In a slowing economy, uncertainty makes it hard for brands to navigate. Recession or not, will it feel like one and put people off spending?

The rose-tinted glasses are off. Inflation, mass layoffs, and global financial chaos mean your shiny happy campaigns probably won’t land right now.

Consumers are tired of showy PR pushes. It’s time to be real:

People are exhausted - environmental and social justice fatigue is making them care less about credentials and pledges.

Minimalism is in - cautious, thrifty shoppers are reassessing their buying habits (#de-influencing, we see you).

Brand trust is hot currency - people crave honest answers in an unreliable world where they’re not sure who to count on.

Black Friday’s record sales prove price hikes aren’t a death knell. Good reputation and reviews also influence purchases, showing the power of trust and reliability in uncertain times.

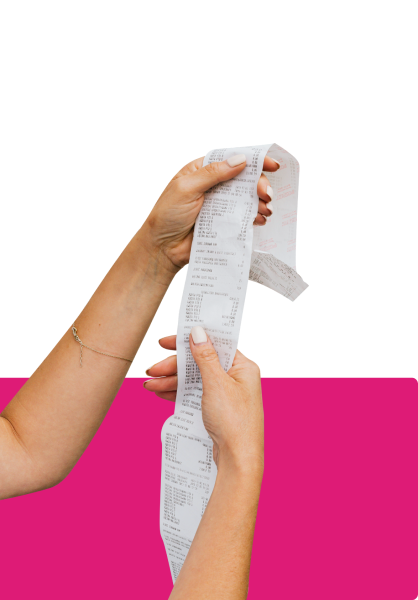

Over half of Americans most want companies to be honest. Give people plenty of warning before raising prices - 7 in 10 consumers want at least a month’s notice.

People want to feel in control of their spending, so knowing when a rise will happen is more important to consumers than the price itself. Tell them a concise, value-driven story.

People are still indulging in little pick-me-ups. They just aren’t making a big deal about it.

Clothing, fragrances, and makeup are some of the most popular discreet treats, with “affordable luxury” brands thriving in the US. Home entertainment is also holding its own, as just 11% plan on canceling TV subscriptions.

But not all trending purchases are quite so secret. Some travelers are more willing to push the boat out on trips, as those looking to spend extra on pampering are 37% more likely to look for top-range options. To them, memorable experiences like vacations and gigs are worth the splurge.

And even if consumers are less interested in noticeable logos, many still want well-made products. In 12 markets, consumers say quality (53%) matters more than cost (36%). Premium brands should think twice before lowering prices, or risk lowering their aspirational power.

Check your assumptions at the door. Younger consumers have more spending power than you might think:

of Gen Z say they’ll end up spending more on non-essentials in 2023

of Gen Z in Western markets say they live with their parents, rising to 72% in APAC

of Gen Z believe their income will increase in 2023

By living at home (often rent-free), these young spenders have found a way to prop up their disposable income.

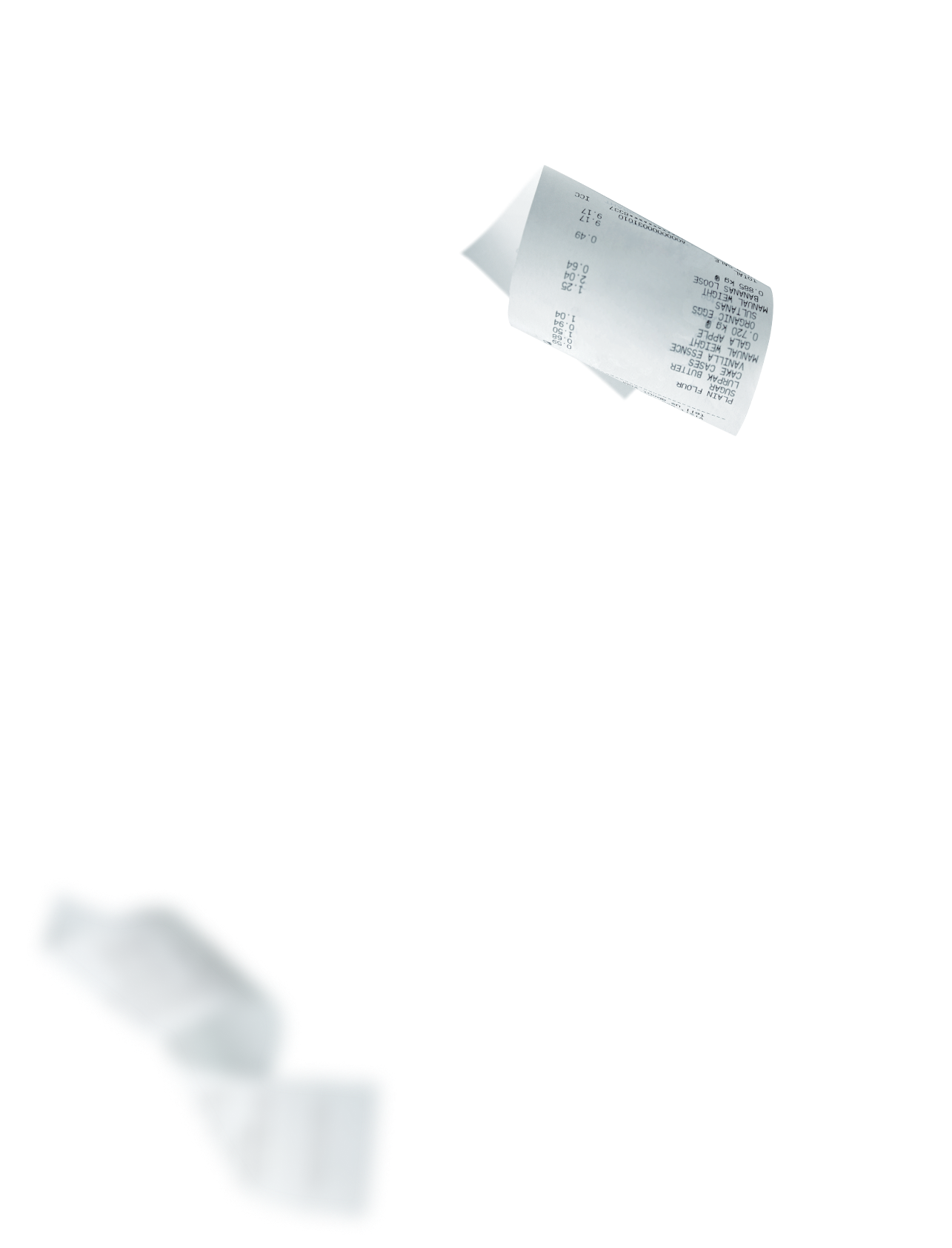

While many are keen to make space for must-have treats, consumers are getting wiser when it comes to making their money stretch further.

Looking at saving behavior, we're seeing some interesting sector trends:

Secondhand market - 15% of UK consumers have used Vinted in the last month, while 21% want to sell/buy pre-loved goods.

Financial services - in 12 markets, 34% plan to set a personal budget, while Americans are turning to “safe” bond buying.

Food & drink - in 12 markets, 44% plan to cook more, while more Americans are buying HelloFresh meal kits (+17% YOY).

Travel - Europeans considering easyJet flights in the next year are 15% more likely to advocate brands offering rewards.

Tapping into these desires and incentivizing spending will help brands tell the right story. While de-influencing is helping people to resist unnecessary products, fintech budgeting tools show them exactly how much they can play with.

People want to travel more to make up for lost time during Covid, and save money in the cost of living crisis. It’s a tricky bank balancing act.

Globally, just 28% expect inflation to drop, but those who say it’s had a dramatic impact on their finances are more likely to say they’ll spend more on non-essentials in 2023.

Worries about inflation outpacing savings can drive people to spend, as consumers seek ways to feel good and rebalance their lives.

Demand for budgeting help and memorable experiences is high, and consumers will appreciate brands that showcase ways to enjoy life in a more modest fashion.