Smart business decisions start with great research. But not all research looks the same. Some insights come from stories, conversations, and real human experiences - others come from numbers and cold hard data. That’s where qualitative and quantitative research come into play. One helps you understand why people think and behave the way they do, while the other measures what they’re doing at scale. Knowing when (and how) to use each one? That’s the secret to turning data into insights you can actually use.

Understanding qualitative research

What is qualitative research?

Qualitative research is a method of exploring non-numerical data to understand behaviors, motivations, and experiences. Not everything worth knowing can be measured in numbers. Sometimes, the richest insights come from listening to what people say - and how they say it. That’s where qualitative research shines.

It’s all about exploring the why behind people’s behaviors, motivations, and experiences. Instead of crunching data, it dives into conversations, observations, and stories to uncover what’s really going on beneath the surface, making it a powerful tool for understanding brand perception, shaping product development, and spotting cultural shifts before they happen.

Common methods of qualitative research

There’s more than one way to dig into human behavior. Here are the three most common qualitative research methods:

- Interviews - One-on-one conversations that go deep into personal experiences, attitudes, and decision-making. These allow brands to uncover rich, detailed insights that structured surveys can miss.

- Focus groups - Group discussions that reveal collective opinions and emotional responses. They help brands test new ideas, gauge reactions, and refine messaging in real time.

- Observations - Watching how people behave in real-world settings. This method captures unfiltered consumer habits - what people actually do, not just what they say they do.

Advantages of qualitative research

When numbers don’t tell the full story, qualitative research fills in the gaps. It helps businesses:

- You can understand consumer motivations on a deeper level. It’s one thing to know that 60% of customers prefer eco-friendly brands - it’s another to understand why they care about sustainability.

- It can spot emerging trends early. By listening to consumers, brands can detect shifts in behavior before they show up in the data, giving them a competitive edge.

- It provides richer consumer stories. Numbers offer proof, but qualitative research adds real voices and narratives that bring insights to life. This is especially valuable for marketing and brand storytelling.

- You can be flexible and adaptive. Unlike structured surveys, qualitative research allows interviewers to follow up on interesting responses, dig deeper, and uncover insights they didn’t expect.

-

It humanizes data. It helps brands see their consumers as real people - not just data points - making it easier to create messages and products that truly connect.

Limitations of qualitative research

While qualitative research is invaluable for context, it has its limits:

- It’s harder to scale. Since it relies on small sample sizes, the findings don’t always represent the broader market.

- Analysis takes time - and interpretation matters. Unlike quantitative research, which delivers clear-cut numbers, qualitative insights require careful analysis and can sometimes be influenced by researcher bias.

- It’s difficult to replicate. Because qualitative research involves open-ended discussions and subjective interpretations, results can vary depending on who conducts the research and how participants respond.

- It can be costly. In-depth interviews and focus groups require experienced moderators, participant incentives, and time for analysis, making them more resource-intensive than large-scale surveys.

- There’s a risk of participant bias. People may adjust their answers based on what they think the interviewer wants to hear, making it harder to get completely authentic responses.

Understanding quantitative research

What is quantitative research?

Quantitative research is the science of measuring behaviors, opinions, and trends with numbers. It collects structured, measurable data to identify patterns and correlations - helping businesses make decisions based on hard evidence rather than gut feelings. From market sizing and revenue forecasting to customer satisfaction analysis, this approach delivers insights at scale, making it essential for brands looking to back up their strategies with data.

If you need to answer “How many people prefer our product?” or “What percentage of customers will buy again?”, quantitative research is the way to go. But if you’re asking “Why do people choose us over competitors?”, you’ll need to bring in qualitative research too.

Common methods of quantitative research

Quantitative research relies on structured methodologies to gather data on a larger scale. Here are three of the most commonly used approaches:

- Surveys - Structured questionnaires designed to gather statistical insights. Businesses use multiple-choice and rating-scale questions to track consumer sentiment, brand awareness, and purchasing behavior.

- Experiments - Controlled tests that determine cause-and-effect relationships. Whether it’s testing different ad creatives, price points, or product features, experiments help brands refine their strategies with measurable outcomes.

- Longitudinal studies – Research that tracks variables over time to reveal trends. By following the same group of consumers over months or years, businesses gain a clearer picture of brand loyalty, shifting preferences, and evolving market demands.

Advantages of quantitative research

Quantitative research gives businesses the confidence to make data-driven decisions at scale. Here’s why it’s so valuable:

- It’s scalable and generalizable. Since it analyzes large datasets, the findings are statistically significant and applicable to broader markets.

- You can predict trends with confidence. By tracking historical data, businesses can forecast demand, measure customer sentiment, and anticipate market shifts before they happen.

- It’s objective and comparable. Because it relies on numbers instead of interpretation, results are easier to compare across markets, demographics, and time periods - helping businesses measure performance consistently.

Limitations of quantitative research

Despite its strengths, quantitative research isn’t perfect. Here’s where it falls short:

- It lacks depth and context. Numbers tell you what’s happening but not always why. For example, knowing that customer satisfaction dropped by 10% doesn’t explain the emotions or frustrations behind that shift.

- It may oversimplify human behavior. Real-world decisions aren’t always rational or linear. Surveys and rating scales can miss the nuance behind why people choose one brand over another.

- There’s potential for response bias. Participants may answer surveys in ways they think are expected or socially acceptable rather than revealing their true opinions.

Key differences between qualitative and quantitative research

As we’ve covered, market research comes in two main flavors: qualitative and quantitative. One dives deep into human experiences and emotions, while the other delivers hard numbers and statistical proof. Both have unique strengths, but they serve different purposes - and the best insights often come from using them together.

Here’s how they compare:

|

Qualitative research |

Quantitative research |

|

|

Data type |

Non-numerical (text, images) |

Numerical (percentages, statistics) |

|

Objective |

Explores and understands |

Measures and quantifies |

|

Approach |

Open-ended, subjective |

Structured, objective |

|

Outcome |

Provides narrative insights |

Offers statistical validation |

Why does this matter?

Numbers can tell you what’s happening, but they don’t always reveal why. Likewise, deep conversations can uncover motivations, but they can’t measure trends at scale. That’s why smart businesses combine both research methods - using qualitative insights to bring depth to quantitative data and vice versa.

A great example? Customer satisfaction research. A survey (quantitative) can tell you 80% of users love your product, but follow-up interviews (qualitative) can reveal why they love it - or what’s still missing.

Are demographics qualitative or quantitative?

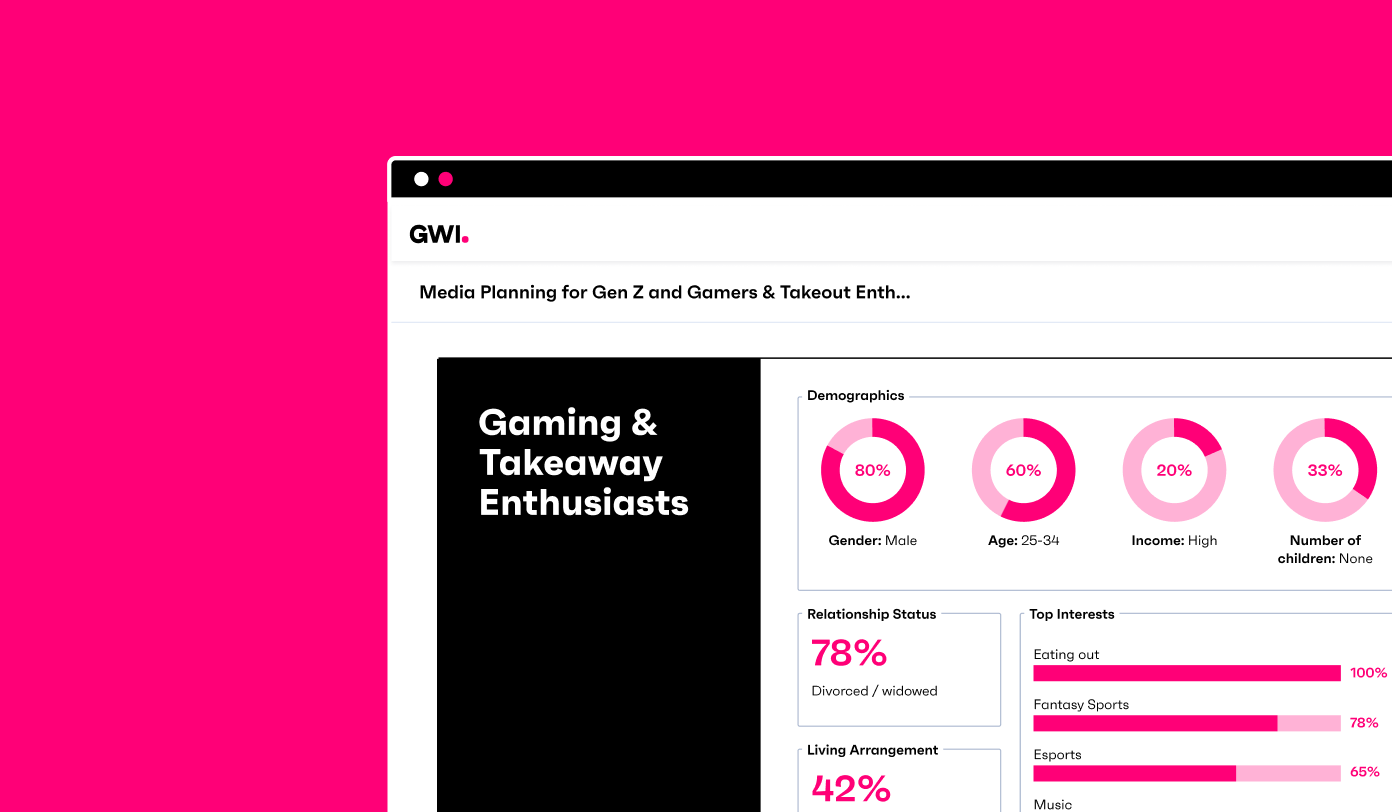

Demographics are at the core of most business decisions. Whether you’re segmenting your audience, shaping a marketing campaign, or personalizing products, knowing who your customers are is essential. But are demographics purely numbers, or do they tell a deeper story? Well, as it turns out, they can be both quantitative and qualitative.

What are demographics?

Demographics refer to measurable characteristics like age, gender, income, education, and occupation. Businesses use this data to understand their audience, tailor messaging, and develop strategies that resonate with different consumer groups. But while most demographic data is numerical and easy to measure, it can also reveal deeper motivations and cultural influences - which is where qualitative research comes in.

Quantitative demographic data

Most demographic data is quantitative because it consists of measurable variables. For example:

- What percentage of customers are aged 25-34?

- How many people in a specific region earn over $50,000 per year?

- What percentage of your audience identifies as Gen Z?

These numbers help businesses segment their market, track consumer trends, and forecast demand. If 50% of your customers are 18-24, that’s a clear indicator that your brand resonates with younger audiences - which can inform product development, pricing, and advertising strategies.

Qualitative demographic data

But demographics aren’t just numbers - they also tell a story about behaviors, motivations, and cultural influences. Knowing that 60% of your audience is Gen Z is useful, but understanding why they prefer sustainable brands, digital-first experiences, or specific social platforms adds depth to your strategy. This kind of qualitative demographic insight helps businesses:

- Refine brand messaging: Speak to what matters most to your audience.

- Improve customer experience: Design products and services that fit their lifestyle.

- Stay ahead of cultural shifts: Adapt marketing and content to evolving consumer values.

Numbers can tell you who your customers are, but understanding their motivations and behaviors helps businesses connect with them in a more meaningful way. That’s why the smartest brands use both quantitative and qualitative demographic insights - combining data-driven decisions with human understanding.

How businesses use demographics

Demographics aren’t just numbers on a spreadsheet - they’re the foundation of how businesses understand and connect with their audience. Whether brands are launching a new product or refining their existing messaging, demographic insights help them make smarter, more strategic decisions.

But not all demographic data is the same. Some insights come from hard numbers, while others reveal the emotions and behaviors behind those numbers. Here’s how businesses use both:

|

Research type |

How businesses use it |

|

Quantitative |

Market segmentation - Dividing audiences based on age, income, or location to tailor marketing efforts. |

|

Targeted advertising - Using demographic data to personalize campaigns for specific consumer groups. |

|

|

Sales forecasting - Predicting future demand based on demographic trends. |

|

|

Qualitative |

Understanding consumer behavior - Exploring why different demographics prefer certain brands or products. |

|

Refining brand messaging - Crafting messages that resonate with specific cultural and generational values. |

|

|

Analyzing cultural shifts - Spotting emerging trends and adapting strategies before they go mainstream. |

Businesses that rely solely on numbers might miss the deeper motivations behind consumer decisions. On the flip side, focusing only on qualitative insights without measurable data can lead to gut-feel decisions instead of data-driven ones.

The best brands don’t choose between qualitative or quantitative - they use both to build a complete, data-backed understanding of their audience.

Applications in business research

Whether a company is on a mission to develop a product or improve their workplace culture, the research approach they choose shapes the insights they get - and the actions they go on to take.

So when should businesses turn to qualitative research vs quantitative research?

When to use qualitative research

When businesses need deep, human-centered insights, qualitative research delivers. It helps uncover emotions, motivations, and perceptions that raw data alone can’t explain. Here’s when it’s most valuable:

- Product development: Understanding what customers need before launching a product can mean the difference between success and failure. Qualitative research helps businesses identify unmet needs, refine early concepts, and test ideas through direct consumer feedback.

- Brand perception: A brand isn’t just a logo - it’s how people feel about it. By analyzing consumer sentiment, qualitative research helps businesses strengthen brand positioning, messaging, and customer loyalty.

- Employee feedback: A company’s culture directly impacts retention, productivity, and overall success. Open-ended discussions and qualitative surveys provide honest, in-depth insights into workplace culture and areas for improvement.

Why does this matter? Because understanding the why behind consumer and employee behavior helps businesses make informed decisions - not just educated guesses.

When to use quantitative research

When businesses need clear, measurable data to guide decision-making, quantitative research is the go-to method. It helps companies spot trends, forecast demand, and track performance with confidence - turning raw numbers into strategic insights. Here’s when it’s most valuable:

- Market sizing: Before launching a product, businesses need to understand demand. By analyzing industry trends, competitor data, and consumer statistics, they can determine the market potential and identify the best opportunities for growth.

- Customer satisfaction: How happy are your customers? Quantitative research tracks metrics like Net Promoter Score (NPS), customer retention rates, and feedback trends over time - helping brands improve experiences and reduce churn.

- Sales analysis: Numbers tell the story of business performance. By analyzing growth trends, revenue patterns, and purchasing behavior, companies can forecast future performance and adjust strategies for maximum impact.

For a clearer view, here’s how businesses apply both research types:

|

Research type |

Use cases |

|

Qualitative |

Product development, brand perception, employee feedback |

|

Quantitative |

Market sizing, customer satisfaction, sales analysis |

Relying on just one research type can leave gaps in understanding. While quantitative research delivers hard numbers, qualitative research adds the context behind them. Businesses that combine both get a fuller picture of their audience, leading to sharper strategies and better results.

Integrating qualitative and quantitative research: Mixed methods approach

Relying on just one research method is like seeing half the picture. That’s why the smartest businesses don’t choose one over the other - they use both. This mixed methods approach combines statistical validation with human context, delivering insights that are both accurate and actionable.

Why does this approach work?

- Stronger validity: When qualitative and quantitative findings align, businesses gain more confidence in their data.

- Richer insights: Numbers tell the story, and qualitative research fills in the details - helping brands understand what really matters to their audience.

- Better decision-making: Data-backed strategies are more effective when they combine the precision of quantitative research with the depth of qualitative insights.

But there’s a catch. Blending both methods requires time, expertise, and the right tools.

Challenges of a mixed methods approach

- More resource-intensive: Conducting both qualitative and quantitative research requires more planning, execution, and analysis.

- Data alignment takes effort: Ensuring that both types of insights complement each other (instead of contradicting) requires careful execution.

- Not all data platforms support both: Some research tools focus solely on one type of data, making integration more difficult.

Final thoughts

Qualitative and quantitative research are both essential to business strategy - one uncovers motivations and emotions, while the other delivers statistical proof. The best brands don’t pick one and ignore the other. They use both to get the most complete view of their audience and market.

At GWI, we help businesses bridge the gap between quantitative data and qualitative insights - giving brands the tools to deeply understand their customers and make data-backed decisions with confidence. Whether you’re tracking global trends or uncovering hidden motivations, GWI brings the complete picture into focus.

.webp?width=495&height=317&name=pink_thumb_graphs%20(1).webp)

.webp?width=495&height=317&name=pink_thumb_letter%20(2).webp)