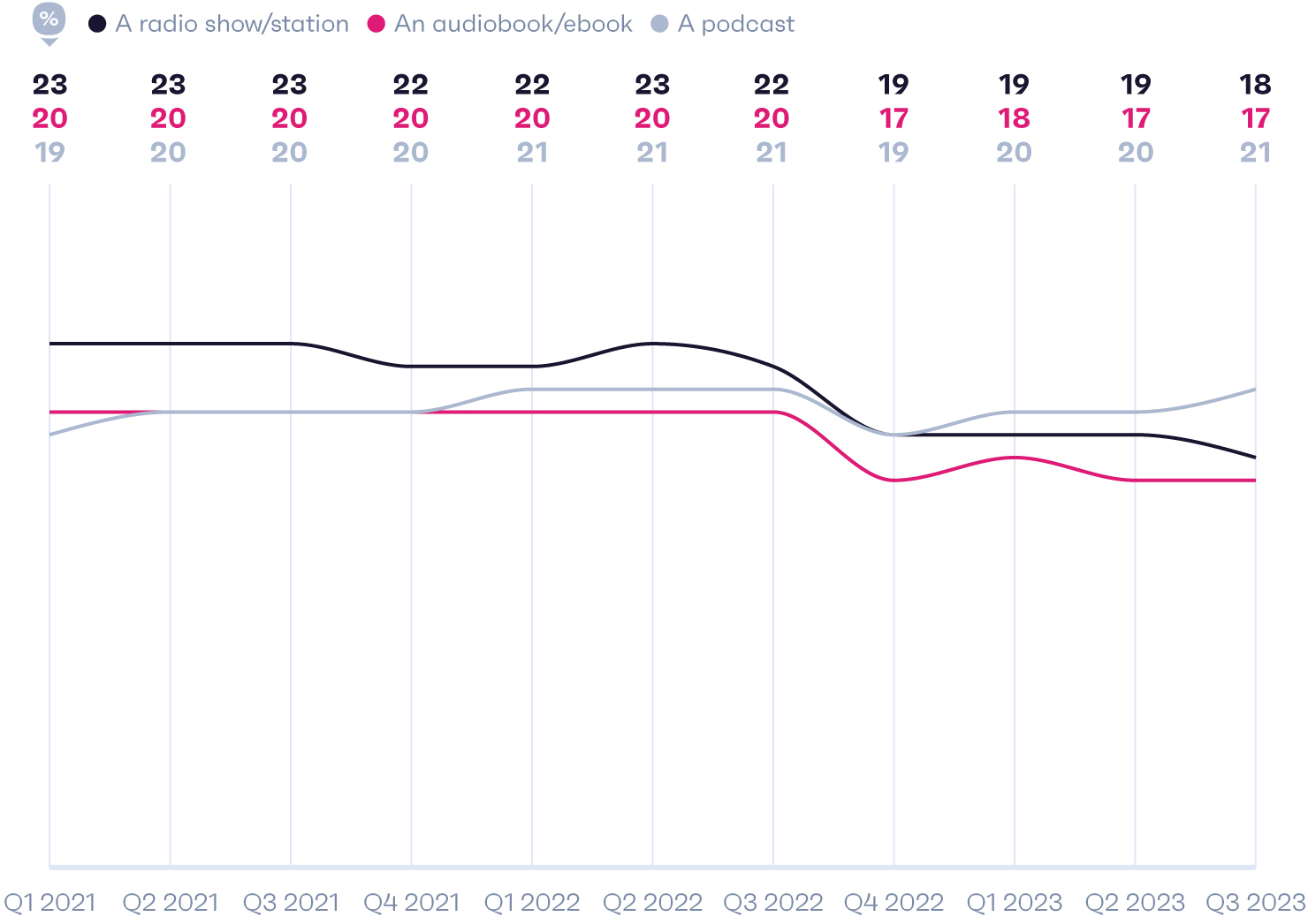

Podcasting has matured. What’s next?

Every medium has its golden age, where growth is rapid, investments are high, or competition is more scarce. Then, the hype dies down and formats enter their next phase. That’s what’s happened with podcasts.

Still, progress has been impressive, especially when we compare podcasting to long-standing forms of online audio; and advertisers now want to know which audiences they can speak to using it, and how well.

Podcasting's growth has slowed, but it's overtaken other forms of online audio

% of global consumers who say they've listened to the the following online in the last week

- Source: GWI Core Q1 2021-Q3 2023

- Base: 2,495,245 internet users aged 16-64

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core Q1 2021-Q3 2023

- Base: 2,495,245 internet users aged 16-64

Already a GWI user? Explore the data on the GWI platform

This format also carries weight in the B2B space. There’s been a 93% rise in work decision-makers saying they use podcasts to keep up with developments and products in their sector since 2019; and among Western decision-makers, they’ve surpassed ads, radio, blogs, and magazines in that timeframe. As long as marketing is well-placed, it’ll get through to some influential people.

02

Understanding the battle for consumers' attention

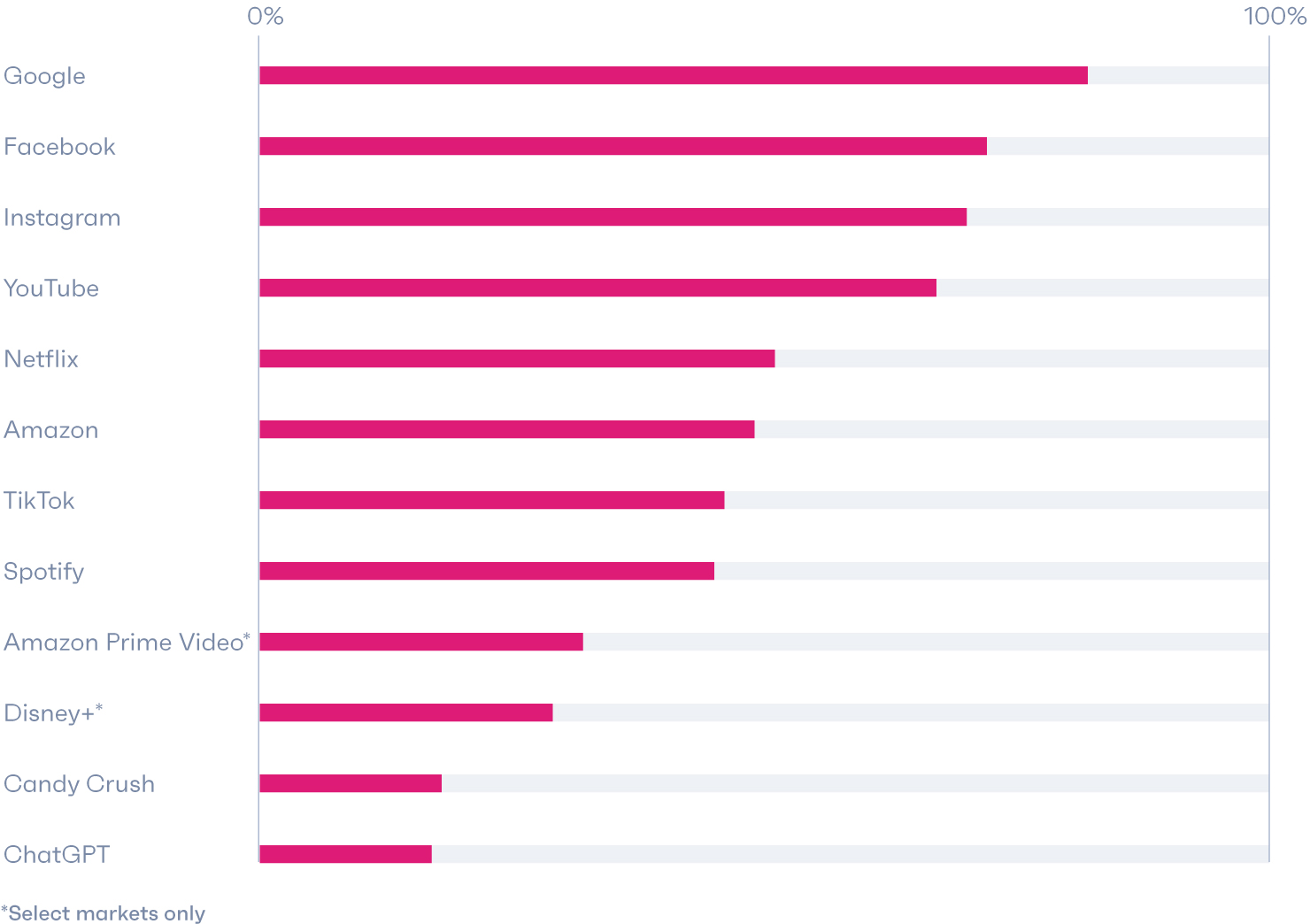

All platforms are in competition with each other for consumers' time

Based on the % of global consumers (outside China) who say they use the following monthly

- Source: GWI Core Q3 2023

- Base: 215,392 internet users outside China aged 16-64

Already a GWI user? Explore the data on the GWI platform

- In the last month, which of these websites/apps have you visited or used?

- How often do you visit or use these services?

- In the last month, which of these services have you used to listen to/download music, radio or audiobook content?

- In the last month, which of these services have you used to watch/download TV shows, films or videos?

- Source: GWI Core Q3 2023

- Base: 215,392 internet users outside China aged 16-64

Already a GWI user? Explore the data on the GWI platform

- In the last month, which of these websites/apps have you visited or used?

- How often do you visit or use these services?

- In the last month, which of these services have you used to listen to/download music, radio or audiobook content?

- In the last month, which of these services have you used to watch/download TV shows, films or videos?

This data also shows why companies add new revenue streams. Consumers only have so many hours in a day, so it helps to monetize them via other services, as Amazon and Disney do very well. This is what Jeff Bezos meant when he said, “I’m pretty sure we’re the first company to have figured out how to make winning a Golden Globe pay off in increased sales of power tools and baby wipes!”.

Your customers might be searching for you on AI chatbots

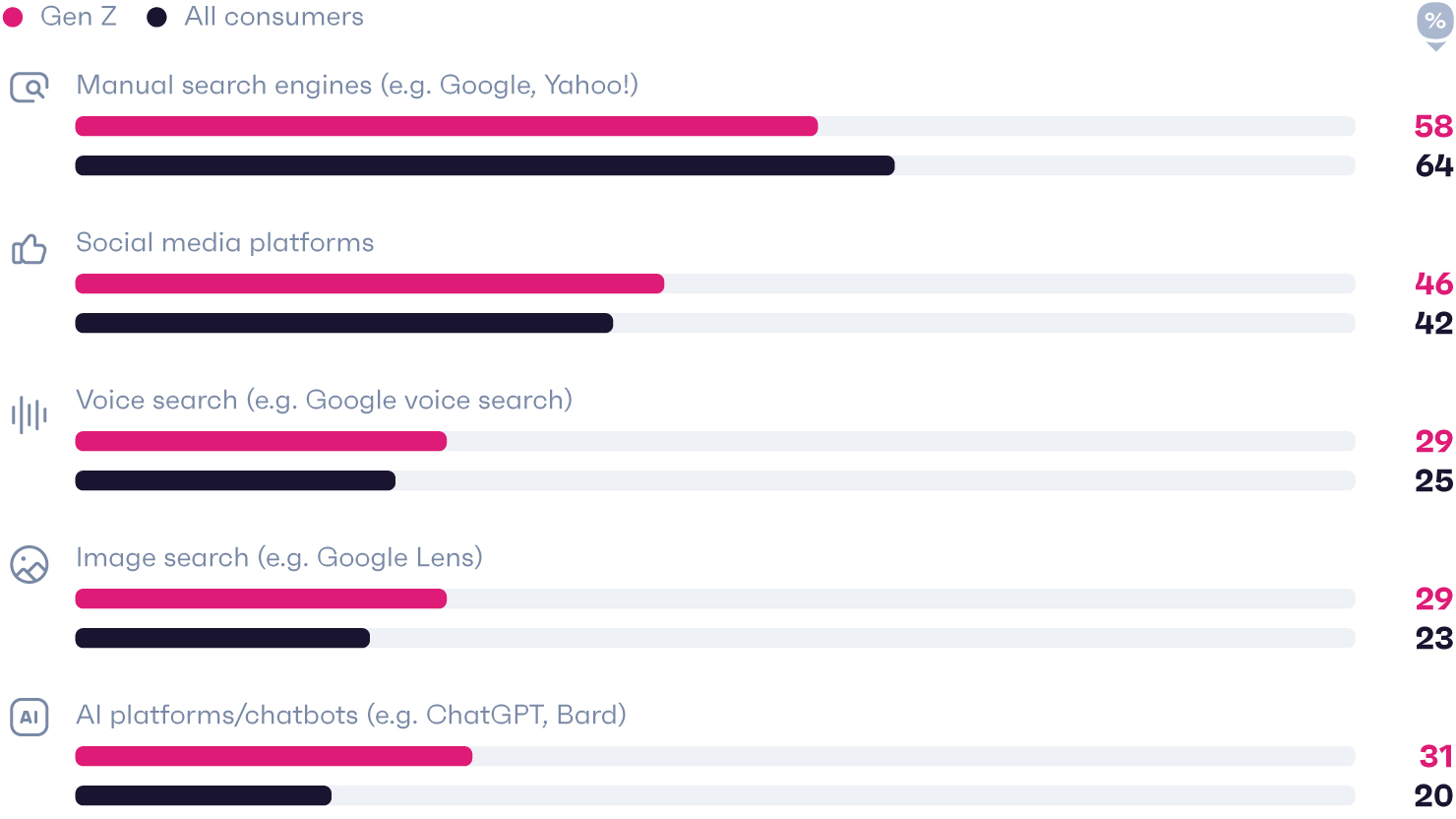

If you read the full list of platforms above, you’ll have spotted ChatGPT. Having achieved in one year what took voice and image search a decade, it’s now one of the top three ways Gen Z search for information.

As the only generation to pick social platforms over search engines for shopping-related research, Gen Z clearly like customized results, which explains their enthusiasm for AI. Plus, with over a fifth of 12-15 year-olds saying they mainly use social media to find things to buy, it’s likely Gen Alpha will have similar search preferences as they age. Brands should future-proof their strategies to include AI, as even if people don’t trust everything they see on chatbots, they’re finding more reasons to spend time on them.

Report

The new age of Gen Z

Today’s “it” consumers are becoming parents, finding work-life balance, and defining themselves by their passions. Here’s what matters to them now.

See the trendsAI chatbots are one of Gen Z's top three most-used search platforms

% of Gen Z/all consumers who say they use the following platforms most to find information on the internet

- Source: GWI Zeitgeist August 2023

- Base: 15,469 internet users aged 16-64 in 12 markets, and 2,072 Gen Z aged 16-26

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Zeitgeist August 2023

- Base: 15,469 internet users aged 16-64 in 12 markets, and 2,072 Gen Z aged 16-26

Already a GWI user? Explore the data on the GWI platform

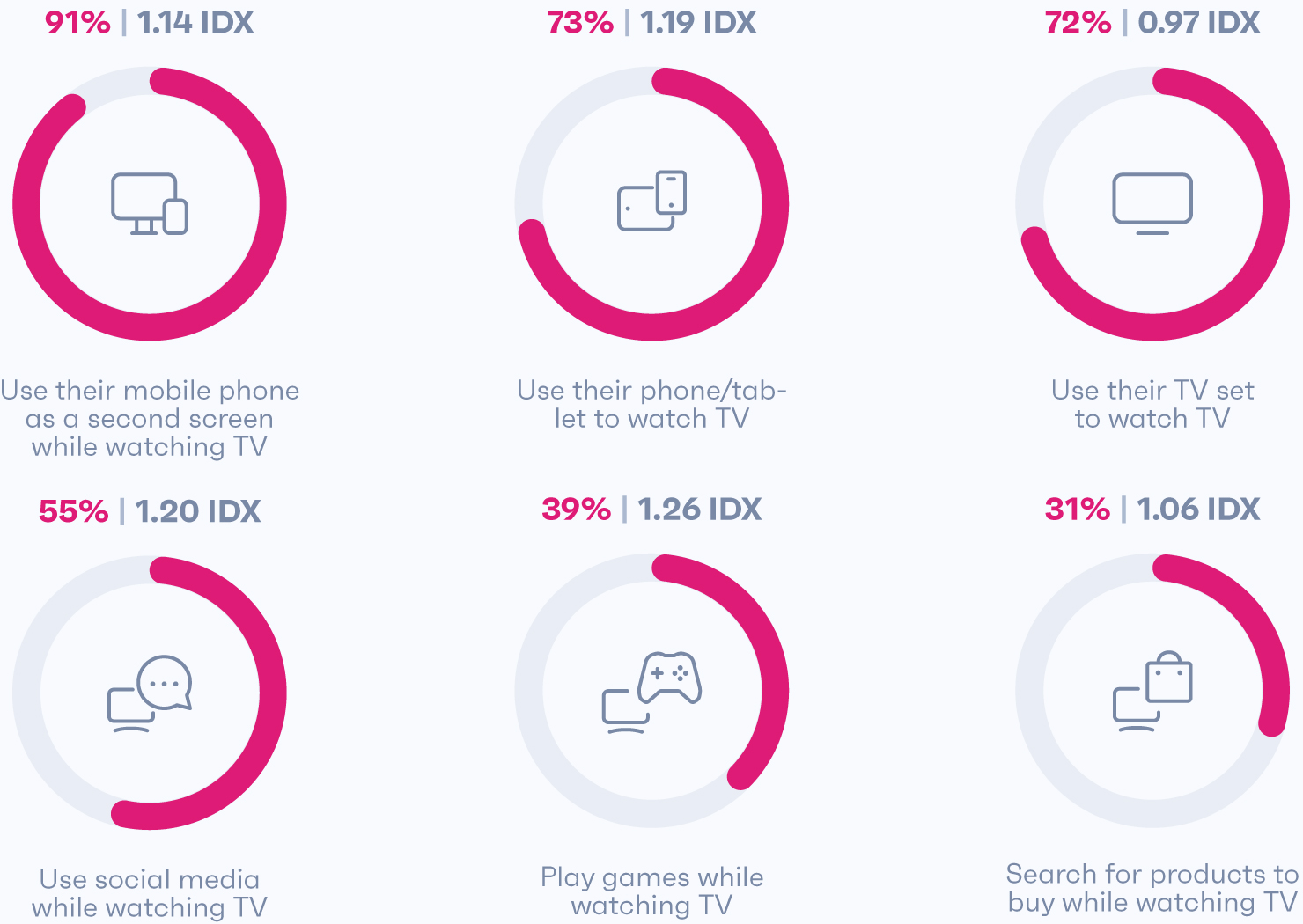

Southeast Asia spotlight

Most global consumers use TVs and mobile phones simultaneously, either when watching TV on their smartphones or as a second screen for information and entertainment. In Southeast Asia, it’s actually rare not to, and just as common to watch TV on a phone as on an actual TV set.

So, capturing people’s attention isn’t just difficult because we’re using more media channels; it’s also difficult because we're jumping between them.

Don't take "TV time" literally

% of consumers in Southeast Asia who...

The index (IDX) is how likely internet users in Southeast Asia are to do the following compared to other global consumers, where 1.00 is the average

Source: GWI Core Q3 2023 • Base: 25,267 internet users in 6 Southeast Asian markets aged 16-64 • Questions: Which of these devices do you use to watch live TV/TV Channels | on-demand TV/streaming services? | Which of these devices do you often use while watching television? | Which of these things do you do online when watching TV?

Interactive ad formats and cross-platform campaigns are a good workaround. 1 in 5 consumers in Southeast Asia who use their smartphone as a second screen have scanned a branded QR code or provided ideas for a new product/design in the last month, which should spark some ideas. During the 15th edition of the Indian Premier League, ecommerce platform Dunzo showed a QR code on screen for 20 seconds with the line: “Inconvenience is regretted. Convenience is not”; they saw 10x traffic on their app.

If you want to know more about TV trends in APAC, you can find our insights and so much more in Avia’s 2024 Asia Video Industry Report.

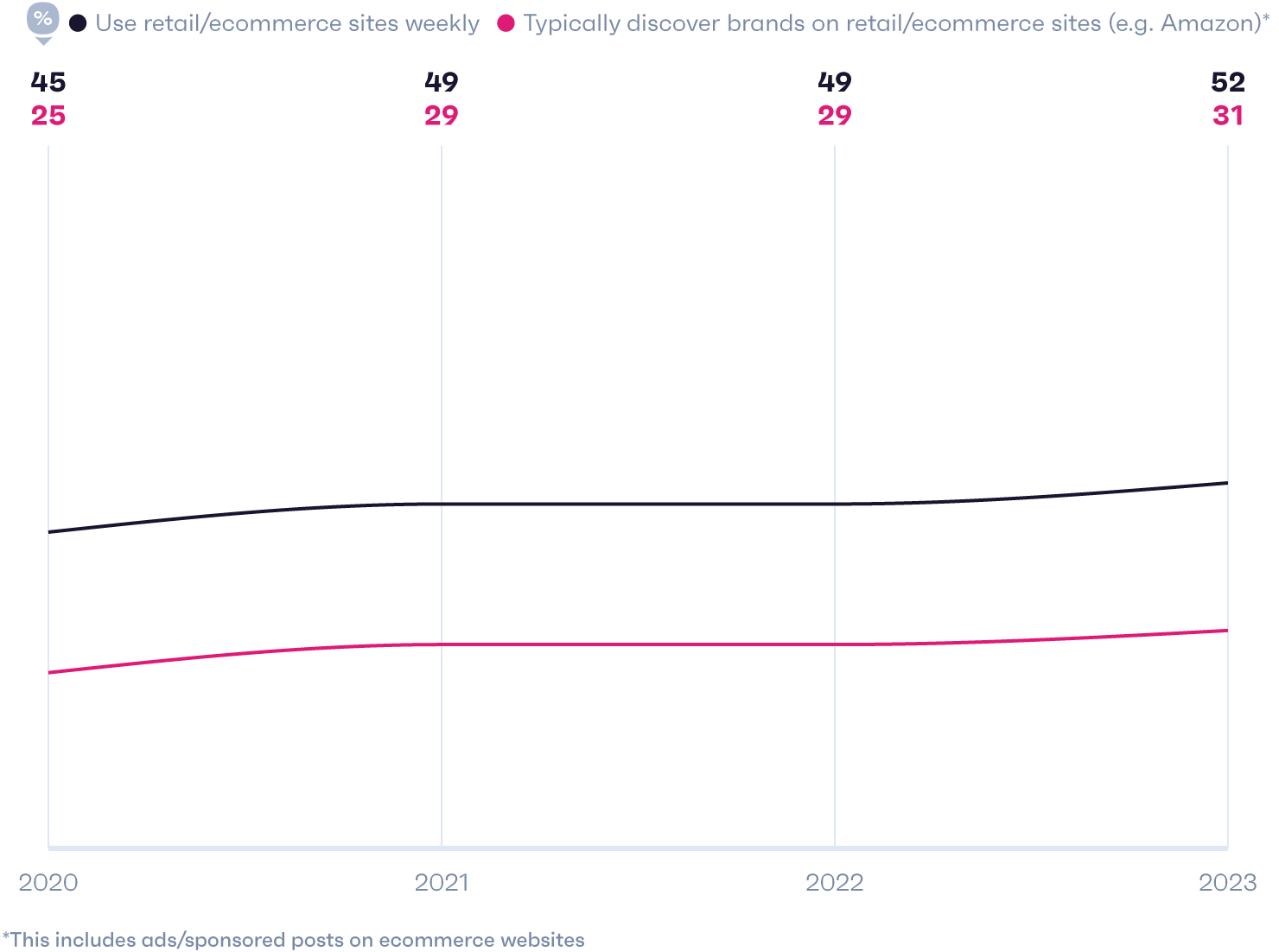

From click to cart, ecommerce is evolving

Online shopping is also eating up consumers’ attention. Ecommerce has grown in the US over the last few years, and retailers have a wealth of privacy-compliant data on their customers, which is one of the reasons why retail media networks have become popular among advertisers.

Retail and ecommerce sites are emerging as a discovery channel

% of Americans who…

- Source: GWI USA Q2 2020-Q4 2023

- Base: 283,710 US internet users aged 16+

Already a GWI user? Explore the data on the GWI platform

- Source: GWI USA Q2 2020-Q4 2023

- Base: 283,710 US internet users aged 16+

Already a GWI user? Explore the data on the GWI platform

The number of Americans who say they typically hear about products via ads on ecommerce sites has grown 17% year-on-year.

Report

You are what you buy

Get the scoop on how, when, and why shoppers buy in our global 2024 commerce report.

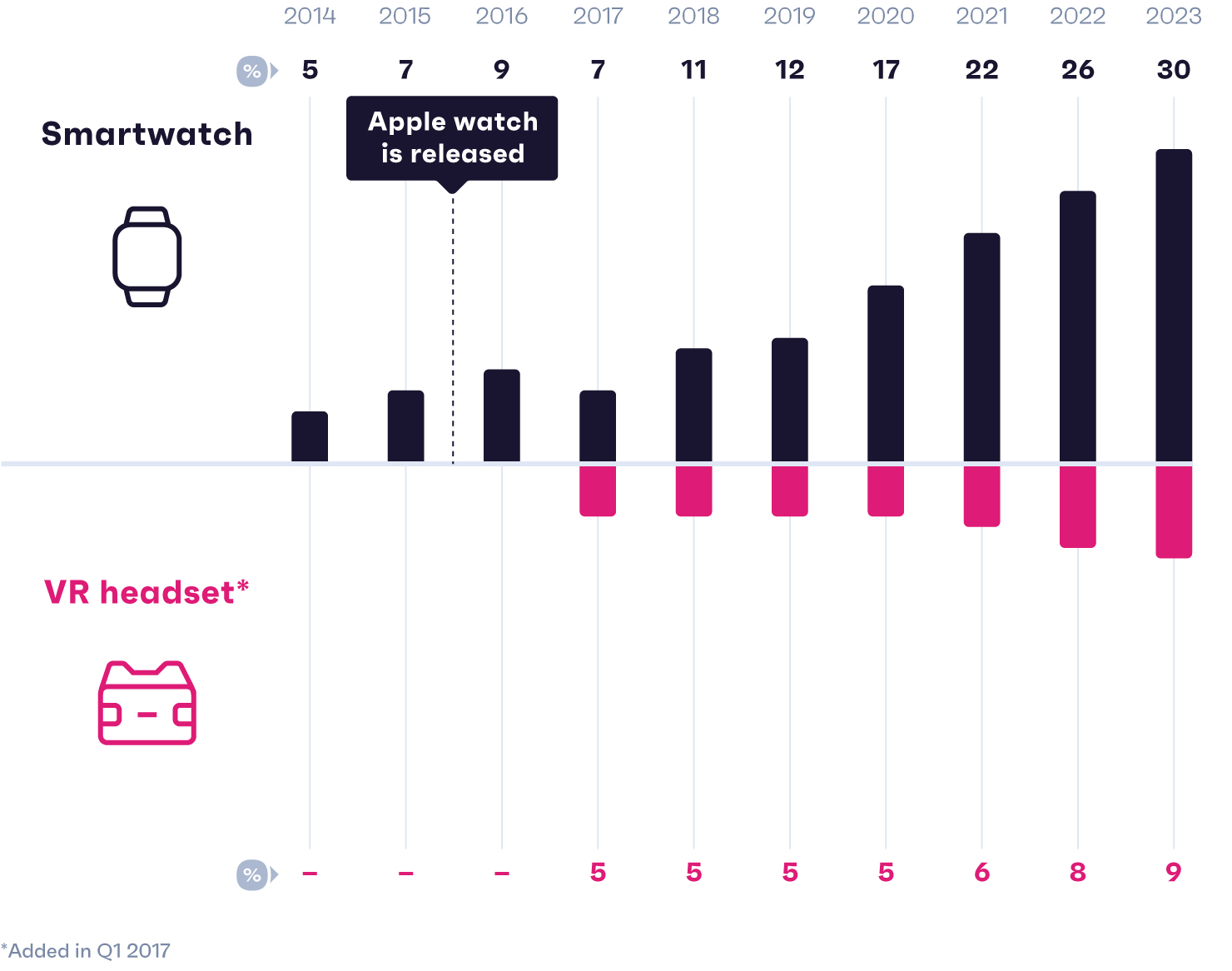

Download the reportVR devices are catching people’s eye

Apple’s Vision Pro represents its first new hardware release since the Apple Watch. So, we looked at the impact Apple had on the smartwatch market, to consider what it might do for VR devices.

VR devices haven't taken off yet, but they could

% of consumers in North America who say they own the following

- Source: GWI Core Q3 2014-Q3 2023

- Base: 821,390 internet users aged 16-64 in the US and Canada

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core Q3 2014-Q3 2023

- Base: 821,390 internet users aged 16-64 in the US and Canada

Already a GWI user? Explore the data on the GWI platform

You might already know that the Vision Pro sold out shortly after it became available for pre-order, but here’s something you might not know: more people in North America currently own a VR headset (9%) than owned a smartwatch before Apple entered the market (7%).

While hundreds of retailer apps are already on the Vision Pro, companies that get a real feel for who’s wearing it and why are most likely to eventually crack the code on using this space effectively.

03

Driving ROI with the right channels

Because consumers’ attention is split in a myriad of ways, it can be easy for marketers to feel like they’re not coming at them from enough angles. While new shiny platforms always seem to offer something that others can't, many advertisers are working with fewer funds. 1 in 5 professionals responsible for marketing or digital media/content say that budget cuts are one of the biggest challenges their team or company is facing right now, and management consulting agency Gartner suggests that “the era of more” has finally come to an end.

Fortunately, brands don’t need to be on every channel imaginable to get ahead, as most audiences can be found across the media spectrum. In fact, they all have fairly big reach and overlap.

Instead, marketers should aim to select a mix of platforms based on the specific things they want to achieve.

There's so much crossover across media channels

Overlap of media channel usage on a typical day

- Source: GWI Core Q3 2023

- Base: 167,280 internet users aged 16-64

Already a GWI user? Explore the data on the GWI platform

- On an average day, how long do you spend listening to/watching/reading the following? (Excludes: Do not use)

- Source: GWI Core Q3 2023

- Base: 167,280 internet users aged 16-64

Already a GWI user? Explore the data on the GWI platform

-

On an average day, how long do you spend listening to/watching/reading the following? (Excludes: Do not use)

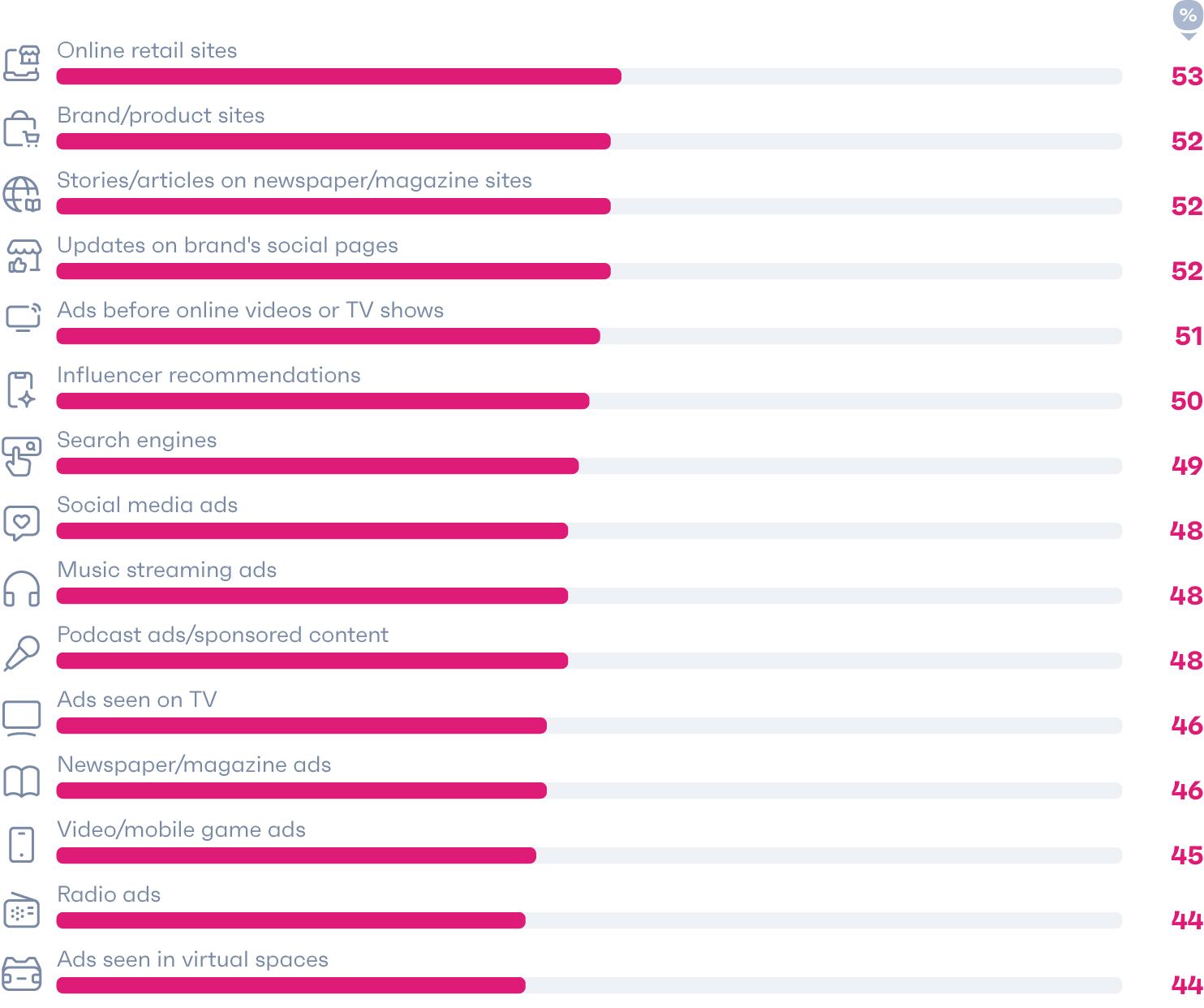

Getting on your audience’s radar

Let’s start with brand exposure. More than 1 in 4 workers responsible for marketing say that raising brand awareness is an important initiative to help drive growth in the next year. And it’s a goal that – unless you’re Coca-Cola – businesses are continuously working toward.

Certain outlets are better at driving brand awareness among users

% in each category who say they typically find out about brands/products via that media type

- Source: GWI Core Q3 2023

- Base: 239,397 internet users aged 16-64

Already a GWI user? Explore the data on the GWI platform

- How do you typically find out about new brands and products?

- On an average day, how long do you spend listening to the following?

- Which of these types of website or apps have you used in the last month?

- Which social media accounts do you follow or subscribe to?

- Which of the following actions have you done online in the past month?

- Which of these devices do you use to play games?

- Which of these gaming genres have you played in the last 12 months?

- Source: GWI Core Q3 2023

- Base: 239,397 internet users aged 16-64

Already a GWI user? Explore the data on the GWI platform

-

How do you typically find out about new brands and products?

-

On an average day, how long do you spend listening to the following?

-

Which of these types of website or apps have you used in the last month?

-

Which social media accounts do you follow or subscribe to?

-

Which of the following actions have you done online in the past month?

-

Which of these devices do you use to play games?

-

Which of these gaming genres have you played in the last 12 months?

Over a third of search engine users typically discover brands or products on them, which is another reason not to get too distracted by emerging platforms and lose sight of SEO.

In contrast, only 8% of simulation gamers make discoveries via ads in virtual spaces. These environments are much better at cultivating loyalty among existing customers than spreading awareness, given simulation gamers are the most likely to want brands to run customer forums and to say they buy products to access the community built around them; Nikeland and Vans World are good examples.

Moving from discovery to checkout

Our data can be used to suggest the best channels for conversion post-discovery too. If companies are focused on reaching groups that make the most online purchases, retail, brand, and product sites are the spaces to be. Consumers in retail spaces are eager for inspiration, creating an opportunity for brands to boost sales.

The outlets with the most "likely-to-buy" audiences

% of global consumers who discover brands/products in the following ways and say they've purchased a product online in the last week

- Source: GWI Core Q3 2023

- Base: 239,397 internet users aged 16-64

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core Q3 2023

- Base: 239,397 internet users aged 16-64

Already a GWI user? Explore the data on the GWI platform

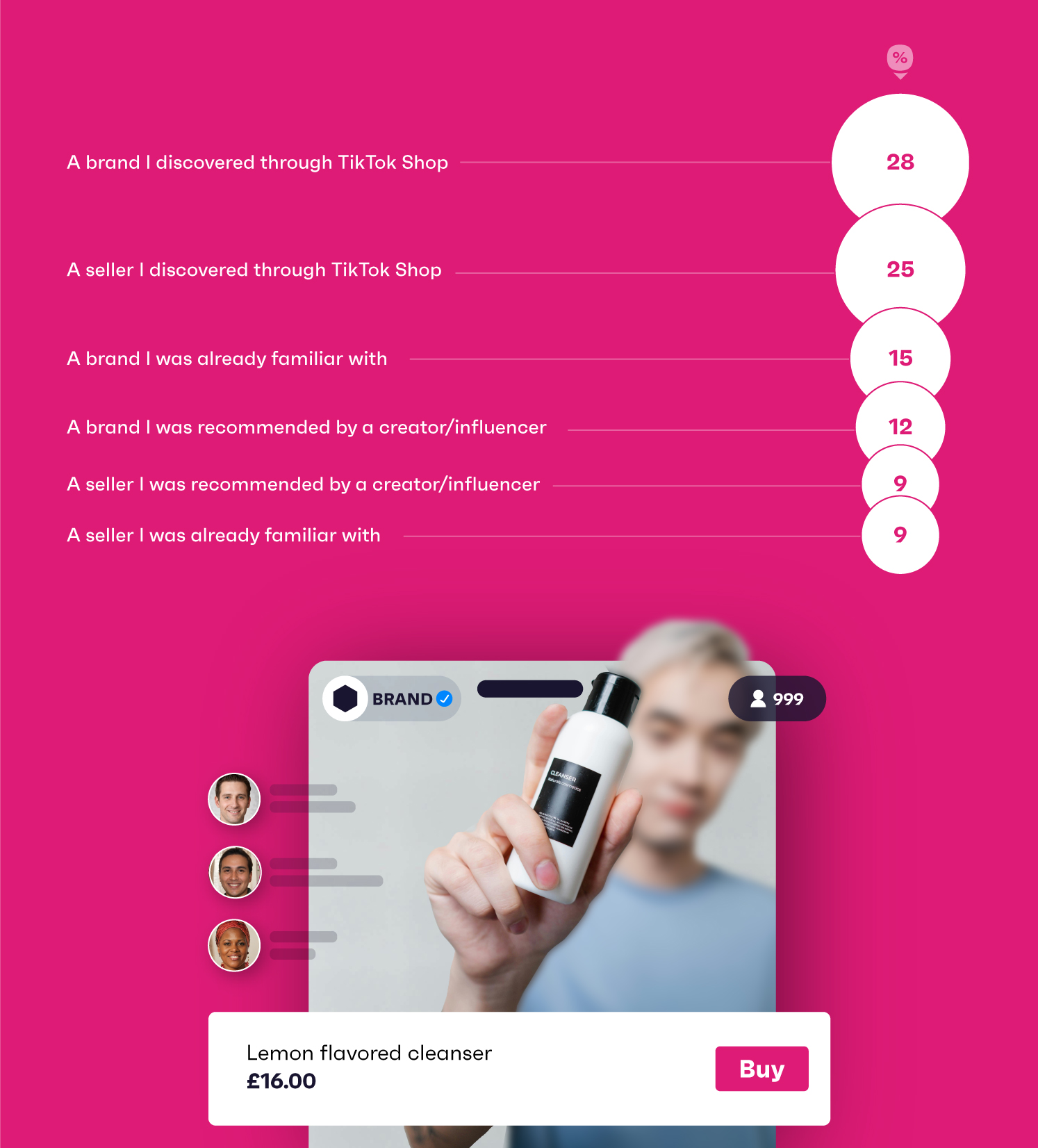

Smaller brands are making it big on TikTok Shop

Consumers who discover brands in commerce environments have the most buying intent, and various platforms are building these spaces within their walls. TikTok has made some of the biggest jumps in this area recently.

Social shops are putting new brands in the spotlight

% of TikTok Shop users who say they last purchased from the following via the app

- Source: GWI Zeitgeist January 2024

- Base: 1,145 consumers who purchased a product on TikTok Shop aged 16-64 in 12 markets

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Zeitgeist January 2024

- Base: 1,145 consumers who purchased a product on TikTok Shop aged 16-64 in 12 markets

Already a GWI user? Explore the data on the GWI platform

04

Cutting through the noise with creative messaging

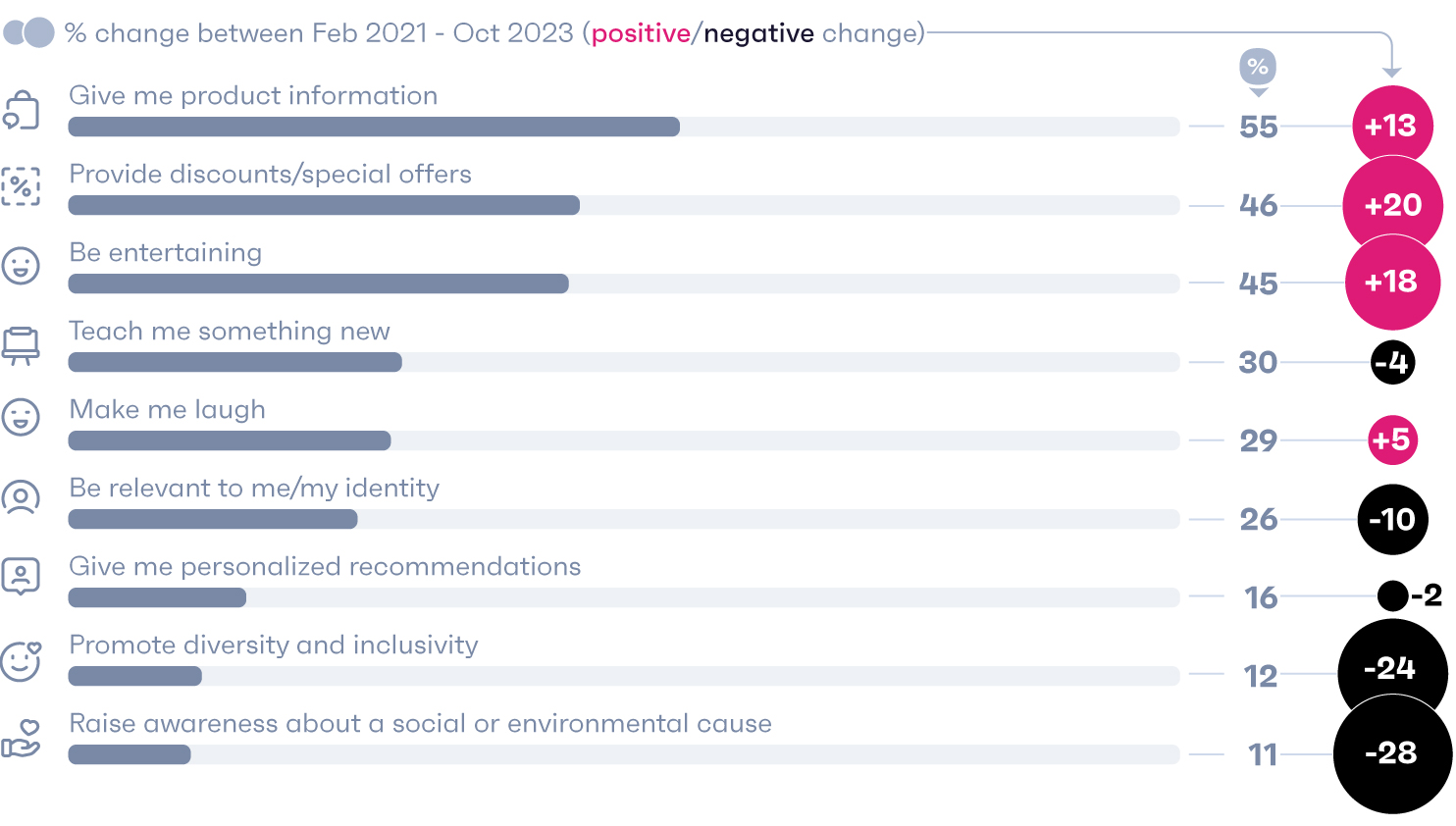

The first thing to know is that consumer priorities have shifted. Money’s become tighter, which means more people want ads to get down to business and offer discounts or practical information. McDonald’s has already pivoted its messaging in an effort to get more low-income consumers back on board in the year ahead.

On the other hand, consumers have generally grown less responsive to social responsibility and wary of “CSR washing”, which is something we’ve spotted across our research.

Consumers want more talk around discounts, and less around CSR

% of UK/US consumers who most want ads to do the following

- Source: GWI Zeitgeist February 2021 & October 2023

- Base: 4,013 UK/US consumers aged 16-64 (2021) & 4,083 UK/US consumers aged 16-64 (2023)

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Zeitgeist February 2021 & October 2023

- Base: 4,013 UK/US consumers aged 16-64 (2021) & 4,083 UK/US consumers aged 16-64 (2023)

Already a GWI user? Explore the data on the GWI platform

Taking the pulse on podcast ads

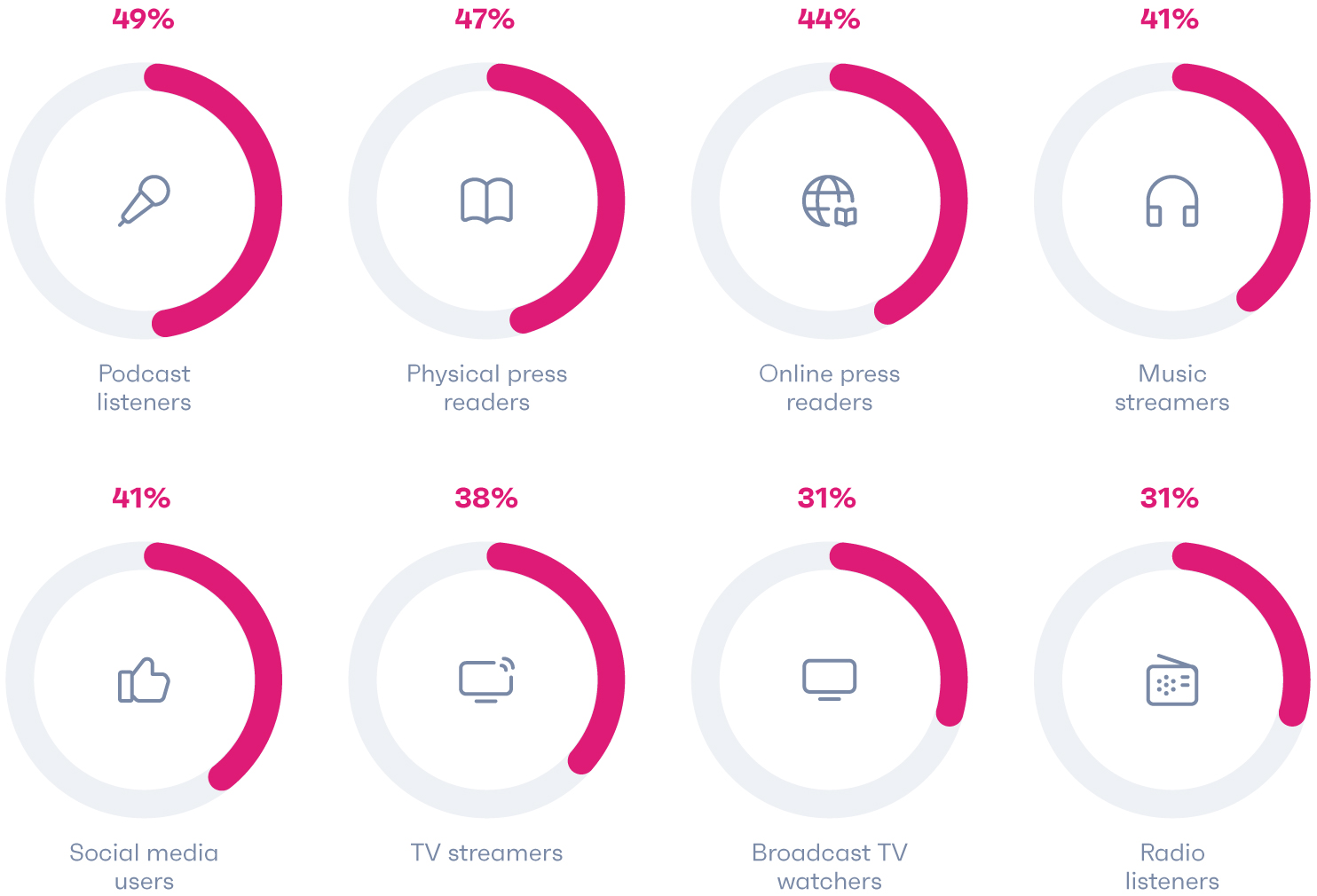

Purpose-driven messaging can also be deemed more or less appropriate depending on the media channel.

For instance, heavier podcast listeners are more receptive to ads promoting diversity and raising social awareness than their radio-listening counterparts. This can partly be explained by their attitudes and characteristics; they’re more likely to consider themselves opinion leaders, think immigration is good for their country, and say that contributing to their community is important to them.

Purpose messaging may be better suited to certain channels

% of consumers who use the following media for 4+ hours a day and say they want ads to promote diversity or raise social awareness

- Source: GWI Zeitgeist October 2023

- Base: 4,106 internet users aged 16-64 in 12 markets

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Zeitgeist October 2023

- Base: 4,106 internet users aged 16-64 in 12 markets

Already a GWI user? Explore the data on the GWI platform

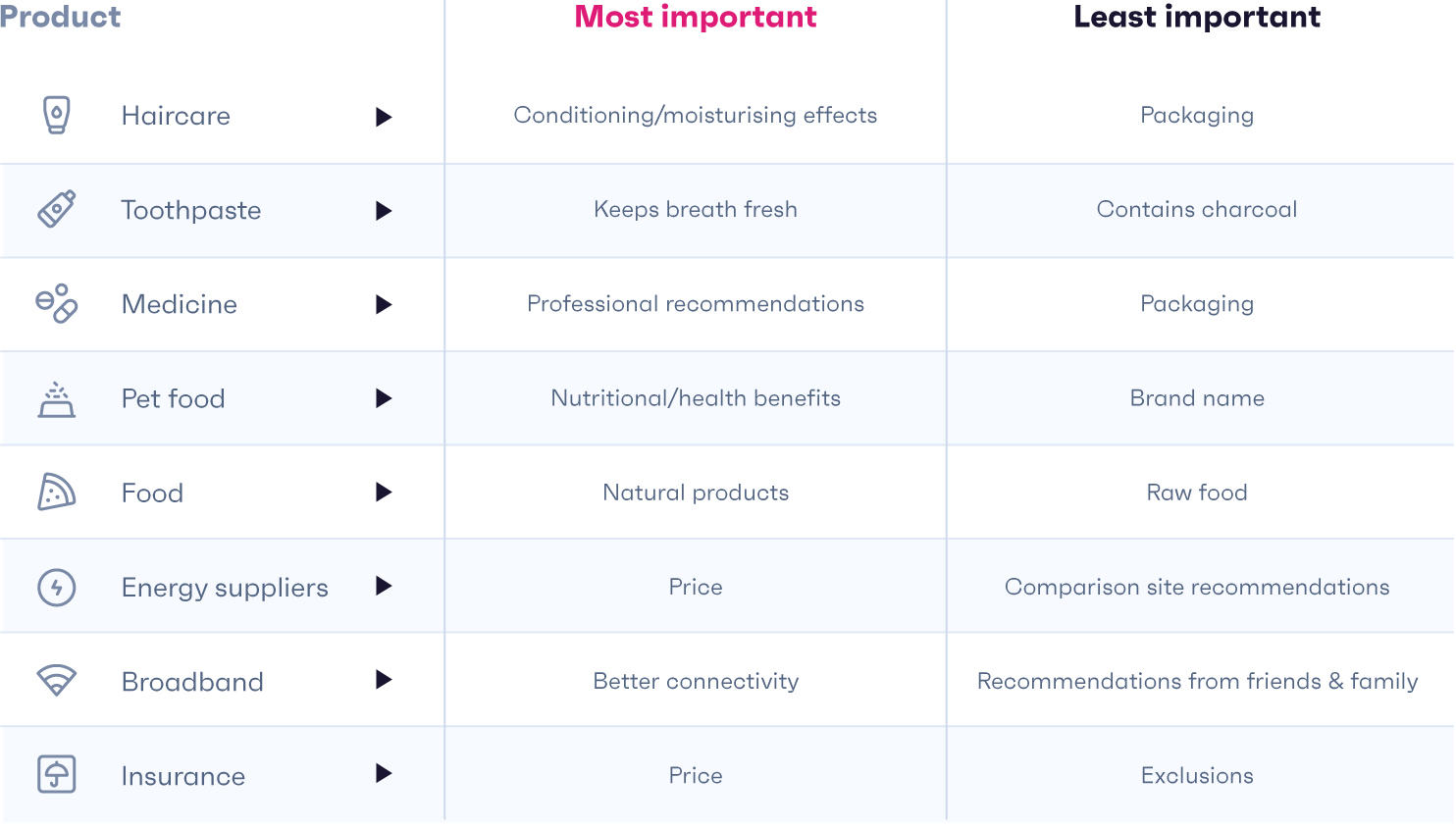

Knowing your audience starts with the industry you’re in

Another way brands can cut through the noise and tailor their messaging effectively is by understanding consumer priorities in their sector. It goes without saying that price is important during an economic downturn, and for some industries and brands, affordability needs to be in the limelight.

But quality also suggests value and drives loyalty. In 2019, North American and European consumers said rewards like discounts would most motivate them to promote a brand online. Fast forward to today, and high quality products are the top incentive.

To stand out, brands need to know what "value" means to the consumer

The most/least important factor when buying the following products, based on the % of consumers who cite them

- Source: GWI Core Plus Q3 2023

- Base: 26,131 consumers aged 16-64 in 8 markets

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core Plus Q3 2023

- Base: 26,131 consumers aged 16-64 in 8 markets

Already a GWI user? Explore the data on the GWI platform

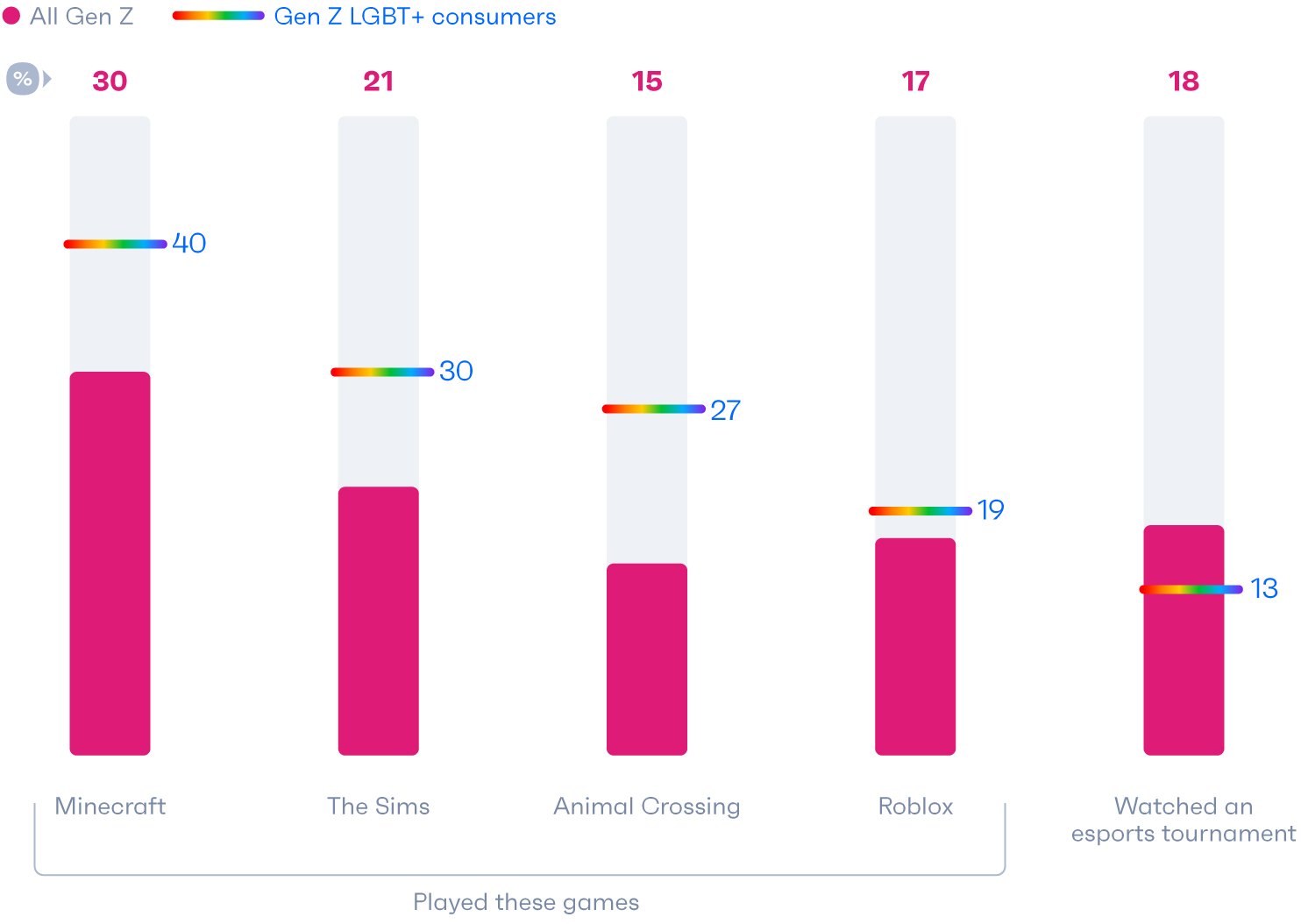

Jokes that sell

Entertaining marketing has also become more important. UberEats' Super Bowl ad, which features the Beckhams parodying their own Netflix documentary, is a great example of brands being light-hearted and culturally relevant.

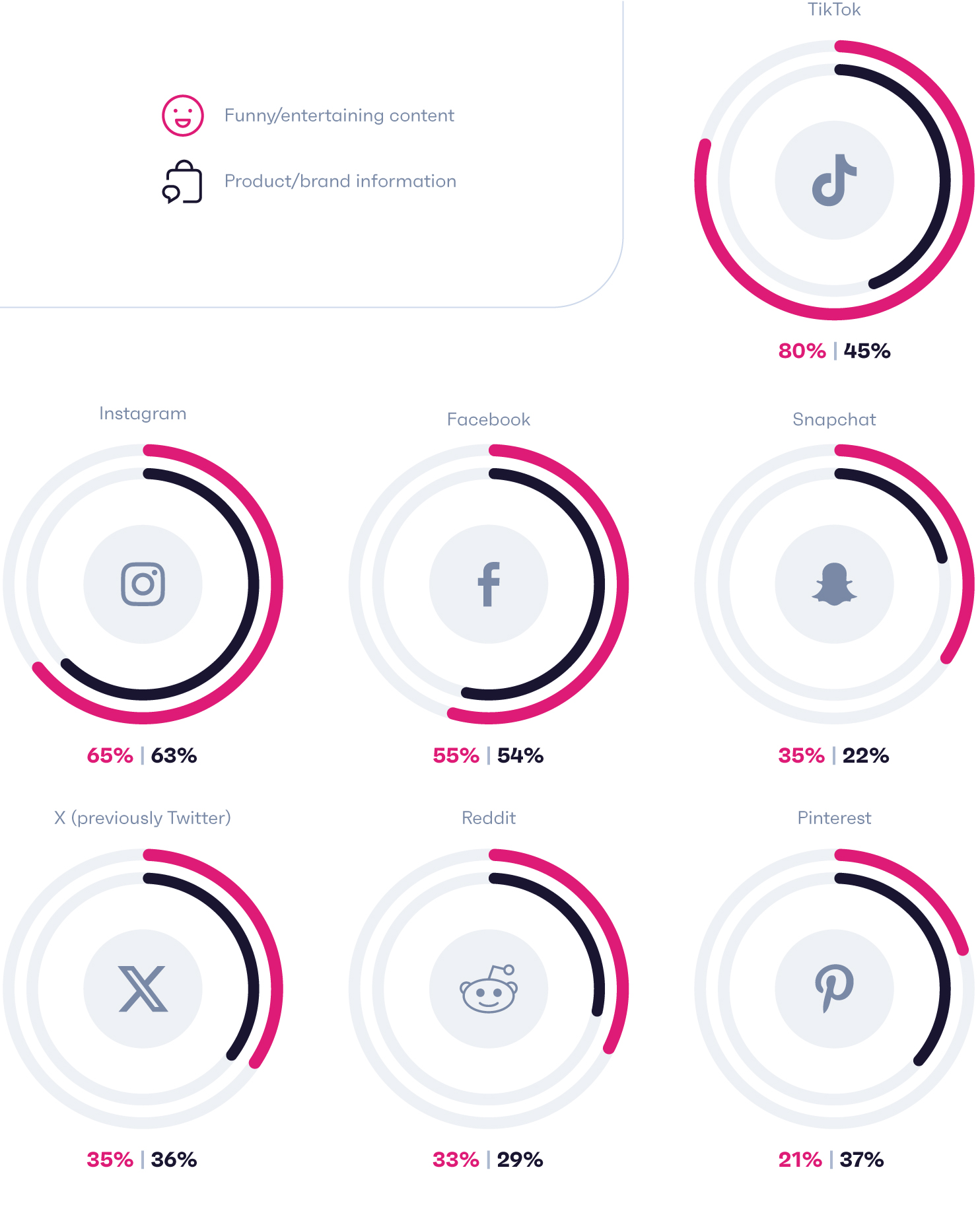

On social media, people generally want content over brand information

% of each platform's users who say they log onto it for the following reasons

- Source: GWI Core Q3 2023

- Base: 201,701 social media users outside China aged 16-64

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core Q3 2023

- Base: 201,701 social media users outside China aged 16-64

Already a GWI user? Explore the data on the GWI platform

Infographic

Social media use by generation

Take the guesswork out of your social strategy with this handy infographic on each generation's social media behaviors.

See it now05

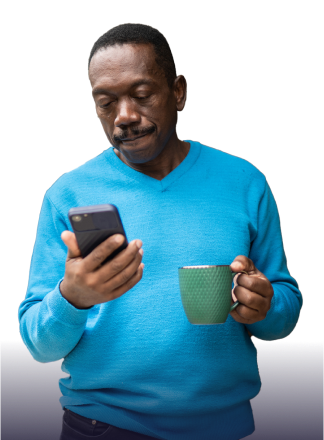

Building brand trust and affinity online

One audience that’s often overlooked is baby boomers. Although they shop online more than Gen Z and have relatively high spending power, they feel less represented in ads – largely because they are. They're ultimately a lucrative and increasingly accessible market, as well as an untapped opportunity for many brands.

Boomers shop online as much as millennials, but feel less represented in ads

% of consumers in each generation who say the following

- Source: GWI Core Q3 2023

- Base: 57,996 Gen Z, 80,400 millennials, 85,168 Gen X, and 15,833 baby boomers aged 16-64

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core Q3 2023

- Base: 57,996 Gen Z, 80,400 millennials, 85,168 Gen X, and 15,833 baby boomers aged 16-64

Already a GWI user? Explore the data on the GWI platform

Blog

10 characteristics of baby boomers in 2024

Still not sure how to connect with baby boomers? We’ve got the data to help you see just how diverse this audience really is.

Read moreLevel up with LGBT+ consumers

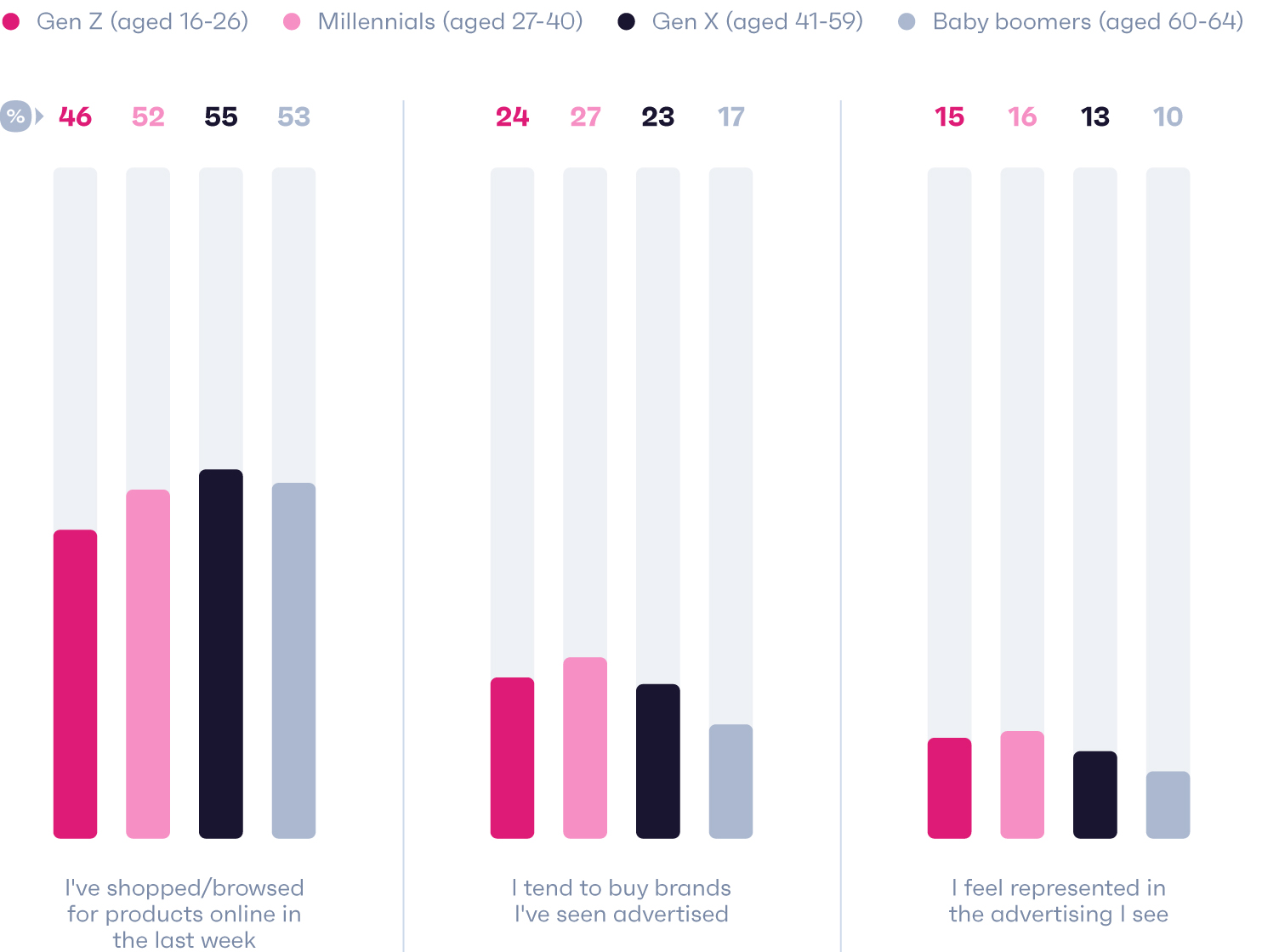

While the metaverse hype has died down, it's worth remembering that “proto-metaverses'' like Minecraft, Fortnite, and Roblox are still going strong; among these titles, regular engagement has grown by 28% since 2020. They’re great spaces for engaging with certain demographics too, namely LGBT+ consumers.

Gaming spaces and proto-metaverses are safe spaces for LGBT+ consumers

% of all Gen Z/Gen Z LGBT+ consumers who say they've played/watched the following in the last 12 months

- Source: GWI Core Q3 2023

- Base: 17,470 Gen Z aged 16-26, and 3,458 LGBT+ Gen Z in the 14 markets

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core Q3 2023

- Base: 17,470 Gen Z aged 16-26, and 3,458 LGBT+ Gen Z in the 14 markets

Already a GWI user? Explore the data on the GWI platform

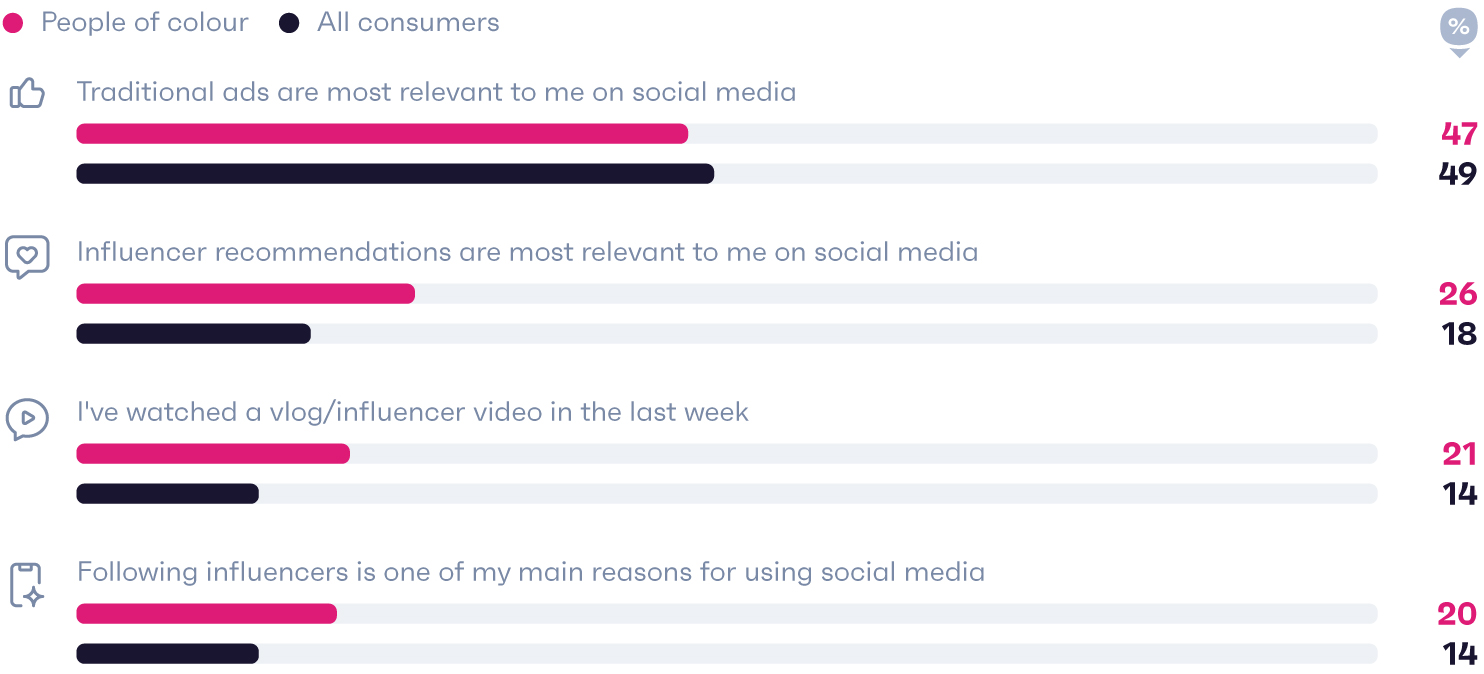

Influencer diversity demands attention

While there’s definitely been progress, minority groups are still underrepresented in many spaces and accustomed to seeking answers elsewhere.

People of color relate to influencers more than others

% of POC and other consumers in the UK, US, Australia, and Canada who say the following

- Source: GWI Zeitgeist April 2023

- Base: 6,100 consumers and 1,212 people of color aged 16-64 in the UK, US, Australia, and Canada

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Zeitgeist April 2023

- Base: 6,100 consumers and 1,212 people of color aged 16-64 in the UK, US, Australia, and Canada

When looking to connect with POC, influencers can help bridge the gap. Major lifestyle and beauty brands are already attending culturally-relevant events like Essence Festival, and working with influencers that reflect the Black community they want to engage with.

Lessons gleaned from influencer partnerships can be used to inform traditional advertising too, and we’ve leaned on our USA Plus data to offer some general best practice tips.

US spotlight

This is crucial: it’s not just about representation, it’s about the quality of any representation. Above all else, POC emphasize the need for better portrayals of diverse groups in marketing.

More than anything, it's about the quality of the representation

% of US POC who say the following would improve diverse representation in ads

Source: GWI USA Plus Q3 2023 • Base: 691 US people of color aged 16+ • Question: Which of the following would improve diverse representation in ads?

Minority groups want to hear less about pledges or hardships. Instead, they’re eager to see themselves reflected authentically and celebrated. They’re interested in ads that capture the nuances of their experience, rather than those that highlight their community’s struggles; and to see meaningful social impact, rather than good intentions.

Who brands feature also makes a statement. POC most want ads that focus on diverse representation to include individuals or consumers (56%) and employees of the brand (39%) rather than TV stars and artists (29%).

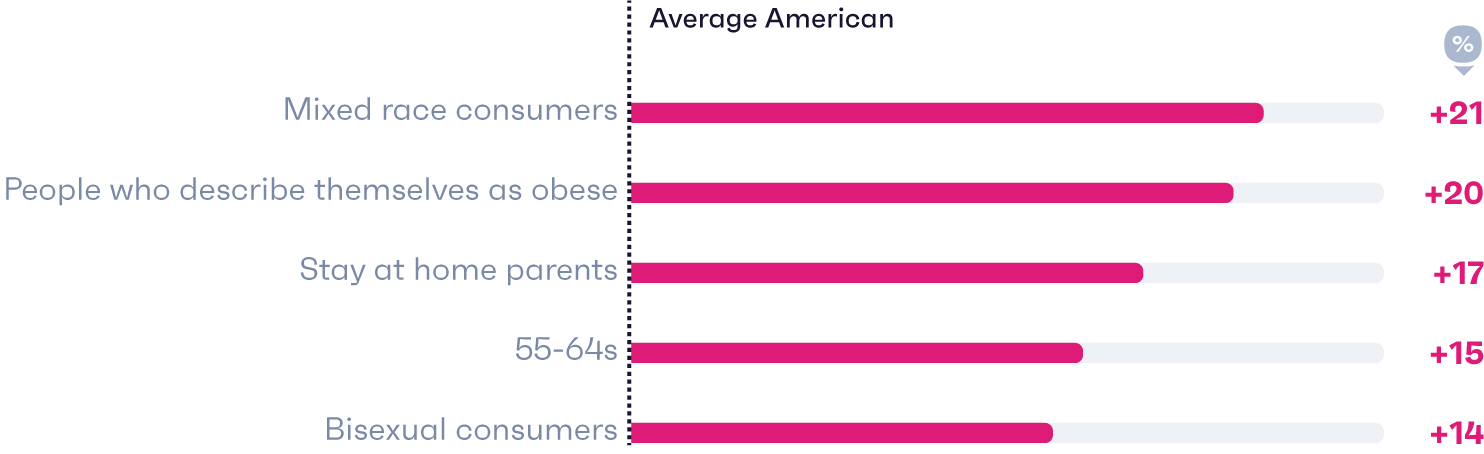

Charting new territories with retail media

Finally, retail media networks have a lot of potential when it comes to connecting with diverse or underserved audiences.

Retail/ecommerce sites can also help brands engage with diverse audiences

How much more likely each group is to discover brands on ecommerce/retail sites, compared to the average American

- Source: GWI USA Q4 2023

- Base: 239,091 Americans aged 16+

Already a GWI user? Explore the data on the GWI platform

- Source: GWI USA Q4 2023

- Base: 239,091 Americans aged 16+

Already a GWI user? Explore the data on the GWI platform

Clever partnerships with retailers could help brands better communicate with underrepresented groups, and our data can be used to discover which sites they stand out most for using, and what kinds of ads they want to see. For example, full-time parents in the UK use apps like Wayfair and Vinted more than average, while expectant moms (a group that we’ve started thinking about more creatively) are distinct for visiting spaces like Gumtree.

06

Uncovering new partners and opportunities

Identifying new opportunities is at the heart of most, if not all, key growth initiatives for marketing teams, be that offering better services to their customers, or boosting differentiation against competitors.

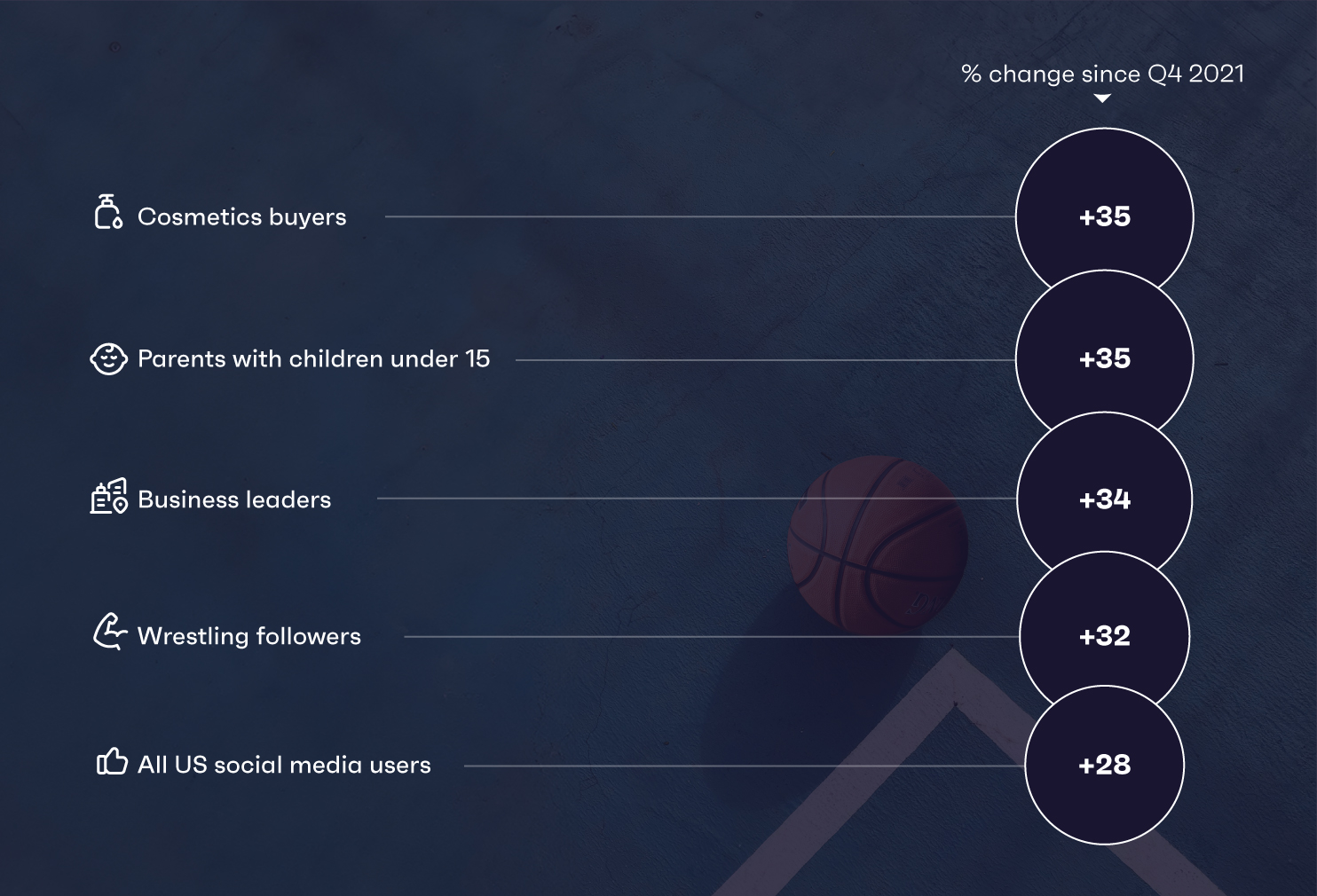

Let’s start with cross-sector collaborations in the world of sports. So much has happened in this space. Netflix partnered with WWE, Estée Lauder teamed up with Manchester United, and Disney, Fox, and Warner Bros. Discovery are planning to launch a sports service to capture younger audiences who don’t watch as much traditional TV.More sports partnerships are surfacing thanks to social media

% change in the number of Americans in each category who say they've watched sports highlights in the last month since Q4 2021

- Source: GWI USA Q4 2021 & Q4 2023

- Base: 37,551 US social media users aged 16+

Already a GWI user? Explore the data on the GWI platform

- Source: GWI USA Q4 2021 & Q4 2023

- Base: 37,551 US social media users aged 16+

Already a GWI user? Explore the data on the GWI platform

All these partnerships make sense. Consumers are increasingly watching sports on social platforms, especially combat sports. And these organizations are diversifying their fanbases as a result; MMA and boxing represent two of the three sports that have grown most in the US since 2020, and some of the audiences they’ve attracted are surprising too: groups like mascara wearers and Forever 21 shoppers.

There's definitely room for more of the leagues emerging on social media to collaborate with TV streamers. Over 1 in 5 consumers say that live sports events are important when streaming TV, and our data can be used to help sports companies find their audiences on OTT platforms. Amazon Prime users stand out most for following cricket and American football, for example, and Disney+’s audience for following skateboarding and ice hockey.

FAST streaming is coming in hot

While streaming sites are less established as a marketing channel, FAST models are likely to move the needle. Since Q4 2021, there’s been huge growth in Americans saying they watch FreeVee (+108%), Tubi (+68%), and Pluto TV (+32%) monthly.

More eyeballs means fresh opportunities for marketers, with 23% of FreeVee users saying they usually discover products through pre-show ads. Not only that, FAST platforms tend to have cheaper ad rates than traditional TV, more transparency on performance, and the potential for interactive ads – so we’re excited to watch this space develop.

Here’s a final reason we think it’s worth keeping an eye on FAST sites: brands can reach unique audiences through them.

US Pluto TV and Amazon FreeVee users are much more likely to use the internet to research healthcare, use financial investment tools, and engage with publishers like NBC News than the rest of the region. They’re just three examples of sectors that could benefit from exploring this space as a marketing channel.

Luxury has a home in horror games

Other opportunities worth looking into are gaming partnerships and in-game ads. There's a strong appetite for luxury gaming collaborations, especially within certain categories.

There's demand for luxury gaming collaborations

% of all gamers/those in each category who are interested in a luxury gaming collaboration

- Source: GWI Luxury Q3 2023

- Base: 7,992 gamers aged 16-64 in 5 markets

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Luxury Q3 2023

- Base: 7,992 gamers aged 16-64 in 5 markets

Already a GWI user? Explore the data on the GWI platform

Among those interested in luxury gaming collaborations, the idea of virtual fashion items for characters is the most popular, followed by esports merchandise, and gaming accessories. So, there are many directions these partnerships can take.

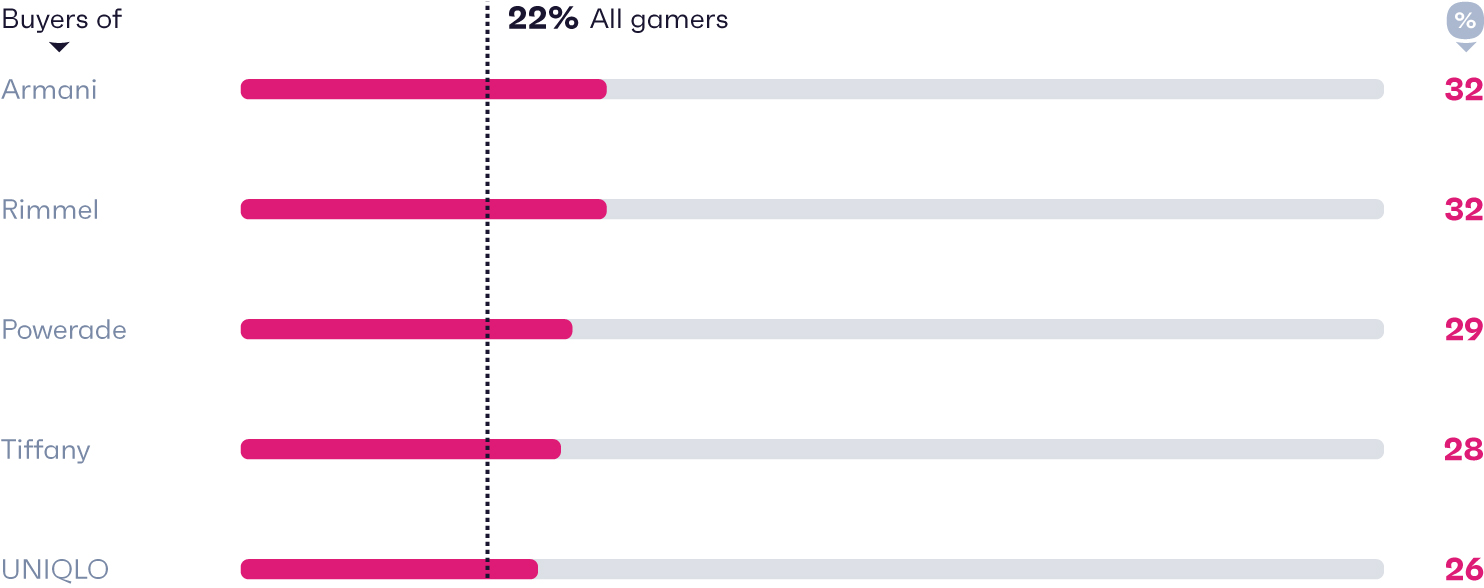

If brands don’t want to go down the route of collabs, in-game ads could be a good option for certain product categories.

In-game advertising has potential among some unexpected groups

% of all gamers/buyers of the following brands who say they watch ads in exchange for in-game rewards

- Source: GWI Gaming Q2 2023

- Base: 5,842 gamers who watch ads for in-game rewards in 18 markets

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Gaming Q2 2023

- Base: 5,842 gamers who watch ads for in-game rewards in 18 markets

Already a GWI user? Explore the data on the GWI platform

Ask our customers

Gaming is a highly immersive and interactive media channel. Brands are increasingly recognizing the power of gaming to capture attention and engagement through advertising experiences that are authentic to the gameplay experience. Adopting a player-first mindset for these in-game activations is critical, from rewarded video which offers players an in-game reward for watching the ad, to playable mini games, brands can offer fun and interactive ways for their audiences to engage.

Marketing campaigns that don’t exist, but probably could. FIFA x Revlon: Level up your hair game

We’ve recently started experimenting more with our data, taking popular brands and seeing which segments of their audience lie outside usual stereotypes. We then feed it into ChatGPT and get a description of a hypothetical marketing campaign aimed at that group. Here’s one for you.

FIFA is the most played game globally, and its fans share certain characteristics. Your average adult FIFA player is a 33 year-old man who enjoys watching esports tournaments and follows a sports or gaming account on social media. He’s likely to play soccer; in fact, over half of UK FIFA gamers play it, compared to 18% of the general population. All this you might expect.

But one of his habits gets less attention: he devotes a lot of time and energy to his personal style. Compared to other Gen Z and millennials, FIFA players are 49% more likely to use hair coloring kits and 37% more likely to use Revlon products each week, inspired by the footballers who invest in standing out on the pitch. Brazil’s Neymar is reported to have flown his personal barber over 6,000km to Qatar for a pre-match trim.

Off the back of this, ChatGPT suggested that Revlon and FIFA develop a tutorial series together, which could be hosted on YouTube and promoted on FIFA players’ favorite social platform: Instagram. This would showcase soccer icons demonstrating their preferred looks and ways to achieve them, and encourage followers to share their own takes – basically, setting up another competition, and saying “game on”.

Want to unmask your audiences?

Book a no-strings-attached demo of our consumer research platform.

Book a demo

Notes on methodology

Each year, GWI interviews over 960,000 internet users aged 16-64 in 53 markets via an online questionnaire for our Core data set. A proportion of respondents complete a shorter version of this survey via mobile, hence the sample sizes presented in the charts throughout this report may differ as some will include all respondents and others will include only respondents who completed GWI’s Core survey via PC/laptop/tablet.

When reading this report, please note that we focus on data from our ongoing global quarterly research, but also refer to our monthly Zeitgeist studies across 12 markets, our GWI USA data set, which surveys over 80,000 internet users in the US aged 16+ each quarter, along with our GWI USA Plus data set which is an add-on to GWI USA and surveys 7,000 internet users annually.

Throughout this report, we refer to indexes. Indexes are used to compare any given group against the average (1.00), which unless otherwise stated refers to the global average. For example, an index of “1.20” means that a given group is 20% above the global average, and an index of “0.80” means that an audience is 20% below the global average.