Report

6 consumer trends to watch in 2025

Connecting the dots

Jump into the trend you’re most curious about

Key insights

Podcasts

For the very first time, consumers prefer podcasts to radio, and they're eating up a bigger slice of the audio market. Brands now have a unique opportunity to reach premium product buyers when they're highly engaged.

Side hustles

Over 1 in 10 business professionals have a side hustle now. But get this - who they are might surprise you.

Women’s sports

In the US, women's sports are seeing a surge in popularity, especially on the basketball court. Brands that target these captive audiences and elevate female players can turn today's momentum into lasting growth.

Energy drinks

With 46% of consumers enjoying energy drinks every month, new audiences offer brands opportunities to refresh and diversify product lines. Marketing to dietary and lifestyle preferences is key to boosting sales.

Rethinking college

The number of US teens who say college is important has dropped 21% since 2021. Businesses should consider whether traditional degrees are really necessary in shaping the future workforce.

Smart security

Ownership of smart security devices (e.g. video doorbells) has overtaken smart utility products (e.g. smart lights), growing 58% since 2019. Taking lifestyle indicators into account will help brands target new groups.

01

Podcasts are

shaking up the ad game

When Alex Cooper started a comedy and advice podcast in 2018, a business venture probably wasn’t on her radar. Fast forward to 2024, and her podcast, Call Her Daddy, just sold its distribution and advertising rights to SiriusXM for a whopping $125 million USD.

With more and more podcast deals being agreed, it’s a lucrative opportunity for businesses to get into the audio advertising space.

Now playing: The rise of podcasts

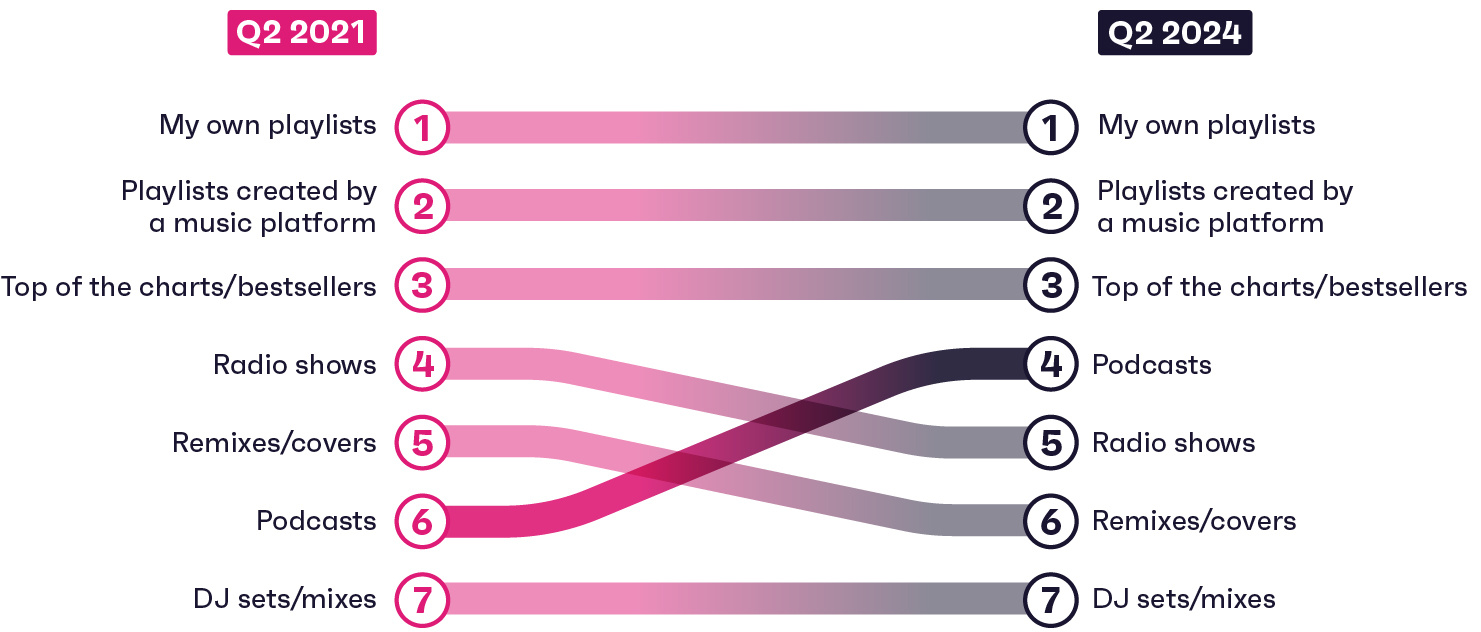

Three years ago, consumers preferred radio shows over podcasts. Now that’s switched around, and podcasts are still making strong gains in our daily lives.

Podcasts are climbing the charts

Ranking of the types of audio content consumers aged 16-64 like to listen to

- Source: GWI Core Q2 2021 and Q2 2024

- Base: 67,976 (Q2 2021) and 96,364 (Q2 2024) consumers aged 16-64

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core Q2 2021 and Q2 2024

- Base: 67,976 (Q2 2021) and 96,364 (Q2 2024) consumers aged 16-64

Already a GWI user? Explore the data on the GWI platform

Today, podcasts only trail behind playlists and the charts in terms of preferred audio content, and radio has dropped a spot. 65% of podcast fans already listen to music during commutes and 56% use it as background noise, so podcasts are on their way to taking over radio’s place. On average, consumers listen to podcasts and the radio for the same amount of time daily, but just three years ago, radio had an outright lead.

And it isn’t just commuters who are digging podcasts – Gen Alpha love them too. 1 in 5 tune in, so podcasts already have a stronghold here. In fact, listeners aged 12-15 would rather chat about podcasts than the music they listen to, making them a hot topic at school lunch tables and a sign of podcasts’ cultural power.

Regional spotlight: MEA consumers are tuning in

In Q2 2021, the Middle East & Africa were the top regions worldwide for online radio listening, with podcasts being a bit of an afterthought. Today, there are more podcast listeners in the market than online radio listeners, thanks to a 39% increase in the former. That’s enough to make MEA the fastest-growing region in the world for podcasts.

Morocco, Kenya, and South Africa are all standout markets, with podcast listenership seeing increases of 243%, 56%, and 47% since Q4 2021 respectively. A quick look at their top shows on Apple Podcasts at the time of writing tells a vivid, intriguing story.

Morocco’s top podcast touches on religion (Islam), but relationship advice and English learning podcasts aren’t far behindIn Kenya, DJ mixes take the top spot, alongside religious podcasts (Christianity) and original shows tackling topics like family and relationships

Podcast ads are worth the investment

If you’re wondering whether to dip your toe into podcast advertising, know this – they’re becoming a popular way to discover brands and products.

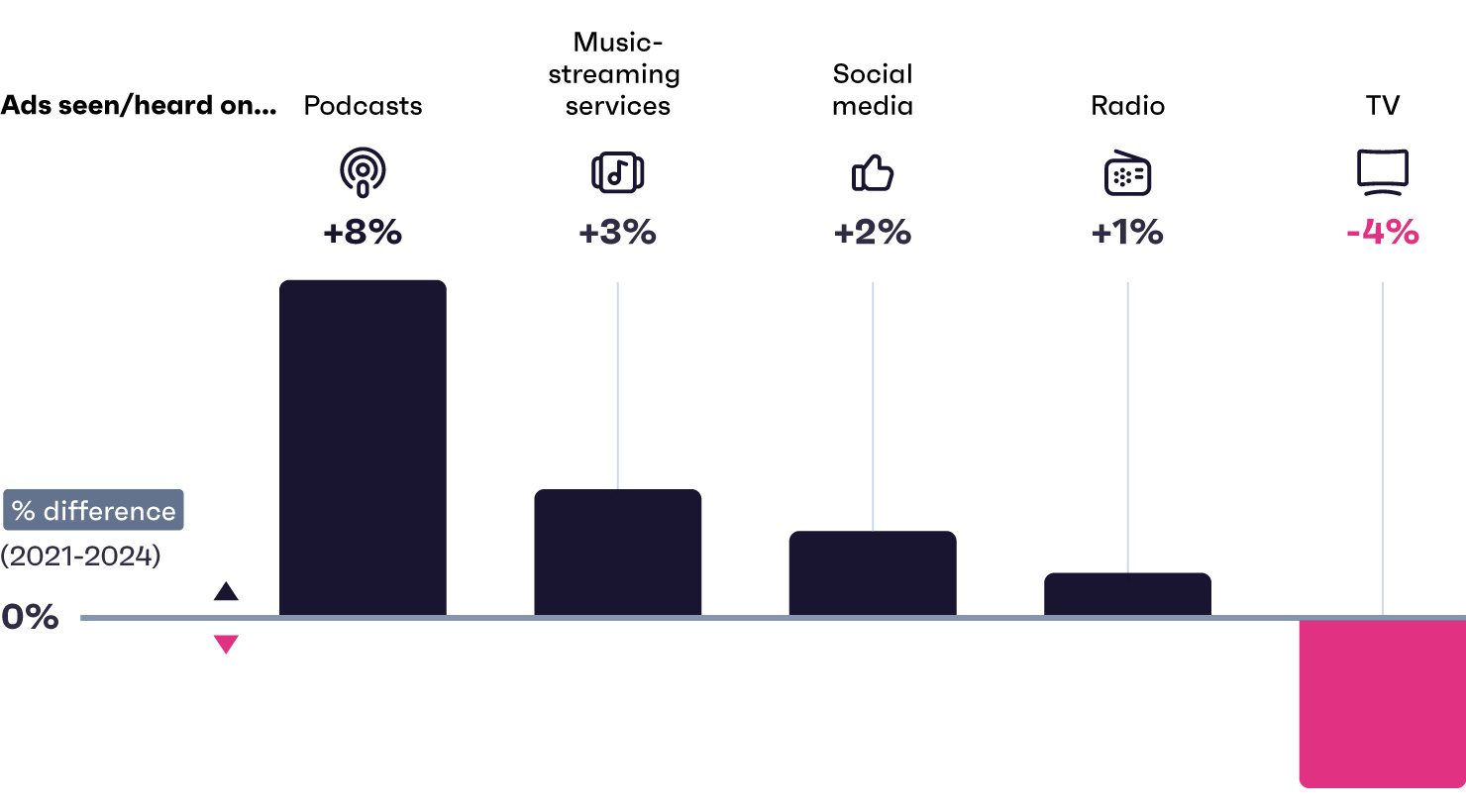

Gen Z are all ears when it comes to podcast ads

% change between 2021-24 in the number of each channels' daily Gen Z users who say they typically discover brands/products on them

- Source: GWI Core 2021 - 2024 (averages of waves conducted between Q1 2021 and Q2 2024)

- Base: 207,105 daily Gen Z TV watchers • 180,043 daily Gen Z music streaming listeners • 295,302 daily Gen Z social media users • 156,523 daily Gen Z podcast listeners • 157,729 Gen Z radio listeners

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core 2021 - 2024 (averages of waves conducted between Q1 2021 and Q2 2024)

- Base: 207,105 daily Gen Z TV watchers • 180,043 daily Gen Z music streaming listeners • 295,302 daily Gen Z social media users • 156,523 daily Gen Z podcast listeners • 157,729 Gen Z radio listeners

Already a GWI user? Explore the data on the GWI platform

Ask our customers

Podcasts are no longer just capturing ears - these cultural conversations are now captivating eyes too. Video podcast consumption on Spotify has increased by 88% this year, and Gen Z is leading the charge, with 21% of 13-17 year-olds’ podcast time dedicated to video. And their love for podcasts extends offline, with 37% attending live podcast events, deepening their relationships with trusted hosts and communities. This means podcasts are now a 360-degree amplification opportunity for brands. Spotify’s ecosystem - from live events to social and audience targeting via Spotify Audience Network and more - lets brands reach these highly-engaged audiences and forge authentic connections across multiple touchpoints.

Since 2021, the number of Gen Z who discover new products when listening to podcasts has grown faster than the number who do this while watching TV, using social media, and listening to the radio or music streaming services. With brand discovery via podcasts trending upward, there’s plenty of room for brands to get involved.

Ads may be a top complaint about TV and streaming, but podcast hosts can deliver them in their own style to alleviate the feeling of interruption – especially if the content is relevant and tailored to the listener.

Gen Z podcast listeners are also more likely to buy the premium version of a product, adding to the high ROI outlook of podcast ads. They’re also relatively cheap to run, so pairing with even a moderately successful podcast can meaningfully engage an audience and bring in a big return.

Report

The global media landscape

Where do consumers hang out online, and what kind of ads are they most receptive to? Uncover the latest insights into changing media preferences.

Explore the trendsUnlocking big opportunities across industries

Podcasts offer a wide range of opportunities for many businesses, but there are a few industries that should be paying close attention.

One of the groups listening to podcasts more are full-time stay-at-home parents. For many, podcasts are background noise while caring for children and the home, and the right ad about cleaning or childcare products could resonate.

Podcast ads are also up among cord cutters, or consumers who’ve canceled their TV service. With no TV ads in their life, they’re discovering useful brands and services between podcast interviews and segments.

02

Side hustles are

the new norm

Most of us have heard of the term “side hustle” – it’s that side job you do from 5-9 after your 9-5. These days, side hustles are influencing how people think about work.

Today, 11% of the entire workforce has a side hustle. It’s not all your usual suspects either - in fact, 38% are VPs and above. Side hustlers can be anyone these days, and it’s shaking up the job market.

Who’s hustling?

Side hustlers can be found in every demographic, but they do lean male and younger; Gen Z are 30% more likely than the average consumer to have a side hustle, for example. And when we look into their characteristics, side hustlers are more likely than the average business professional to describe themselves as ambitious, creative, and money-driven.

Even with a tough global economy, the prevalence of side hustles across seniority levels means that these aren’t just for extra money - they also tap into passion projects and entrepreneurial dreams.

We see this especially among those who work in the arts, media, and advertising sector, who may continue to use their creativity across other ventures after signing off from their 9-5.

How to keep (or attract) a side hustler

Side hustlers value learning new skills and innovation, making them an asset to their workplace. But at the same time, workplaces are at a higher-than-average risk of losing these motivated hustlers.

Nearly a third of side hustlers say it’s likely they’ll look for a new job in the next six months – this is more likely than the average business professional. And these aren’t just the junior employees who are looking for greener pastures - in fact, 40% of all side hustlers who are thinking about finding a new job are VPs and above.

It’s not just work-life balance frustrations that drive them to quit. Uninteresting or heavy workloads are also reasons side hustlers may choose to move on. At the same time, they’re looking for work that complements their entrepreneurial spirit. Learning opportunities and flexibility can go a long way in helping them balance their passion and professional projects.

Side hustlers are all about flexibility

Highest-indexing reasons side hustlers may look for a new job & their priorities when choosing one, compared to the average job seeker

- Source: GWI Work Q3 2024

- Base: 899 side hustlers aged 16-64 who are likely to look for a new job in the next 6 months in 17 markets

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Work Q3 2024

- Base: 899 side hustlers aged 16-64 who are likely to look for a new job in the next 6 months in 17 markets

Already a GWI user? Explore the data on the GWI platform

Want to keep your side hustlers happy? Flexibility and openness are the magic words. These workers are ambitious and creative, and they’ll bring that mindset to the workplace.

We know companies can’t accommodate everyone, but openness to new ideas and approaches can keep side hustlers motivated. Only 15% of them say they receive personal/professional development funds at work – which is a perk that could make a difference in talent retention.

03

Women’s sports

are taking center court

The WNBA is soaring. Not only is it the fastest-growing league in the US, it’s also been capturing the attention of younger audiences at a grassroots level. Basketball has become the most widely played sport among 12-15-year-old American girls.

As tennis legend Billie Jean King said, "Women need to see other women do well. It empowers them.” Women’s sports are indeed having their moment, and basketball is leading the charge. Since Q4 2020, interest in the WNBA has grown by 100%.

Other sports can take note here – but to keep the momentum going, brands, clubs, and rights holders need to use data to figure out what's hitting a home run.

Ask our customers

After decades of sexism, pay inequality, and minimal media coverage, women's sports are rightfully in primetime. The world is finally ready to catch up to the brisk pace that women athletes have been setting for years.

The rise of women's sports is challenging us to re-think the normative model of sports and fan experiences that were created by and for men. Women athletes are utilizing innovative platforms to engage with their fans. Fans of women's sports are displaying their fandom in new ways. Women will inevitably reshape the future of sports in terms of how they are marketed, promoted, covered, broadcasted, sponsored, endorsed, invested in, and capitalized upon. Brands need to wake up to the value of women's sports and truly understand the unique needs of women in order to harness the momentum and generate impact.

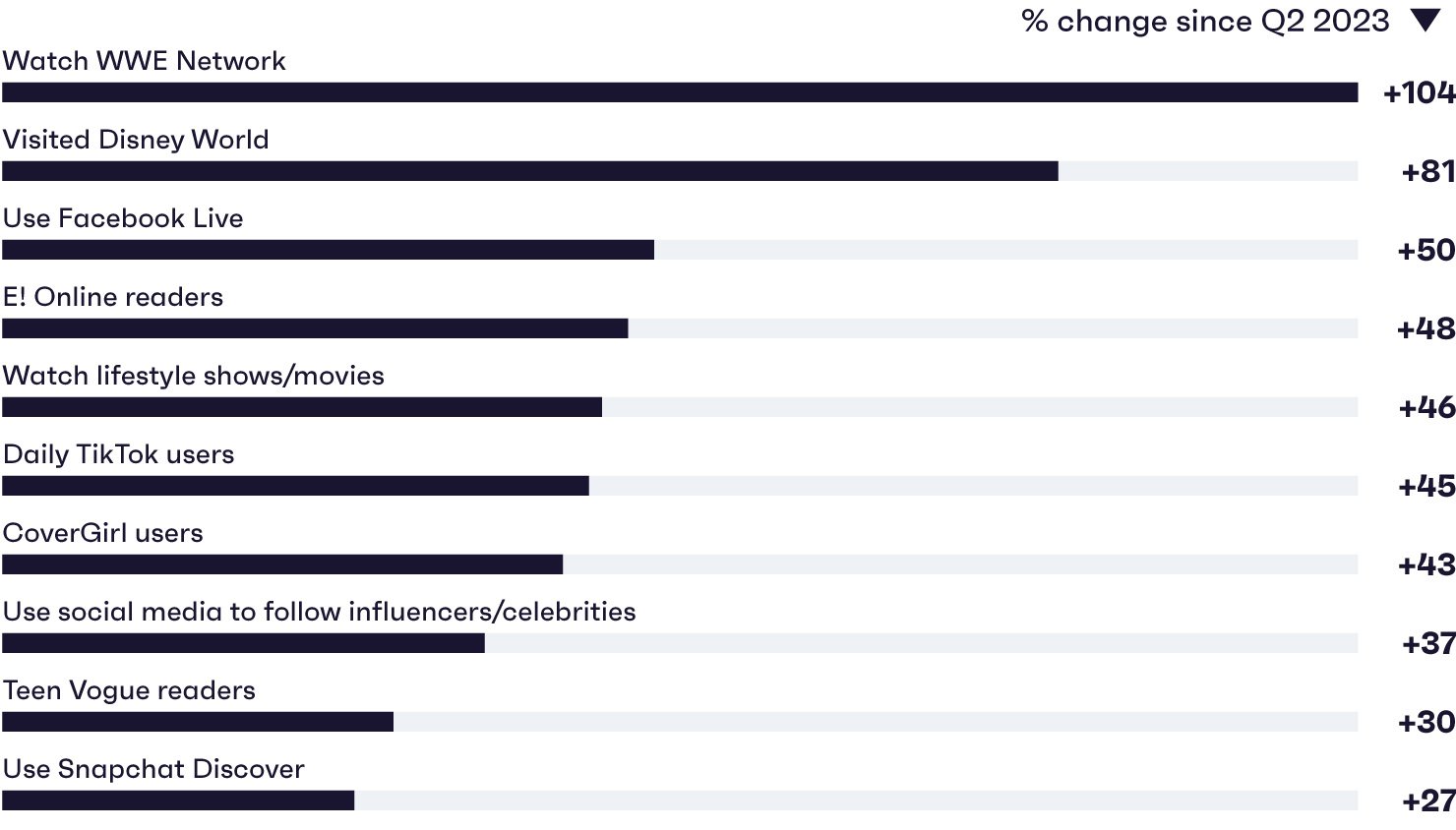

Meet the fans driving the WNBA’s buzz

% change since Q2 2023 in the number of US consumers in each group who say they watch the WNBA

- Source: GWI USA Q2 2023-Q2 2024

- Base: 2,120 WNBA watchers aged 16+

Already a GWI user? Explore the data on the GWI platform

- Source: GWI USA Q2 2023-Q2 2024

- Base: 2,120 WNBA watchers aged 16+

Already a GWI user? Explore the data on the GWI platform

Let’s break it down. Brands that partner with the league have the chance to reach engaged and influential audiences. For example, Facebook Live users are ideal for real-time engagement strategies like live Q&A sessions with athletes or behind-the-scenes broadcasts. And daily TikTok users thrive on short-form content, which is perfect for quick, digestible highlights or viral moments that amplify a brand's visibility.

But it’s not just about basketball. The WNBA’s success can offer lessons for how to grow more women’s sports leagues.

If we expand our view to other women’s sports, we see similar patterns emerging. For instance, audiences like daily Discovery+ watchers, Tumblr users, and New York Giants fans have shown a notable interest in the FIFA Women’s World Cup. Just like with the WNBA, these audiences provide a clear path for brands to target and grow communities by aligning with sports on the rise.

Women’s sports thrive with star power and short-form video

Last year, we identified the key drivers for growth in emerging sports, with short-form video taking center stage. The data showed how women's sports could benefit from applying a similar approach.

Understanding engaged audiences is the first step, but to truly harness the momentum, brands need to focus on accessibility and engagement strategies that will continue to drive growth.

Report

Social media trends: The highlight reel

Want to keep up with what’s going down online? We talked to nearly 1 million consumers for this highlight reel of 2024’s biggest social media trends.

Start exploringThere’s a real opportunity to align with a sport on the rise and engage with a young, passionate fanbase. Brands should invest in making women’s sports more accessible to fans by securing streaming platform coverage, offering behind-the-scenes content, and exclusive clips that connect fans to the action beyond game time.

Ask our customers

The majority (65%) of Fubo subscribers watch women’s sports on the platform, speaking to the genre’s widespread popularity across all demographics. Recent record-breaking women’s sporting events like March Madness and the World Cup have engaged viewers like never before, with women’s March Madness audiences peaking at 24 million viewers on US television, in turn driving advertiser demand. At Fubo, we’re partnering with brands on creative tactics that leverage our new interactive CTV ad formats to align with popular women’s sports programming in meaningful ways.

Short-form video is where passionate audiences engage with sports content — Gen Z and millennials are the most likely generations to follow sports leagues (whether that’s a team or an athlete) on social media. By creating bite-sized, engaging videos that highlight key moments or athlete personalities, brands can build deeper connections with these audiences.

The WNBA’s rise is a blueprint: star athletes like Caitlin Clark are pivotal, but growth is also driven by smart digital strategies. The rise of figures like Clark, Simone Biles, and Ilona Maher shows personal branding matters, but it’s not enough to rely solely on popularity. Brands and leagues must create shareable, accessible content that brings these stars into fans' daily lives.

When brands invest in both athletes and the platforms their fans frequent, they ensure that women’s sports continue to grow. With the right strategy, brands can fuel the momentum and empower other leagues to follow suit. But one thing’s for sure: this isn’t just a moment for women’s sports — it’s the beginning of a movement.

04

Energy drinkers

have a different look

Who comes to mind when you think of someone who likes energy drinks? Maybe young males, gamers, university students, or even risk takers? Your assumptions here aren’t necessarily wrong; these groups do drink them more than average.

But assumptions tend to be generalizations, and energy drink consumers are a broader audience than you might think.

The energy drinks market is growing, attracting more consumers from different demographics, professions, attitudes, and interests. So grab a drink while we show you what’s changing.

People want a productivity boost

The number of consumers who drink energy drinks has grown each year since 2018, with 45% saying they have them at least once a month. For context, this is more than a combined audience of those who drink gin, vodka, whiskey, or rum each month – so it’s worth paying attention to.

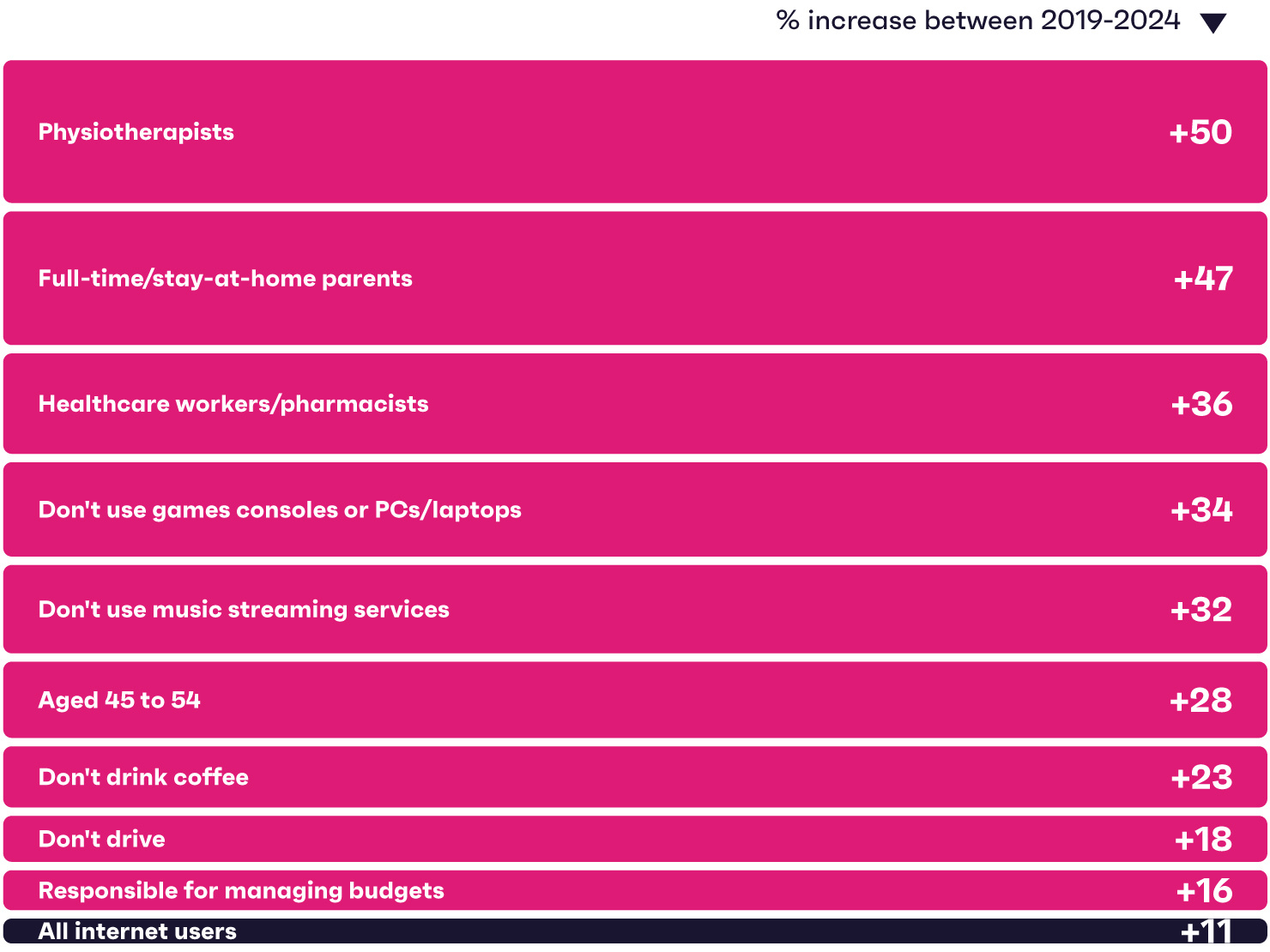

Health workers need a kick to keep up on shift

% increase since 2019 in the following groups drinking energy drinks at least once a month

- Source: GWI Core Q1-Q4 2019 & Q1-Q2 2024

- Base: 598,185 (2019) & 454,802 (2024) internet users aged 16-64

Already a GWI user? Explore the data on the GWI platform

- Taken from a number of data points in GWI Core

- Source: GWI Core Q1-Q4 2019 & Q1-Q2 2024

- Base: 598,185 (2019) & 454,802 (2024) internet users aged 16-64

Already a GWI user? Explore the data on the GWI platform

-

Taken from a number of data points in GWI Core

Since 2019, the number of people who don’t use game consoles or PC/laptops but consume energy drinks has grown 34%, and among 45-to-54-year-olds, energy drink consumption has risen 28%.

So when we think about who likes energy drinks, we could be talking about the middle-aged professional who needs a concentration boost at their desk, or the stay-at-home parent who wants an energy kick to get through another episode of Bluey. Brands in this space should consider why these products appeal to these audiences, and how to market them accordingly.

There’s a market for premium energy drinks with health benefits

Let’s take 45-to-55-year-olds in Europe and their food attitudes as an example. Taste is no more important to energy drink fans than the average consumer, but this group stands out for wanting high protein, probiotic, and fat-free food. They’re also more likely to be buying brands they’ve seen advertised, and to visit upscale juice bars and cafés. So, there's an opportunity for premium energy drinks that emphasize benefits, exude luxury, and appeal to health-conscious consumers.

Regional spotlight: Protein’s getting a lift in Europe

Older audiences aren’t the only ones driving the protein trend in Europe – it’s a quality all energy drink consumers in the region are increasingly on the lookout for, with the number who say they want protein in their diet growing 26% between 2021-2024.

And this isn't necessarily something just the gym-buffs are getting in on. Among energy drinkers who want high-protein diets, the number who are trying to gain muscle has grown less than a single percentage point since Q3 2021. It's more likely to do with all-round healthier lifestyles, with losing weight and controlling blood sugar levels the fastest-growing reasons these consumers are making changes to their diet.

It’s another sign that these products are appealing to audiences outside those you might expect – not to mention opening the door to energy drinks which specifically appeal to this need.

As any market grows, so does the diversity of consumers within it, influencing what can be sold - and importantly, how it’s sold. Brands need to stay consistent with the usual suspects, while tapping into unique audiences to refresh product lines and boost revenue streams.

05

Teens are

rethinking the college dream

The cost of pursuing a degree continues to soar; what was once seen as a surefire investment in young people’s futures now feels like more of a gamble.

As a result, more teens are questioning the value of following in their parents’ footsteps when it comes to higher education and their career paths.

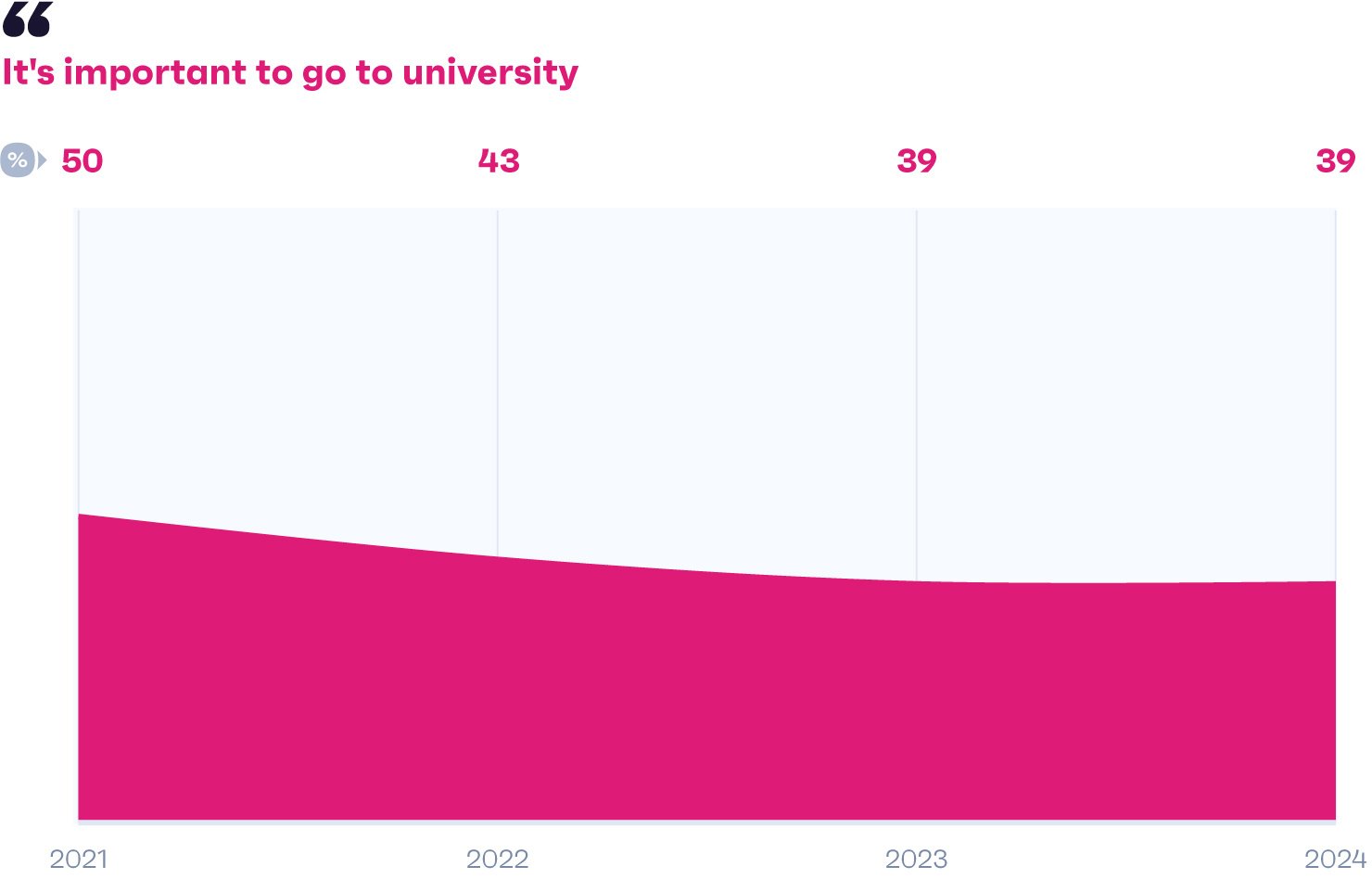

The college dream is getting a wake up call

% of US 12-15-year-olds who say it's important to go to university

- Source: GWI Kids Q1 2021-Q1 2024

- Base: 4,031 kids based in the US aged 12-15

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Kids Q1 2021-Q1 2024

- Base: 4,031 kids based in the US aged 12-15

Already a GWI user? Explore the data on the GWI platform

The number of American teens who believe going to college is important has taken a nosedive since 2021, with the drop most noticeable among those who:

So, what’s happening here? Younger people (typically those interested in tech) have found alternative ways to put their skills to work and create the opportunity to build careers without needing a college degree.

And it isn’t just teens who feel this way – across the globe, the number of Gen Z who say they’re pursuing a bachelor's degree or higher has fallen 21% in the last year.

Report

The new age of Gen Z

Forget what you think you know about Generation Z – this diverse audience is growing up fast. Uncover the real lives of young consumers around the globe.

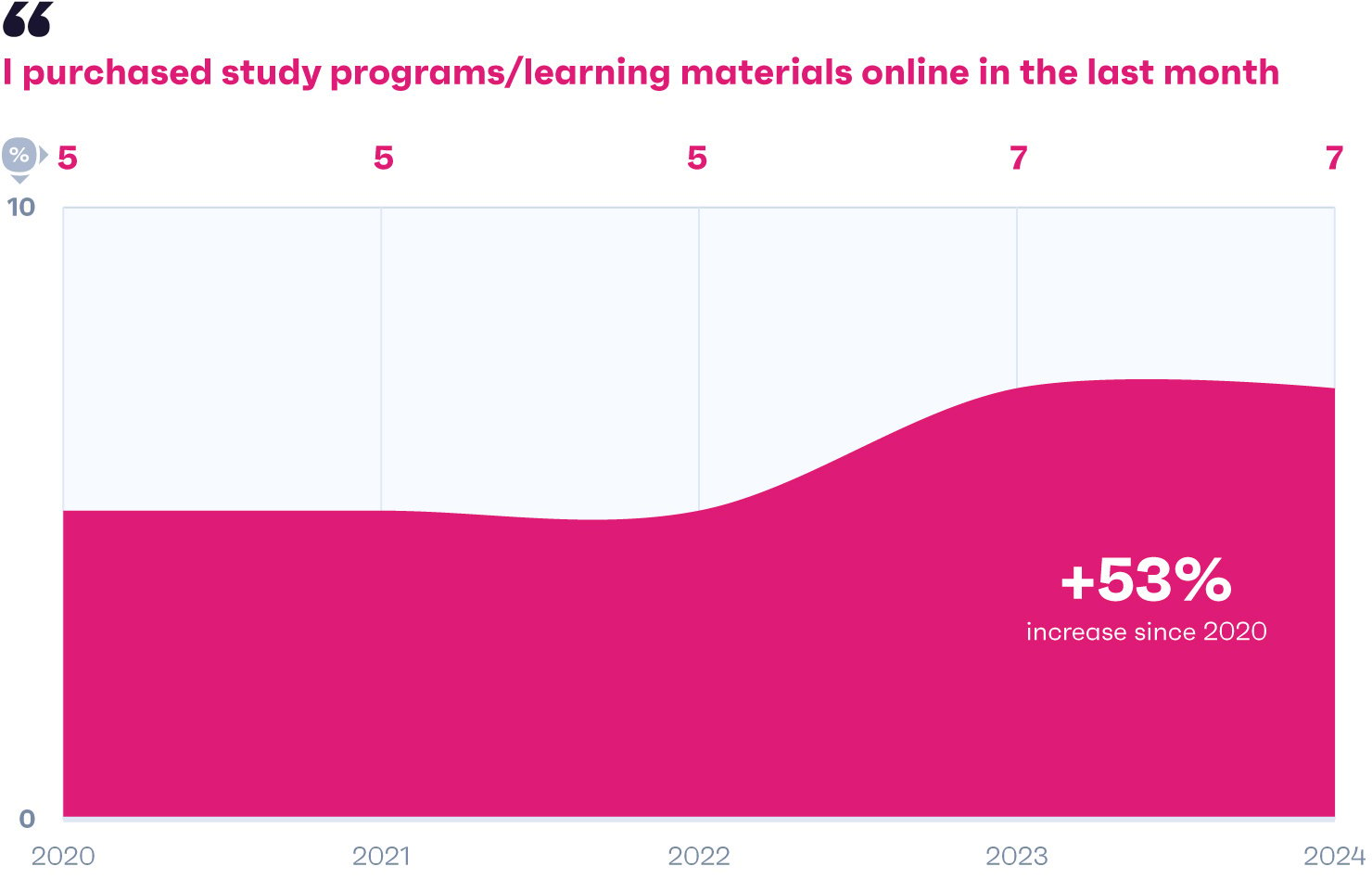

Read it nowTaking EdTech from the classroom to the workplace

With fewer teens seeing a college education as the only option, EdTech companies have a golden opportunity to step in and fill this gap.

Teachers are filling their carts with EdTech tools

% of consumers who work in education and say they have purchased study programs/learning materials online in the last month

- Source: GWI Core 2020-2024 (averages of waves conducted between Q1 2020 and Q2 2024)

- Base: 20,032 educators in the US aged 16-64

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core 2020-2024 (averages of waves conducted between Q1 2020 and Q2 2024)

- Base: 20,032 educators in the US aged 16-64

Already a GWI user? Explore the data on the GWI platform

Over the past few years, we’ve seen a rise in teachers buying study programs and learning materials online. This shift shows a growing acceptance of alternative platforms, which highlights the potential for EdTech to succeed. Over 6 in 10 teens say they do their homework on a mobile, tablet, computer, or games console. As traditional education becomes less of a rite of passage, EdTech is well-positioned to shape the future workforce.

Job boards are about to get a new look

It isn’t just schools feeling the shift – employers are taking notice too. Companies may need to reconsider whether degree requirements are really necessary, especially with nearly half (49%) of people in senior management roles saying they don’t have an undergraduate or postgraduate degree.

Some companies are already doing this. A recent study showed the share of jobs that require a bachelor’s degree fell from 51% in 2017 to 44% in 2022. As practical skills become more important, employers should consider prioritizing experience over education.

Sure, the college dream may be losing its luster, but this shift just means new opportunities are popping up. For EdTech companies, it’s a chance to lead the future labor market with practical, skills-based education that today’s employers are craving. For businesses, it’s a call to action: it's time to rethink your hiring practices and focus on the skills that truly matter in the modern workplace.

And for colleges, there’s an opportunity to adapt – by revising entry requirements and reshaping learning materials to better align with the interests and practical needs of today’s tech-savvy generation, ensuring higher education remains relevant in the evolving career landscape.

06

Smart security

sales are sneaking up

Have you come across moments caught on home security cameras in your social media feeds? We’d be surprised if you haven’t – there are over 375 million posts about Ring doorbells on TikTok alone.

2022 was the year smart security ownership (things like remotely controlled doorbells and security cameras) overtook smart utility products (lights, plugs, sensors, etc.). With smart home devices fitted in nearly 60% of homeowners' properties, more people are keeping an extra eye on their possessions - and the market opportunities are huge.

People are investing in peace of mind

Smart security ownership has grown 58% since 2019. To give you a sense of that scale, there are more owners of these devices than Volkswagen owners, fans of Chelsea FC or AC Milan, or even those who’ve have bought cider in the last month.

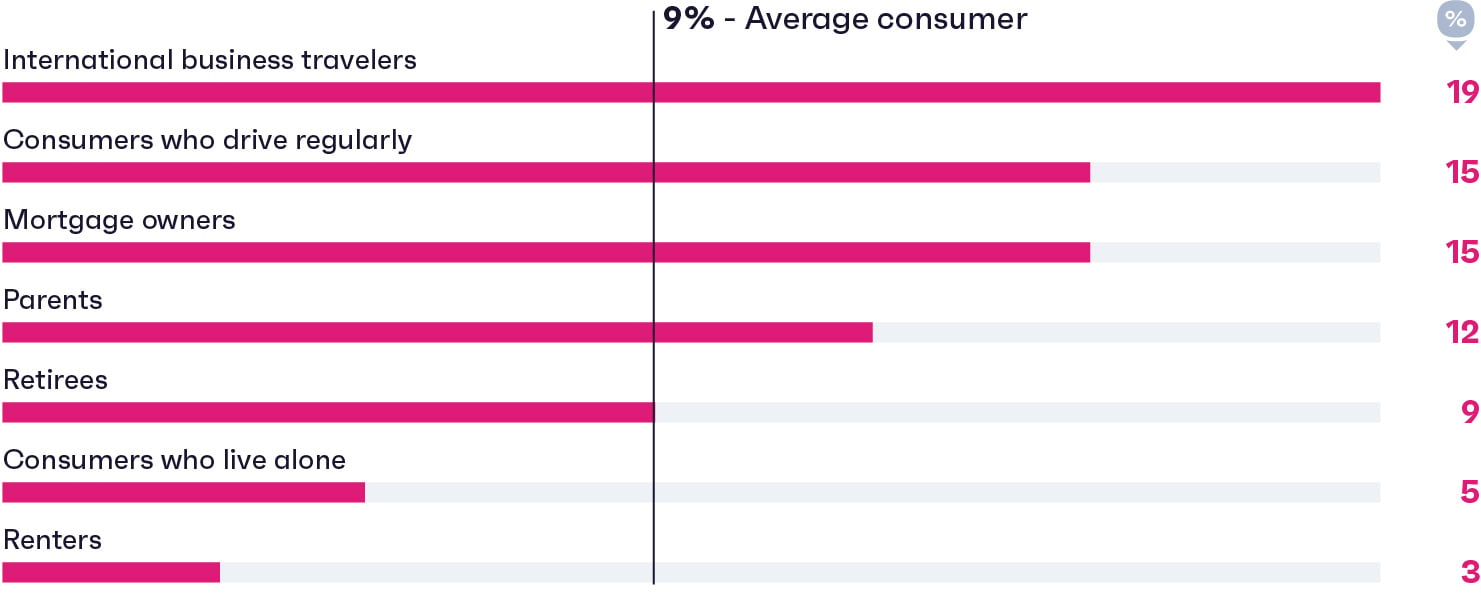

It's safe to say travelers are an ideal target market

% of consumers in the following groups who own a smart security device

- Source: GWI Core Q2 2024

- Base: 239,225 internet users aged 16+

Already a GWI user? Explore the data on the GWI platform

- Source: GWI Core Q2 2024

- Base: 239,225 internet users aged 16+

Already a GWI user? Explore the data on the GWI platform

It’s a trend driven by groups you might expect; business travelers, regular car drivers, and parents (to name a few). The types who want to keep an eye on their home while they’re away, be that for security or to check in on a delivery.

We’ve also seen high growth among regular public transport users, cinema-goers, and diners, which is a mass market group who want peace of mind day-to-day, even if they’re only out of the house for a couple of hours.

Keeping more than an asset safe

Typically, these products have a lot of appeal with high earners. The number who own a smart security device more than doubled in a handful of markets we’ve tracked since 2019, with the biggest increases seen in Ireland (+187%), Australia (+135%), Canada (+132%), and the UK (+103%).

But income alone isn’t a measure of purchase intent, and despite the cost pressures many are facing, price isn’t everything. Among consumers without any savings or investments, smart security ownership has grown 38% since 2020.

In each income segment, the likelihood of owning a security device increases when consumers do more out-of-home activities – things like regularly dining out, going to the cinema, running, hitting the gym, or riding a bike.

The takeaway here? As the market grows, it brings opportunities to target audience segments with typically lower adoption rates (such as renters), by working specific lifestyle indicators into your ad targeting strategy. As peace of mind becomes a hot commodity, smart security is guarding more than just doors.

Closing thoughts

Consumer behavior is always changing, so staying glued to the latest trends is crucial to getting your business, product, and marketing strategies right in 2025. This report is just the tip of the iceberg – a taste of the granular, global insights you can uncover about your target audience. Whatever you do, stay flexible, and use reliable consumer research to make quick decisions with confidence.

Want on-demand access to the latest consumer trends?

Chat with one of our experts to see how GWI can power your business and data strategies.

Book a free demoNotes on methodology

Each year, GWI interviews over 960,000 internet users aged 16-64 in 53 markets via an online questionnaire for our Core data set. A proportion of respondents complete a shorter version of this survey via mobile, hence the sample sizes presented in the charts throughout this report may differ as some will include all respondents and others will include only respondents who completed GWI’s Core survey via PC/laptop/tablet.

When reading this report, please note that we focus on data from our ongoing global quarterly research, but also refer to our monthly Zeitgeist studies across 11 markets, our GWI USA data set, which surveys over 80,000 internet users in the US aged 16+ each quarter, along with our GWI USA Plus data set which was an add-on to GWI USA and surveyed 7,000 internet users.

Throughout this report, we refer to indexes. Indexes are used to compare any given group against the average (1.00), which unless otherwise stated refers to the global average. For example, an index of “1.20” means that a given group is 20% above the global average, and an index of “0.80” means that an audience is 20% below the global average.

.png)